noharleyyet

Well-known member

<iframe src="https://giphy.com/embed/gdwJdym3VuXQr5OfAc" width="480" height="480" frameBorder="0" class="giphy-embed" allowFullScreen></iframe><p><a href="

">via GIPHY</a></p>

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

“Foreign index fund” sounds vague. Just tell us the fund and it will be easier to see if it matters.Anyone else get a notice that a foreign index fund is no longer holding anything Chinese after month's end?

SMCI had a nice recovery today after taking a dump the last 4 days. I see it's down $20+ in after hours. What are the chances some misfits will try to run it down tomorrow? Being a late entry I don't have much, but if it pops again I just may cash out. For awhile I thought it might head down to $3-$400, esp. after it drops on 4-5 times average trading volume.Today just increased my anxiety about next week. SMCI lost 20% on a single analyst "Hold" report and showed zero ability to find a bid all day. S&P fell on the inflation news, fought back to be positive only to stall and fall and finish near lows for the day. No significant news or data next week and I see no Fed speakers on calendar. The market will be left to its own devices.

I feel like I have no clue on anything after today. NVDA results were fine, but not earth shattering. We seem to be back where we were in that a few stocks drive the market indexes. Over bought and expensive. We need some of others to catch up, small caps particularly. Earnings are about done so it will all be macro news and Fed. I would think people are completely justified in started to trim and take profits in some places. This never goes on forever and even good years can have corrections.SMCI had a nice recovery today after taking a dump the last 4 days. I see it's down $20+ in after hours. What are the chances some misfits will try to run it down tomorrow? Being a late entry I don't have much, but if it pops again I just may cash out. For awhile I thought it might head down to $3-$400, esp. after it drops on 4-5 times average trading volume.

This nvda thing is wild I feel like it’s gonna be a nasty rug pullI feel like I have no clue on anything after today. NVDA results were fine, but not earth shattering. We seem to be back where we were in that a few stocks drive the market indexes. Over bought and expensive. We need some of others to catch up, small caps particularly. Earnings are about done so it will all be macro news and Fed. I would think people are completely justified in started to trim and take profits in some places. This never goes on forever and even good years can have corrections.

Investing in bubbles is funAlmost seems like someone is manipulating SMCI stock.

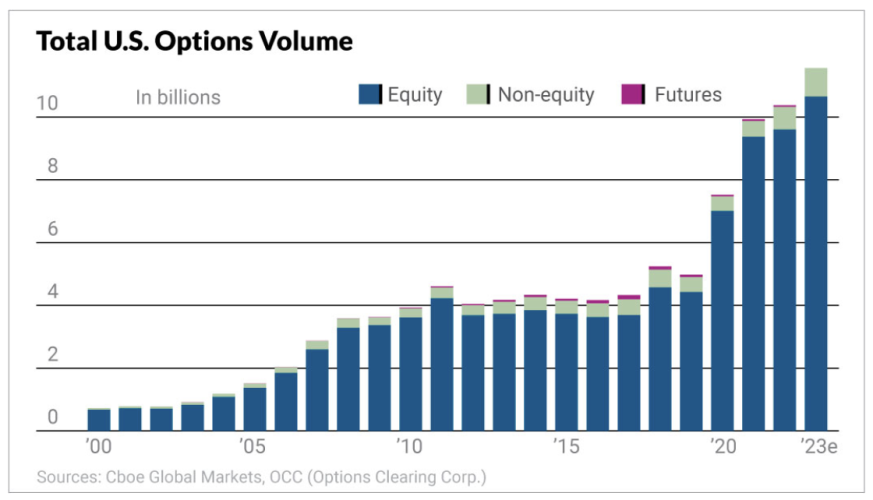

No one is manipulating the price. It is just degenerate gambling. Daily options volume on SMCI is super high and Implied Vol over 250% for options expiring TODAY! Don't try to make sense of it. Investing in a bubble is great if you know when to get out. This is no different than GME or AMC a few years back.You'd think investors would jump in on positive news. What happens overnight to change someone's mind other than manipulation? Hence my earlier comment about WHIMS like Mr. Greenjeans getting his dickie caught in his zipper.

In all seriousness, expand on this...No one is manipulating the price.

In all seriousness, expand on this...

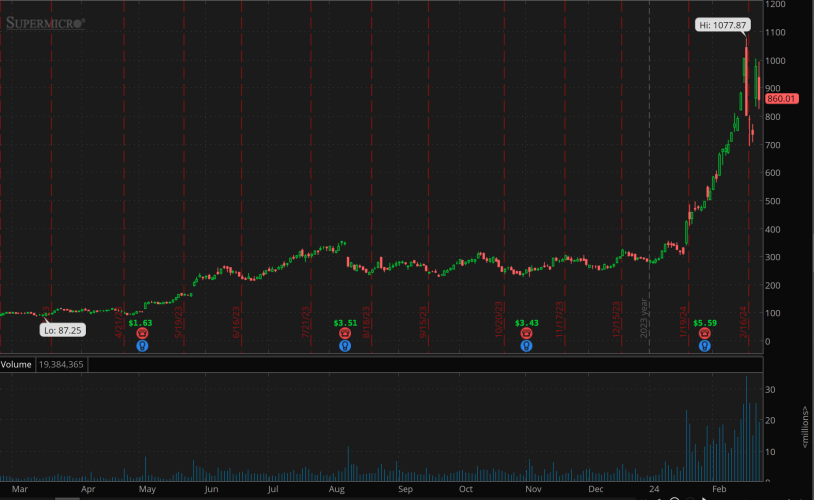

Volatility and large price swings are the same thing, so I'm a little confused by the comment of understanding one but not the other. I don't suggest thinking in terms of $, rather think in terms of %. $100 seems like a lot, but it is a $900 stock. Yes, there is a lot of volatility in this stock right now, but I highly doubt there is any manipulation. Who is manipulating it and what direction? The 1yr chart is below, showing earnings reports and the red vertical dashed lines are option expirations. Volume is at the bottom. Remember, this stock was pretty much unknown until January. If you saw it before that I commend you.I can understand the volatility, but why with such large price swings. I don't know all of the fine points of trading, and I can understand the price rising by $200+ on a good earnings report, but to run up in bigger chunks and then down in bigger chunks makes no sense. FWIW I'm only suggesting that manipulation could be a factor. I don't watch that many stocks, but I can't ever recall any stock that went up after a great report to continue doing so for the next few days. There certainly could be a reason for NVDA to go up $100 a day for several days in a row, but I've never seen that happen with any stock I've watched.

How so?Sorry previous post was so long, but I have been looking at this stuff for 20yrs and have gotten to the point I'm mostly irritated by guys blathering on about growth of earnings and P/E.

I’m a fundamental guy by training. I can tear apart financial statements and build models like any good analyst can. All that stuff matters in the long term. But that isn’t what drives the price in the short term. It’s sentiment, option positioning, and flows, particularly in the biggest names and instruments. Mostly it annoys me when they don’t want to admit it. Instead they spend their time creating a narrative that sounds good on why they haven’t beat the benchmark since Bush was president.How so?

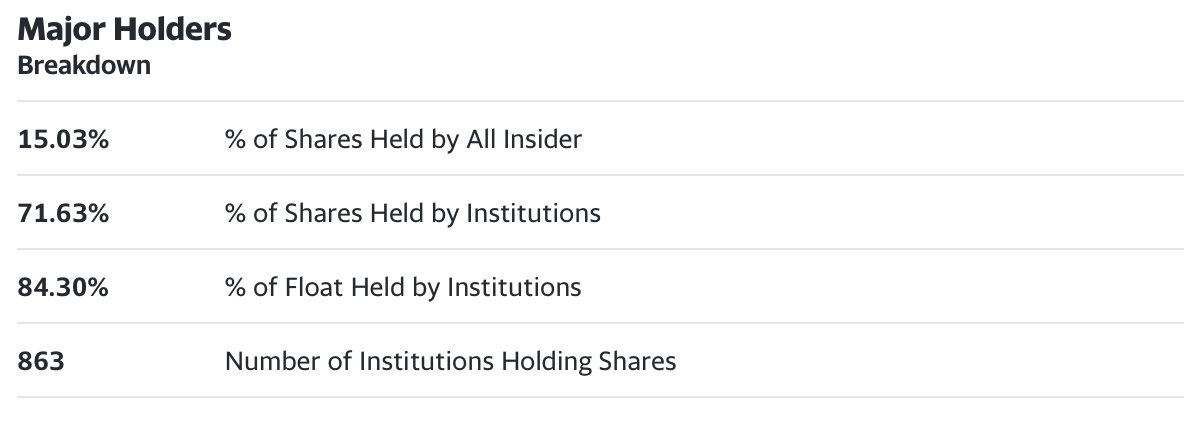

Give me your take on Paul Pelosi’s method.Hard to explain, and I realize I might not convince people if they believe something. SMCI has 54,135,000 shares outstanding. Insiders can't trade without public notification. So who is manipulating? Institutions?

View attachment 316719

Here are the top institutional holders...ALL PASSIVE INDEX FUNDS.

So what it is? It's Options. Last week, which was the monthly expiration, 34,000,000 shares were traded. Today is weekly expiration and we are over 15,000,000 with 3 hours left. SMCI Is in the top 10 of options volume today (for a $50B markets cap) right behind Apple which is around $3T. I'm showing 440,000 options being traded (100shrs each option). Even is I divide that number by two to eliminate a side, that is still half the shares outstanding covered by options.

Options are driving everything these days. Like I said, degenerate gambling. Everyday is a Super Bowl in SMCI and NVDA until they stabilize. But all the betting is causing the volatility, so it is self-fulfilling.