npaden

Well-known member

My 401k balance just got back to where it was on 12/31/2021. Of course I've made over 2 years of contributions in that time so really not quite caught back up yet.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Funny Nathan, my FA was crowing Friday about the same situation.My 401k balance just got back to where it was on 12/31/2021. Of course I've made over 2 years of contributions in that time so really not quite caught back up yet.

Can't quite tell if I'm in major agreement or disagreement with you. Probably somewhere in the middle. Who are you talking about in the last 2 sentences? Fund managers or individual investors?I’m a fundamental guy by training. I can tear apart financial statements and build models like any good analyst can. All that stuff matters in the long term. But that isn’t what drives the price in the short term. It’s sentiment, option positioning, and flows, particularly in the biggest names and instruments. Mostly it annoys me when they don’t want to admit it. Instead they spend their time creating a narrative that sounds good on why they haven’t beat the benchmark since Bush was president.

Think we are agreeing. I'm mostly talking about fund managers. The majority do have a valuation bias, although not always PE. Also agree that determining expensive or cheap is a usually horrible way to make investment decisions. Cheap things can get cheaper and expensive things can get more expensive. My point is the market drivers today are different than they were in in the 1970s. Individual investors can drive moves because they can get $86,000 in exposure to SMCI for about $1000 in their Robinhood account, and they have no intention of ever owning the stock outright (in part because they don't have the money).Can't quite tell if I'm in major agreement or disagreement with you. Probably somewhere in the middle. Who are you talking about in the last 2 sentences? Fund managers or individual investors?

The "it has a high PE and therefore I'm not going to buy it" crowd is one of the dumbest stances to have IMO. Don't think that's quite what you're saying. No you can't have your head in the sand but if all you had to do was buy low PE stocks, investing would be 10x easier.

Keep on hammering? Too soon?Give me your take on Paul Pelosi’s method.

To paraphrase an old comment from Garrett Morris on SNL. META has been very very good TO ME. I'm up over $200 per share since buying back in and I don't see it dropping $50+ per share like some others do.You might be missing the point a little. What was the reason it got that $12 to begin with? A lot of the time people that were short into an event and on the wrong side end up covering. I.e. Get out fast. The imbalance bids up the stock and benefits those long the stock. Eventually the buyers get exhausted and there is no one behind to replace them. Those that are long the stock and need to keep it at a reasonable percentage of the total portfolio start to trim. Sellers with no buyers = decline. It was only a couple of %, so I'm not sure "beat it down" is a good way to describe it. Maybe this helps, I wouldn't pay 30X TTM for META with your money. LOL, ok, maybe I would with your money, but certainly not mine.

You can probably tell that I'm a rank amateur as far as stock market and investing goes and quite likely also with the amount invested. It occurred to me last night that with the recent action with NVDA [a small taters guy like me] that spread over 4 different accounts I have more in unrealized gains than many people get in gross income per year so there's that. I think the outlook for NVDA for the next couple years is decent. Don't know if I would add more at these prices. I usually believe in dollar cost averaging down and not up. If I buy shares at $X the next purchase would be only if the share price was less than $X and so on and so forth..I feel like I have no clue on anything after today. NVDA results were fine, but not earth shattering. We seem to be back where we were in that a few stocks drive the market indexes. Over bought and expensive. We need some of others to catch up, small caps particularly. Earnings are about done so it will all be macro news and Fed. I would think people are completely justified in started to trim and take profits in some places. This never goes on forever and even good years can have corrections.

Hindsight is always 20/20, but it reminds me that earning the same money over and over again kind of sucks. Sorta the same with stocks when they start to pull back. Should I bail with a profit and buy back in at a lower price or hope it will turn around soon.My 401k balance just got back to where it was on 12/31/2021. Of course I've made over 2 years of contributions in that time so really not quite caught back up yet.

For my play around account I tend use a trailing stop loss at whatever percentage I'm comfortable losing if it tanks. And then just let it ride. Then I (try to) trim profits when/if my play works out and put that towards something else.Hindsight is always 20/20, but it reminds me that earning the same money over and over again kind of sucks. Sorta the same with stocks when they start to pull back. Should I bail with a profit and buy back in at a lower price or hope it will turn around soon.

That more of a trade or a 1-5+ year holding? If you like the story and plan to hang on to it for awhile, I'd say a $50-100 pullback over the next 1-6 months would be no big deal. A pullback to the 100 day or 200 day moving average is always possible but IMO not a reason to sell if you plan to hold it awhile.To paraphrase an old comment from Garrett Morris on SNL. META has been very very good TO ME. I'm up over $200 per share since buying back in and I don't see it dropping $50+ per share like some others do.

I had a small position and sold it last fall. A few weeks later I regretted the sale and bought back in. I have a mental sell price of $550, but may hold longer if it splits.That more of a trade or a 1-5+ year holding? If you like the story and plan to hang on to it for awhile, I'd say a $50-100 pullback over the next 1-6 months would be no big deal. A pullback to the 100 day or 200 day moving average is always possible but IMO not a reason to sell if you plan to hold it awhile.

I have been thinking about this a little. Are we too complacent in just assuming the stock market will earn an average of 8-9% and every selloff will rebound? What makes it so? Where does the 8% come from? 2% inflation, 2% population growth, 2% gains in efficiency, and maybe shareholders stealing the last 2% from the worker? This has never been answered. A Nobel prize awaits someone I guess.I don't worry about it. Short term there will always be swings, long term they have always moved up. I just keep dollar cost averaging in. For 33 years I've been invested in 100% equity in my 401k and don't worry about trying to time the market either way.

I don't know. It's been happening for 100+ years though. That could change but it's impossible to know when and IMO not worth changing investments.I have been thinking about this a little. Are we too complacent in just assuming the stock market will earn an average of 8-9% and every selloff will rebound? What makes it so? Where does the 8% come from? 2% inflation, 2% population growth, 2% gains in efficiency, and maybe shareholders stealing the last 2% from the worker? This has never been answered. A Nobel prize awaits someone I guess.

I have been thinking about this a little. Are we too complacent in just assuming the stock market will earn an average of 8-9% and every selloff will rebound? What makes it so? Where does the 8% come from? 2% inflation, 2% population growth, 2% gains in efficiency, and maybe shareholders stealing the last 2% from the worker? This has never been answered. A Nobel prize awaits someone I guess.

It helps that the US is resource rich and our democratic structure allows new businesses to be created easily. It also helps that we haven't had bombs being dropped on us in wars. But do we take all this for granted? We have an entire industry set up on the advice you gave, and I give the same advice. I just wonder what might make it change, because eventually it does.

It's from the median returns of the market since inception. Median compounding returns on 30-yr investments (you understand how that would be different than yearly median returns right?) are ~7% for the DOW, 7.6% for the S&P and 9.5% on the NASDAQ. This takes into account the potential 30-yr returns over the full life of each market. Variance is pretty high, for example, depending when you put in $$$, the Dow's median compound return was between 1.5 - 12%. That is an enormous variance base solely on luck. For example, say you put 5K into the DOW every year for 30 yrs. If you were unfortunate enough to have the min 30-yr return you would have $195K vs $ 1.36 million for the max 30-yr return.....I have been thinking about this a little. Are we too complacent in just assuming the stock market will earn an average of 8-9% and every selloff will rebound? What makes it so? Where does the 8% come from? 2% inflation, 2% population growth, 2% gains in efficiency, and maybe shareholders stealing the last 2% from the worker? This has never been answered. A Nobel prize awaits someone I guess.

It helps that the US is resource rich and our democratic structure allows new businesses to be created easily. It also helps that we haven't had bombs being dropped on us in wars. But do we take all this for granted? We have an entire industry set up on the advice you gave, and I give the same advice. I just wonder what might make it change, because eventually it does.

I wonder what percentage of growth is just American's putting $ into their 401k every month. Just steady demand-side pressure.I have been thinking about this a little. Are we too complacent in just assuming the stock market will earn an average of 8-9% and every selloff will rebound? What makes it so? Where does the 8% come from? 2% inflation, 2% population growth, 2% gains in efficiency, and maybe shareholders stealing the last 2% from the worker? This has never been answered. A Nobel prize awaits someone I guess.

It helps that the US is resource rich and our democratic structure allows new businesses to be created easily. It also helps that we haven't had bombs being dropped on us in wars. But do we take all this for granted? We have an entire industry set up on the advice you gave, and I give the same advice. I just wonder what might make it change, because eventually it does.

Yes I understand the difference. I am not going to get into an explanation or debate of variance drag. It isn't relevant. I think you may have misunderstood the question. Maybe it's a more esoteric, theoretical question. If stock prices follow earnings, real earnings growth over that period (30yrs) is 4.2%ish. Inflation not high enough to get to 9.5%. We all continue to just assume the returns will continue, partially because we can't fully explain the pieces. And I have both heard and made them all, Risk free rate + equity risk premium = blah blah blah. I get it.It's from the median returns of the market since inception. Median compounding returns on 30-yr investments (you understand how that would be different than yearly median returns right?) are ~7% for the DOW, 7.6% for the S&P and 9.5% on the NASDAQ. This takes into account the potential 30-yr returns over the full life of each market. Variance is pretty high, for example, depending when you put in $$$, the Dow's median compound return was between 1.5 - 12%. That is an enormous variance base solely on luck. For example, say you put 5K into the DOW every year for 30 yrs. If you were unfortunate enough to have the min 30-yr return you would have $195K vs $ 1.36 million for the max 30-yr return.....

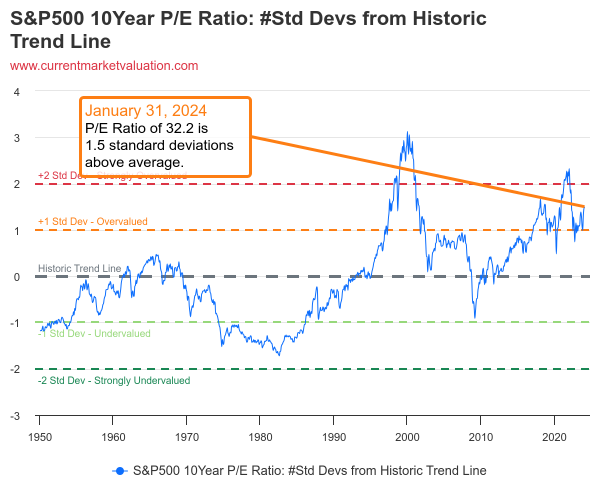

That is part of it. I lean toward a constant bid with little concern for price/valuation being reflected in the multiple. And the average multiple has definitely gone up. But a person can argue that because tech companies have such great margins, the increased multiple is justified. PE's are volatile because the P is volatile, but the trend line should be pretty easy to imagine.I wonder what percentage of growth is just American's putting $ into their 401k every month. Just steady demand-side pressure.

There really is no answer to your esoteric question, the market does what it does for a number of intertwined reasons. We can wonder about it but the there is only one thing that is actionable, diversification (real estate, whatever). No one can tell the future, you can only operate with what you see. More diversification cannot be bad.Yes I understand the difference. I am not going to get into an explanation or debate of variance drag. It isn't relevant. I think you may have misunderstood the question. Maybe it's a more esoteric, theoretical question. If stock prices follow earnings, real earnings growth over that period (30yrs) is 4.2%ish. Inflation not high enough to get to 9.5%. We all continue to just assume the returns will continue, partially because we can't fully explain the pieces. And I have both heard and made them all, Risk free rate + equity risk premium = blah blah blah. I get it.

I worry that increasing views of American isolationism, and globally, make those past returns a less likely assumption.