Irrelevant

Well-known member

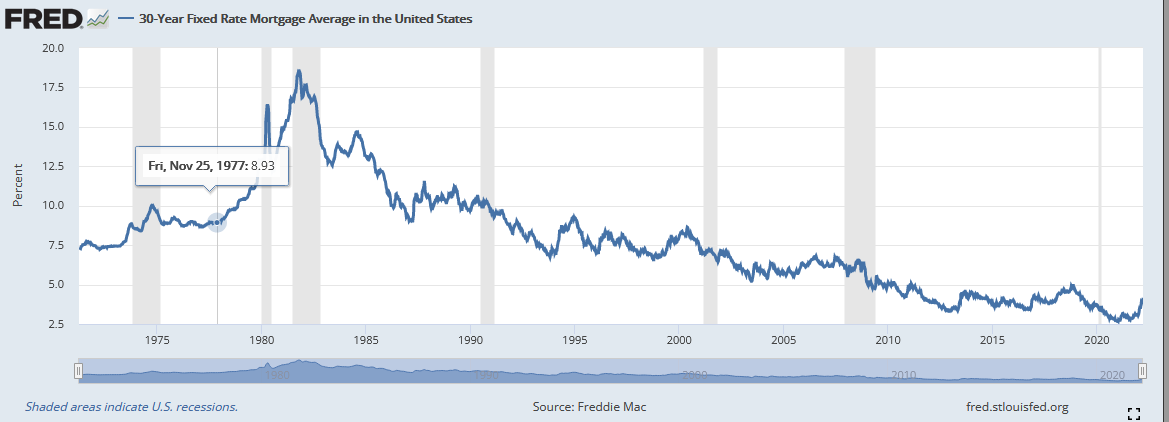

With rates the last decade it doesn't pay to make extra payments, you can easily get more bang for you buck by investing that extra.I’m never paying that price due to making extra payments.

My current rate is 2.87, I'll never refi, I'll never make an extra payment.

it's free money, you'll make more in equity than you'll lose in interest (yes I recognize all the assumptions made with that comment, no need to point them all out).