Forkyfinder

Well-known member

- Joined

- Dec 13, 2023

- Messages

- 3,802

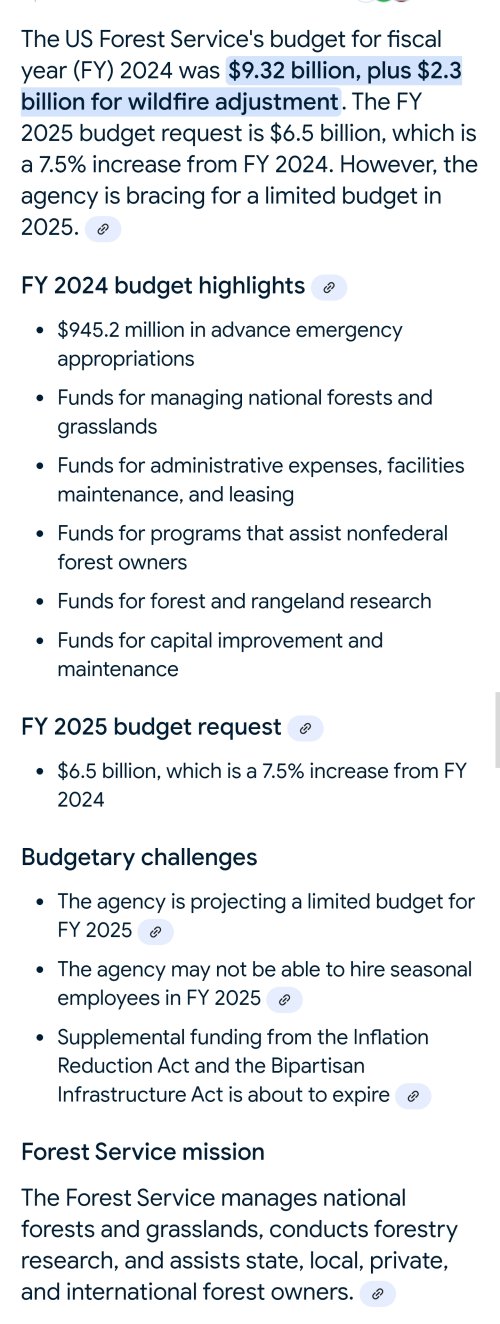

Schmalts! Such a relevant question. Im a numbers guy - and also a smart ass - so i had sort of planned presenting this to some carp thatd probably ignore it. So im glad youll read it.What percentage of your non federal taxes goes to the F&G or to manage public lands? Just a question. I Google AI it and wondered if you get the same. If it is a non-resident funds better then you

As far as the non fed taxes going to those agencies - not a dime. Those all goto the states or partially back to the feds for transportation (gas tax).

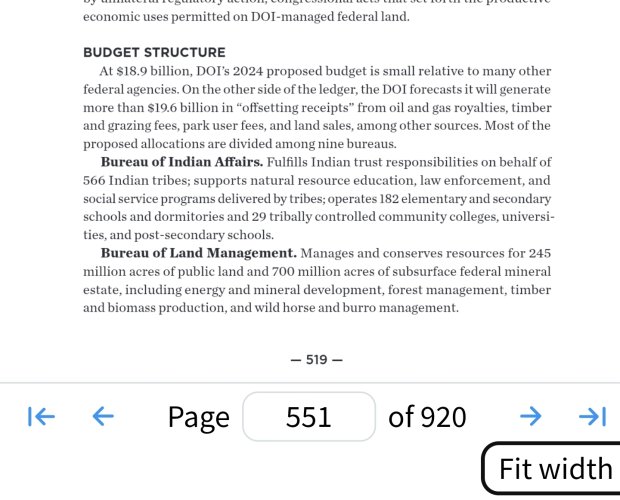

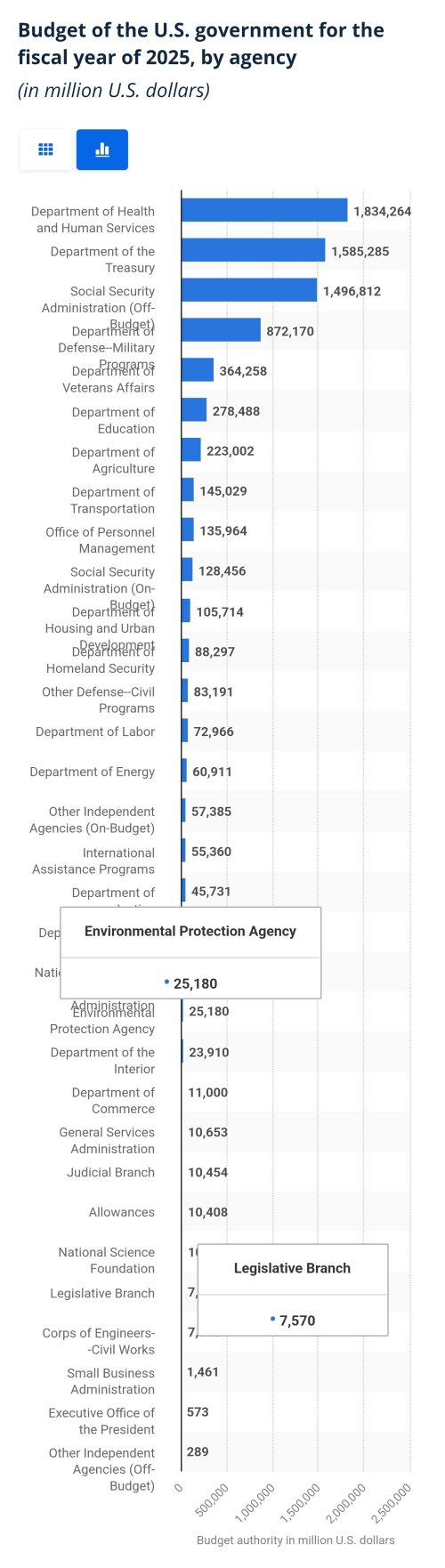

For straight up fed taxes - about 0.5% of the budget. This isnt really a cost as the dept of interior are cash positive according to P2025. Pretty remarkable that they turn a profit if you ask me. So in reality - no one is paying taxes to own federal land. Its just a cheesey talking point. If someone doesnt believe me on that - start about 15 minutes into uncle randys doge ideas - or look at P2025 yourself.

Attachments

Last edited: