Derek44

Well-known member

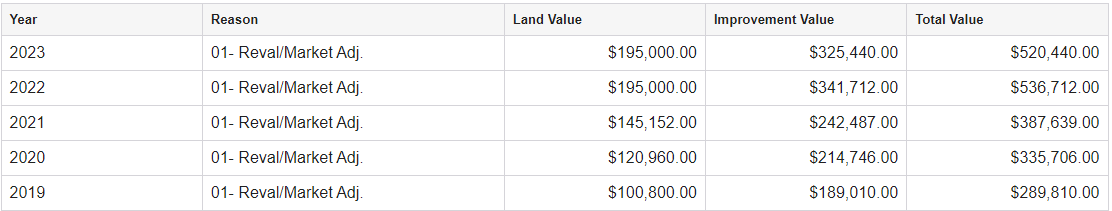

Most substantial argument yet!! Love it. At least someone sees that they’re hitting where it counts. I’d be fuming. That’s just unacceptable!!I could buy 1,230 cans of Hopzone with the extra money I'm expected to pay in taxes in 2023. I'm absolutely protesting this crap.