Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

SAJ-99

Well-known member

News released after market close on Friday that SMCI will be added to the S&P 500. The stock jumped 12% after hours. I'm sure there are going to be some irritated people on Monday. Those longs that decided to keep the short call position in the $910 to $1015 weekly strike calls will be heavy cash come Monday. I would expect SMCI to do a stock split at some point soon.Almost seems like someone is manipulating SMCI stock.

Benfromalbuquerque

Well-known member

- Joined

- Jul 15, 2020

- Messages

- 1,839

BigHornRam

Well-known member

Debt snowball is picking up steam. Don't step in front of it, cause it won't be stopping anytime soon.What’s everyone’s view on impact of adding $1T to the national debt every 100 days? Seems like yesterday we were at $32T now we are fast approaching $35T. Don’t here much from the media, Congress or economists

SAJ-99

Well-known member

Deficit is a problem, but I will worry when demand for the debt starts to slip. Not seeing it, yet.Debt snowball is picking up steam. Don't step in front of it, cause it won't be stopping anytime soon.

antelopedundee

Well-known member

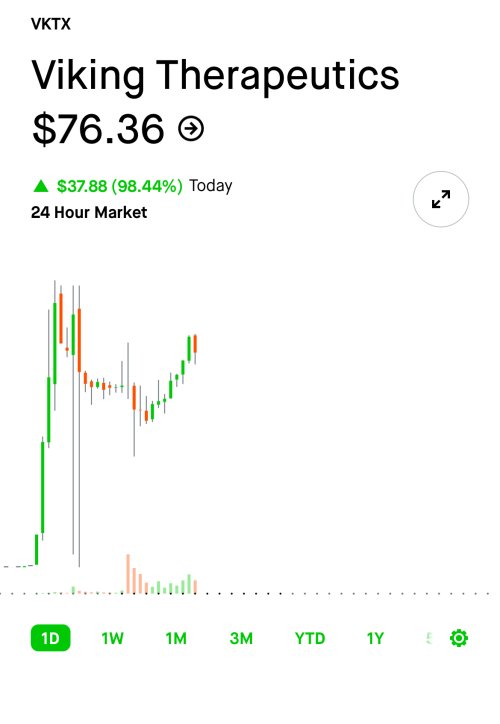

$987 now. Can one take comfort in the fact that those who bought at $1135 are expecting it to go higher? I'm out for now, but too volatile IMO to jump back in.$1,135 today. View attachment 317900

antelopedundee

Well-known member

Obviously tax receipts aren't keeping pace and billions in refunds are taking a bite. Yet some want to cut taxes even more.What’s everyone’s view on impact of adding $1T to the national debt every 100 days? Seems like yesterday we were at $32T now we are fast approaching $35T. Don’t here much from the media, Congress or economists

jryoung

Well-known member

Obviously tax receipts aren't keeping pace and billions in refunds are taking a bite. Yet some want to cut taxes even more.

Don't forget many of the individual rates that changed in the 2017 TCJA will expire at the end of next year.

BigHornRam

Well-known member

jryoung wants his SALT deductions back, I see.Don't forget many of the individual rates that changed in the 2017 TCJA will expire at the end of next year.

"Under the current rule, there is a $10,000 SALT deduction cap for single and joint-filing taxpayers who deduct local property, income and sales tax on their federal return. This deduction cap was created under the Tax Cuts and Jobs Act (TJCA) and is expected to sunset in 2026."

antelopedundee

Well-known member

I wasn't aware that the Feds allowed sales tax to be deducted. Maybe some states do.jryoung wants his SALT deductions back, I see.

"Under the current rule, there is a $10,000 SALT deduction cap for single and joint-filing taxpayers who deduct local property, income and sales tax on their federal return. This deduction cap was created under the Tax Cuts and Jobs Act (TJCA) and is expected to sunset in 2026."

antelopedundee

Well-known member

I think TSLA is a lost cause.

BigHornRam

Well-known member

Up to 10k right now. Standard deduction for married filing jointly is 20k, so that is what is used by the overwhelming majority of taxpayers today. If the TJCA sunsets, that will be a different story, particularly in big tax states like California and New York.I wasn't aware that the Feds allowed sales tax to be deducted. Maybe some states do.

Looking likely that it will be renewed at this moment.

SAJ-99

Well-known member

by MSTR instead!! YOLO!!!$987 now. Can one take comfort in the fact that those who bought at $1135 are expecting it to go higher? I'm out for now, but too volatile IMO to jump back in.

Like I said, no one cares. Even the people screaming about the size of the debt don't care enough to reverse the tax cuts.Up to 10k right now. Standard deduction for married filing jointly is 20k, so that is what is used by the overwhelming majority of taxpayers today. If the TJCA sunsets, that will be a different story, particularly in big tax states like California and New York.

Looking likely that it will be renewed at this moment.

BigHornRam

Well-known member

We fed the beast long enough. Time for the beast to go on a diet.Like I said, no one cares. Even the people screaming about the size of the debt don't care enough to reverse the tax cuts.

SAJ-99

Well-known member

That would fit on a campaign sign. You should run. Only problem is you can't suck on the nipple of the beast yourself without feeding the masses.We fed the beast long enough. Time for the beast to go on a diet.

BigHornRam

Well-known member

I lack patience, money, and a filter to run. Otherwise I would consider it.That would fit on a campaign sign. You should run. Only problem is you can't suck on the nipple of the beast yourself without feeding the masses.

Let's start with 2 big dogs. Social security and Medicare.We fed the beast long enough. Time for the beast to go on a diet.

npaden

Well-known member

Yep. It is the greater of your state income tax or state sales tax. In a state like Texas with no state income tax we get to do a calculation based on our income of the estimated state sales tax we paid, we don't have to keep the receipts or anything for the deduction. If you buy a large item like a car you get to do a specific deduction on that above and beyond the calculated amount.I wasn't aware that the Feds allowed sales tax to be deducted. Maybe some states do.

Then you add the property taxes in as well. For people with expensive houses that live in states with a state income tax it is pretty easy to hit that $10,000 limit.

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 13

- Views

- 656

- Replies

- 22

- Views

- 2K