BigHornRam

Well-known member

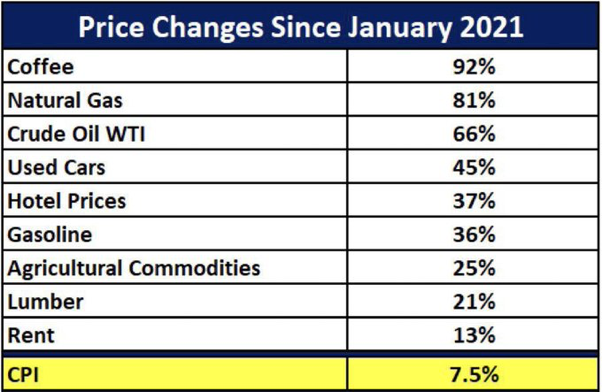

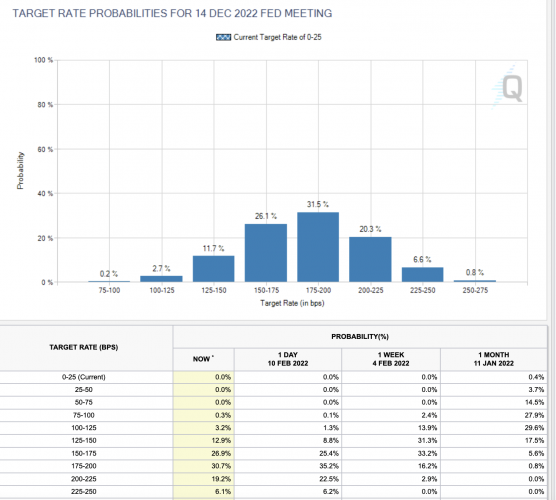

Feds should have raised rates a long time ago when it would have done something positive. I believe you were even on board with it. They didn't. Now it's going to be a big mess.Looked at shorting lumber yesterday, need to do more work. Investors rush into commodities to protect against inflation and drive up the price which in turn creates more inflation. Bad cycle. It will cause the Fed to hike rates faster and crimp demand, sending prices lower.

Everything ends badly or it wouldn’t end