Still on the short side of market life.

And... some koolAid to drink on the subject.

And... some koolAid to drink on the subject.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Still on the short side of market life.

And... some koolAid to drink on the subject.

My son’s college told him during scheduling fall classes to expect the potential of continued long distance learning.and i kind of think: how could it not?

Coronavirus: Lebanon begins 'total' shutdown as cases increase

There has been a steep rise in coronavirus infections since lockdown restrictions were eased.www.bbc.com

with easing comes pain i think, unfortunately

didn't fauci just tell colleges not to count on students coming back this fall?

i still think the market is being far too optimistic when it comes to the virus

Hawaii is bringing kids in 3 weeks early and putting them into a 2 week quarantine. Unique location for sure.and i kind of think: how could it not?

Coronavirus: Lebanon begins 'total' shutdown as cases increase

There has been a steep rise in coronavirus infections since lockdown restrictions were eased.www.bbc.com

with easing comes pain i think, unfortunately

didn't fauci just tell colleges not to count on students coming back this fall?

i still think the market is being far too optimistic when it comes to the virus

The best part of the article is the oddly specific calls - first to 2400 then back to 3000 by year end. It that happened, it would be the most incredible call ever. Its a 20-25% range. What is entertaining is that it seems to allow them to claim some type of victory no matter what. If stocks fall, they got that right. If stocks rise from here, they got that part right instead. Both happen? I wouldn't bet on it There are a lot of investors that are not fully positioned they way they want and missed this rally. Other dips will be bought early. We need a lot of bad news to see 2400 again. Anything is possible, but...and i kind of think: how could it not?

The best part of the article is the oddly specific calls - first to 2400 then back to 3000 by year end. It that happened, it would be the most incredible call ever. Its a 20-25% range. What is entertaining is that it seems to allow them to claim some type of victory no matter what. If stocks fall, they got that right. If stocks rise from here, they got that part right instead. Both happen? I wouldn't bet on it There are a lot of investors that are not fully positioned they way they want and missed this rally. Other dips will be bought early. We need a lot of bad news to see 2400 again. Anything is possible, but...

You will zero disagreement from me, but the market has been optimistic for the last decade so it doesn't surprise me. My general view is we are range bound with the 200day MA as a hard ceiling (about 3000) and the 50day MA as the floor (around 2720). We have a long and hard economic road ahead of us. TSA traveler check daily numbers just passed 200k a few days ago, versus last year at 2.5m per day last year. Protesters can protest all they want, but until people feel safe they aren't going to do much.you make a good point - from a kool aid perspective especially

but i'm speaking more generally and i've firmly planted my foot on the perspective that the stock market is being too optimistic.

perhaps i'm too simple minded. i assume if infection rates go up, stock market will likely go down, which is in some senses what we saw at the beginning. i have a sneaking suspicion we'll be seeing infection rates spike again across the country between now and the fall. the resistance to lockdowns is becoming intense, the chomping at the bit to get some economic activity going again is becoming too great, and until we have a vaccine -- notwithstanding the other discussion of the likelihood the eventual vaccine actually hits the nail on the head -- it would seem logical that any lessening of social restrictions beyond current is going to increase infections

and increase in infection likely means tightening things up again, which stifles economic activity again, which in theory should frighten investors

disclaimer: i make this stuff up as i go and i'm as economically educated as a starfish

Protesters can protest all they want, but until people feel safe they aren't going to do much.

Yup - when a business closes employees that want to go to work protest; and then when the business does open the employees who don't feel safe to go to work sue. Classic damned if you do, damned if you don't. Recent polls suggest for every person that wants the economy "opened up" there are two who want to proceed slowly. So even if the govt takes off the restraints, the consumers/travelers/shoppers/etc aren't just rushing back to pre-crisis levels anytime soon.+1 right there

One I actually pay to access/use. Forums are a bit lopsided though articles are often great insight for this rookie hobby trader.

The market v the real economy

Financial markets have got out of whack with the economy. Something has to givewww.economist.com

A one-month bear market scarcely seems enough time to absorb all the possible bad news from the pandemic and the huge uncertainty it has created. This stockmarket drama has a few more acts yet.

I disagree. It's puffery. I see nothing in there that is new and even less that is material at this stage of the economic recovery. I wouldn't be short, but there is nothing here that causes me to want to be more long. Price remains the driving indicator of sentiment. S&P needs to bust through 2950 in a convincing way and then it hits the 200day MA at just under 3000.

Executive Order on Regulatory Relief to Support Economic Recovery | The White House

In December 2019, a novel coronavirus known as SARS-CoV-2 ("the virus") was first detected in Wuhan, Hubei Province, People's Republic of China, causing anwww.whitehouse.gov

As an exclusive member of the short crew for our market... This one's going to hurt.

For those riding the longs, you're on the right side of this one. I don't like seeing opportunity to make $ slide by... I'm a bit late to this party. May have to flip sides... Though I'm on the short side of the warning China / U.S. Trump fight so hoping it knocks semiconductors/microchips down... I'm still up though I've wiped away some good gains and this Executive Order may place red ink on my ledger for the week.

I believe this will run a green streak through the week and possibly more. This is... Yuuuge!

Yup, I just keep believing that at some point wall street will have to reconnect with mainstreet realities but hasn't so far. Guess it's good I am not an economic advisor.I disagree. It's puffery. I see nothing in there that is new and even less that is material at this stage of the economic recovery. I wouldn't be short, but there is nothing here that causes me to want to be more long. Price remains the driving indicator of sentiment. S&P needs to bust through 2950 in a convincing way and then it hits the 200day MA at just under 3000.

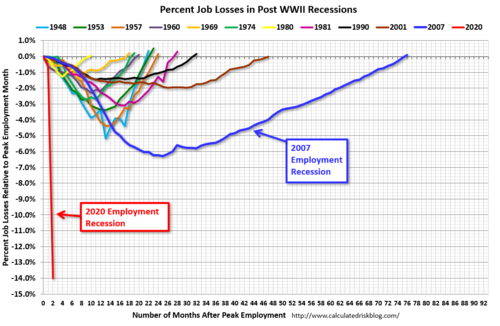

Below is the problem the economy faces. The market can overlook it for a while, and has to get us to this point. The question is over what time frame does a recovery happen. Notice that 2001 and 2007 took the longest time on the chart.

View attachment 140957

I worry about some of the consequences of this executive order, not just from an economic perspective.

Executive Order on Regulatory Relief to Support Economic Recovery | The White House

In December 2019, a novel coronavirus known as SARS-CoV-2 ("the virus") was first detected in Wuhan, Hubei Province, People's Republic of China, causing anwww.whitehouse.gov

The only people that are going to make money on this move are the lawyers on both sides litigating every little step. This is noise more than substance - little will change either direction.I worry about some of the consequences of this executive order, not just from an economic perspective.

I was thinking the same... Was scouring the HT forum looking for our HT member who hides behind his second HT account as, "Mark" post this Executive Order as the destruction of the world... Haha!I worry about some of the consequences of this executive order, not just from an economic perspective.