DouglasR

Well-known member

Preach.

The Colorado ski towns where the rich play and locals have to live in cars

Colorado mountain towns have seen real estate prices soar, particularly as out-of-towners panic bought during the pandemic. Workers can’t afford to live there, creating a workforce and housing crisis, writes Sheila Flynnwww.independent.co.uk

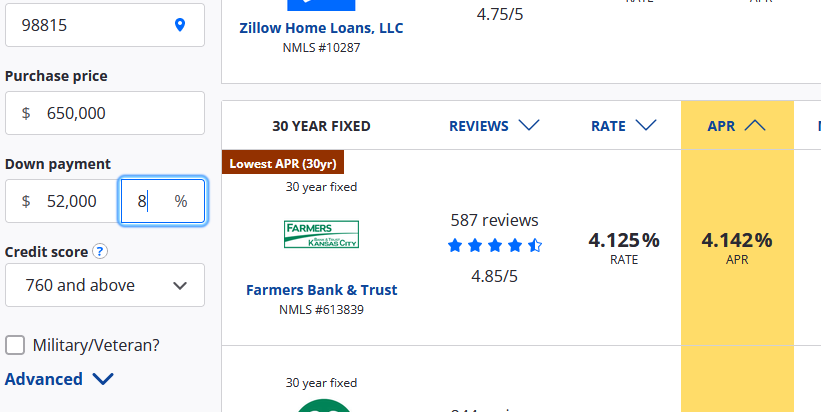

Along with having nearly 40 credit hours in obscure courses from a prestigious community university in east central Il, I’ve been out here living in my car and working full time at an entry level position in this picturesque vacation community for nearly 3 months, yet I cannot afford a modest home in summit county.

This is blasphemy.