BigHornRam

Well-known member

All the politicians are waiting for a blackout, before touching the third rail. That day is coming.Let's start with 2 big dogs. Social security and Medicare.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

All the politicians are waiting for a blackout, before touching the third rail. That day is coming.Let's start with 2 big dogs. Social security and Medicare.

But you are very self-aware. That would be refreshing.I lack patience, money, and a filter to run. Otherwise I would consider it.

Let's start with 2 big dogs. Social security and Medicare.

yepWe fed the beast long enough. Time for the beast to go on a diet.

No offense, but Bloomberg can blow me.yep

America Blew Almost $2 Trillion. Make It Stop.

The expiration of the Tax Cuts and Jobs Act offers an opportunity to get the federal budget under control.www.bloomberg.com

yep

America Blew Almost $2 Trillion. Make It Stop.

The expiration of the Tax Cuts and Jobs Act offers an opportunity to get the federal budget under control.www.bloomberg.com

Who doesn't want a tax deduction back? Especially when it was a partisan "Pay-for".jryoung wants his SALT deductions back, I see.

"Under the current rule, there is a $10,000 SALT deduction cap for single and joint-filing taxpayers who deduct local property, income and sales tax on their federal return. This deduction cap was created under the Tax Cuts and Jobs Act (TJCA) and is expected to sunset in 2026."

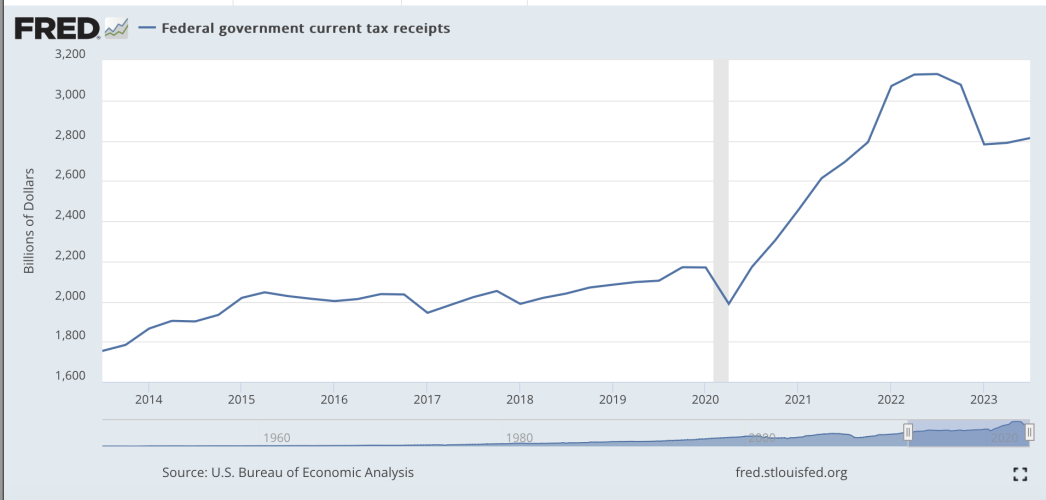

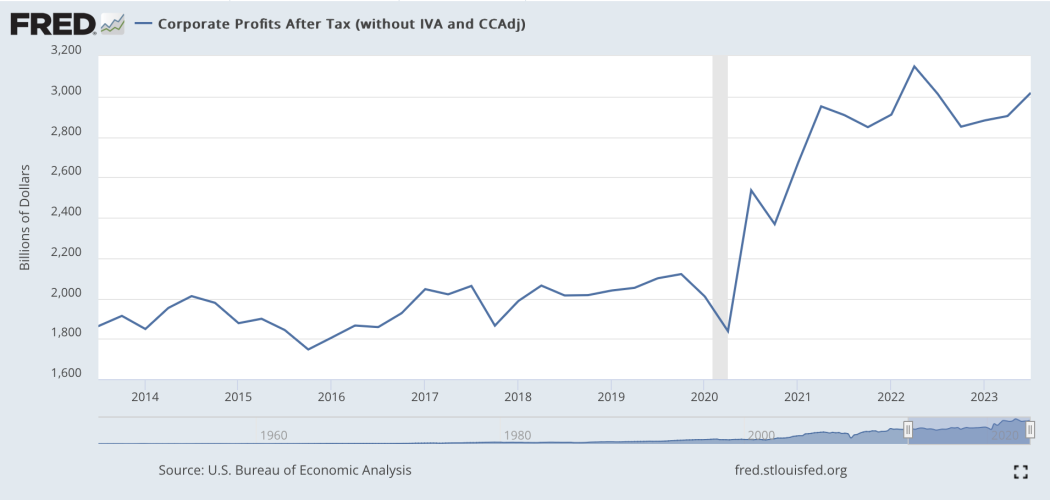

Seems to be more of an out of control spending problem and not so much a lack of tax revenue problemObviously tax receipts aren't keeping pace and billions in refunds are taking a bite. Yet some want to cut taxes even more.

I don't. The standard deduction is plenty.Who doesn't want a tax deduction back? Especially when it was a partisan "Pay-for".

You ever used one of the tax calculators... pretty much impossible to diet enough to make a real difference.We fed the beast long enough. Time for the beast to go on a diet.

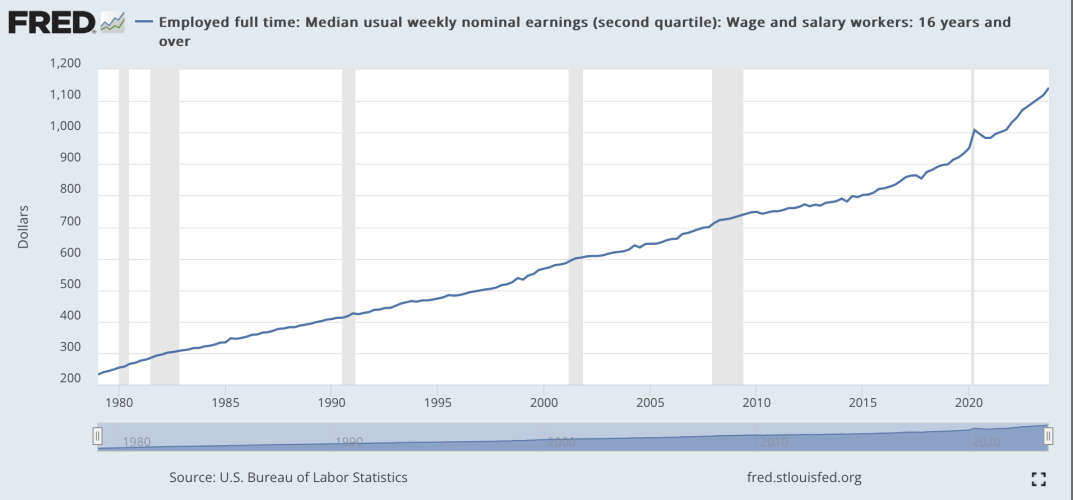

That is a very good question. Hard to say because it is impossible to disaggregate the effect of various policy changes. That is always the case in economics but I'm sure it is especially true when you throw a pandemic in middle of your time frame. If I were to guess, I would say that CRS would keep that conclusion. I say that because we know that, absent some pent-up demand from a restricted economy, tax changes don't have much of an effect on the broad economy. (Only economists that want a position in the government still hold that view).That article (from yesterday) seems to base some of its premise on this: "In 2019, the Congressional Research Service, charged with briefing Congress on its own policies, concluded that the TCJA didn’t increase wages and had little to no effect on economic growth."

Would that still be the CRS's conclusion today?

You can do whatever you want to do. Me, I'm putting an electric fence around my little haystack.You ever used one of the tax calculators... pretty much impossible to diet enough to make a real difference.

Like you'd have to cut the military budget in half and eliminate social security for everyone but disabled/children... etc etc in order to have that make as much a difference as up'ing corporate taxes and income taxes.

MmmmkYou can do whatever you want to do. Me, I'm putting an electric fence around my little haystack.

And no one wanted to listen. So here we are now, spending 1 trillion a year on interest on the debt. And the debt is growing at 1 trillion every 100 days. Do the math, it is growing at a 10.7% annual rate. Sounds like a problem to me.Gosh, someone sure loves to talk about debt.

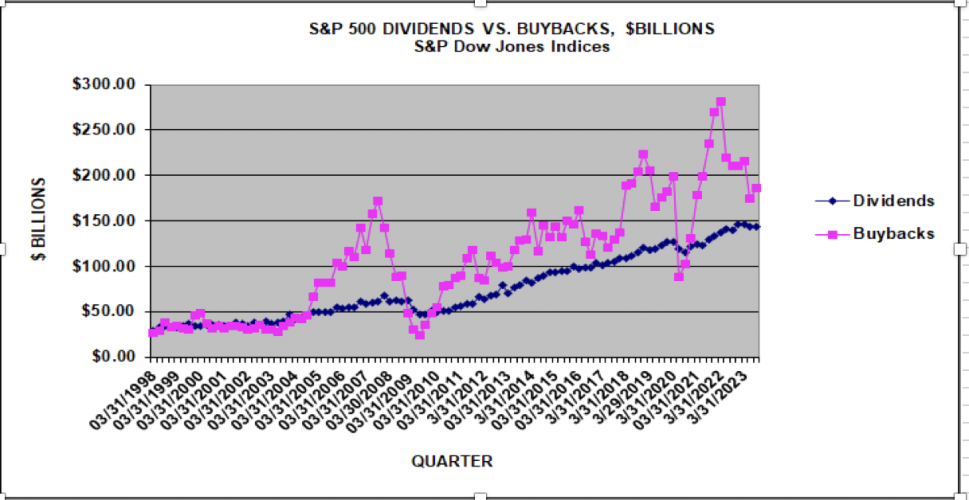

View attachment 318030

What about their further foray into AI? Later this year Apple will announce news on generative AI. At worst their slogan could be: "Apple AI: Way Better than Google's"AAPL is the next stock to toss into the dustbin. What they spent on e-vehicle development is chump change compared to their cash hoard. No blockbusters on the horizon.

Hopefully they've been in it for awhile, but we'll see. I expect it will go lower before it goes higher. How much? Dunno.What about their further foray into AI? Later this year Apple will announce news on generative AI. At worst their slogan could be: "Apple AI: Way Better than Google's"

www.forbes.com

www.forbes.com