BigHornRam

Well-known member

My check for $675 came in the mail yesterday as well. I suppose a person's tax bill could be less than $675 if they lived in an old single wide on a leased lot.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

missoulacurrent.com

missoulacurrent.com

Shouldn't you be worring about Michigan's property tax rates, Ben?The plot continues to thicken, like my arteries

Missoula County joins others in seeking opinion on state mills

Missoula County on Tuesday placed its official support behind an effort lead by Beaverhead County that's challenging the state's “consistent” levying of certain mills despite a provision in Montana law that requires a reduction in mills when taxable values increase.missoulacurrent.com

Shouldn't you be worring about Michigan's property tax rates, Ben?

Explain how Missoula property taxes are twice as high for the same valuation as Ravalli County? Granted the people in Missoula vote for the out of control spending, so they should quit complaining.SB442 is the common thread here.

The states use of property taxes and county levies were at the heart of the disagreement between the governor & legislature.

MT's property tax system is being used as an example of "out of control county & municipal spending," when it's not really the case.

The 95 mills of the state never being adjusted is part of this issue.

As for MI property tax, it's worse if you're in the water. That's why we live in the uplands.

Explain how Missoula property taxes are twice as high for the same valuation as Ravalli County? Granted the people in Missoula vote for the out of control spending, so they should quit complaining.

Explain how Missoula property taxes are twice as high for the same valuation as Ravalli County? Granted the people in Missoula vote for the out of control spending, so they should quit complaining.

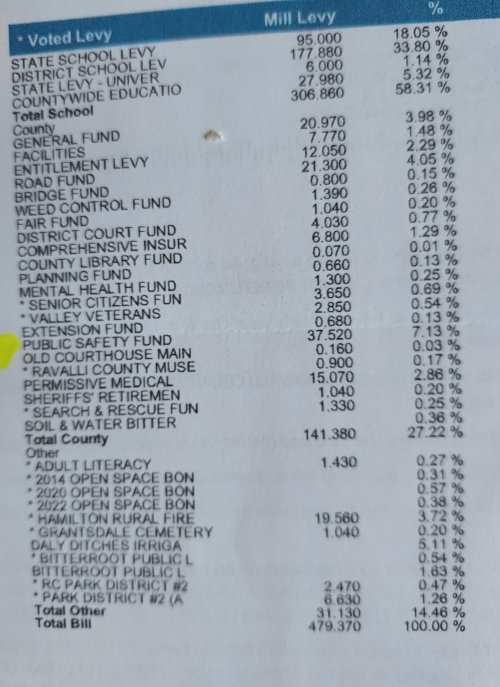

No idea where you keep getting the idea that 75% plus goes to schools. Do you read your tax bill? This is my 2022 bill.The entire budget is on line-

Missoula’s is probably also. It does take a little more work to compare two counties but can be done.

Politicians just like a sound bite that emotional people relate to.

When you look at the numbers. 75% plus is schools. Then looking solely at local county budgets- nearly 75% of that is roads and law enforcement.

So promised tax reform targeting less than 6% of the tax bill is good but is not going to be very noticeable on the bottom line.

Missoula needs to set up toll roads at buchkhouse bridge for everyone with a 13 license plate. A city tax on income for every 'rooter that drives into Missoula for work everyday as well.58.31% of my tax bill dollars goes towards schools. The rest is county and other. My county is fiscally conservative and our property taxes are reasonable. Missoula is fiscally liberal and their taxes are much higher. Not too complicated. The $675 refund more than offsets the project increase in this year's taxes, so nothing to complain about here.

Oh, and a 5% nuisance tax because 'rooters drive like total ass, on average. Ran into some idiot a couple weeks ago in Yellowstone while I was working, driving like total chit. I was so shocked to see a 13 Montana plate when we passed. Shocked I tell you!Missoula needs to set up toll roads at buchkhouse bridge for everyone with a 13 license plate. A city tax on income for every 'rooter that drives into Missoula for work everyday as well.

You know, level the playing field and make the 'rooters pay for the Missoula infrastructure they use.

Bet it was a transplant. Rooters ain't the majority here anymore Buzz. It's a whole new world. mtmuleyOh, and a 5% nuisance tax because 'rooters drive like total ass, on average. Ran into some idiot a couple weeks ago in Yellowstone while I was working, driving like total chit. I was so shocked to see a 13 Montana plate when we passed. Shocked I tell you!

I dont know, my late uncle was born in Stevi, lived on middle burnt fork there his whole life. He either drove 45 or 95 on his way to Missoula. In, of all things, a rambler station wagon.Bet it was a transplant. Rooters ain't the majority here anymore Buzz. It's a whole new world. mtmuley

I go over Skalkaho or through Wisdom when heading east. Missoula can KMA.Missoula needs to set up toll roads at buchkhouse bridge for everyone with a 13 license plate. A city tax on income for every 'rooter that drives into Missoula for work everyday as well.

You know, level the playing field and make the 'rooters pay for the Missoula infrastructure they use.

I'd like to search your pad for Kirkland products.I go over Skalkaho or through Wisdom when heading east. Missoula can KMA.

I don't know what that is and creepy you want to search my pad.I'd like to search your pad for Kirkland products.