Benfromalbuquerque

Well-known member

- Joined

- Jul 15, 2020

- Messages

- 1,839

Well there is this. And my nature would be to wait until the tech bubble explodes then short this mfer into the ground.I dunno, there seem to be some real financial whizzes in Congress.

Too bad we cant just put Pelosi in charge of straightening out Social Security mess. Or at least have her invest it for us:

Nancy Pelosi’s portfolio is up 91% in a year; Here’s what she holds

As recent years have proven, Nancy Pelosi is not only a highly successful stock trader, but also one of the best prominent investors out therefinbold.com

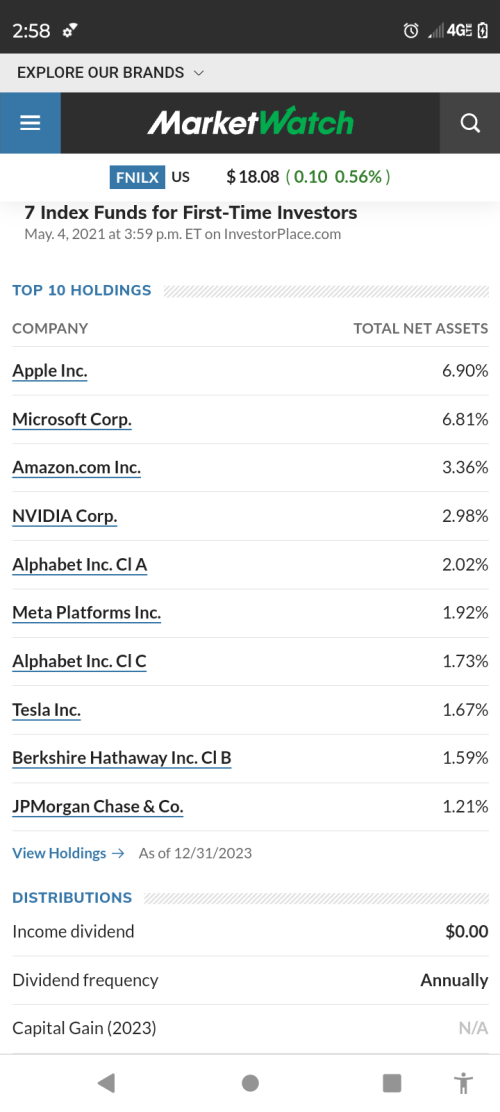

ETF Named After Nancy Pelosi, Tracking Congressional Democrats' Stock Trades, Surpasses S&P 500 with Tech Triumph

An exchange-traded fund that tracks the stock trades of Democratic members of Congress has been outperforming the S&P 500 since its launch in 2023.