SAJ-99

Well-known member

Ok. I guess as long as the grass grows and water flows Montana's economy will have sustainable growth.No, I said both states have economies that can drive sustainable growth. Read it again. lol.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Ok. I guess as long as the grass grows and water flows Montana's economy will have sustainable growth.No, I said both states have economies that can drive sustainable growth. Read it again. lol.

I feel more sorry for Mrs.wllm1313.Comcast broke my internet and so instead of 5% of my focus you poor SOBs are getting 30%

HT is where she sends him to keep him out from under foot.I feel more sorry for Mrs.wllm1313.

She averages like 85 hrs a week soooo lolI feel more sorry for Mrs.wllm1313.

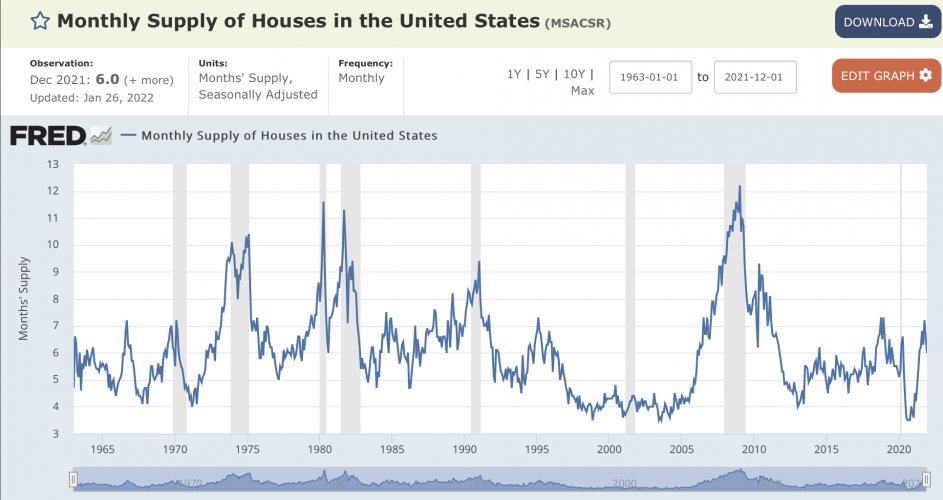

So if you get lucky and keep your job you get to buy a house… but if you don’t then you lose your job and get to figure out how to make your massive mortgage payment?To the OP, here is the chart that matters. Measurement is houses for sale/houses sold. The grey bars are recessions. Rates just jumped again today and Fed members are talking "shock and awe" campaigns to fight inflation. Not sure how they stop inflation without causing a recession, but it is going to be interesting.

View attachment 211893

Locals in each area are just doing what residents of the western states keep talking about with tags: keep raising the prices until the non-residents stop paying it to come LOL.Agreed, though I refuse to believe the market is asymptotic.

There are properties like this all over the place, with no work being done to them...

2015 - 50K

2018 - 120k

2020 - 180k

2021 - 210k

Sure some inflation, but 6 years and 4x you are going to hit a ceiling and then plateau.

To say the least.Not sure how they stop inflation without causing a recession, but it is going to be interesting.

Comcast broke my internet...

Wllm has experienced all of the finer things in life do you don’t have to.Slow down with all the analysis wllm and breathe a little. Sparks are starting to fly out of your head.

Saw a 2021 Polaris ranger with just a handful of miles on it asking 56k tonight. Not a typo, how is that even possible.I've been trying to buy a suburban and might be bowing out. 6 year old rigs with 100,000 miles are at least 40k. WTF over

Yes, but this obviously isn't a hunting thread.IS THIS A HUNTING FORUM!!!?

Everyone underestimates compound interest. ~9.5% so a bit less than the long run S&PPurchased 1970 -> 30K

Remodel 2004 -> 400k

Sale price 2021 -> 3,125,000

Buy during higher interest and low value = goodBorrowing half a million on a house! I don't care what the interest is, you still have to pay the principle back.

Um… not apples to applesEveryone underestimates compound interest. ~9.5% so a bit less than the long run S&P

Or what is a worthless dollar?Buy during higher interest and low value = good

Buy during inflated value and low interest = bad

The bank will never offer to refinance you at a lower principal amount.

The question is whats an inflated value?

Looked at shorting lumber yesterday, need to do more work. Investors rush into commodities to protect against inflation and drive up the price which in turn creates more inflation. Bad cycle. It will cause the Fed to hike rates faster and crimp demand, sending prices lower.Or what is a worthless dollar?

29% increase in February.

Not going to end well.

Lumber prices are up 29% in February as pace of economic reopening sparks new rally in global commodities

Prices for iron, oil, soybeans, and fertilizer have also pointed higher amid cold winter weather, geopolitical tensions, and supply chain disruptions.markets.businessinsider.com