Wish I was on that train! Speak of some lunch $!I sold 190, 195 & 200 calls on FB this morning for a nice gain and happy with it. After hours it's up another $15 to 210. Oh well, bird in the hand.....

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

Irrelevant

Well-known member

Interesting listening to you guys. I've only ever adjusted my buying. I've never sold anything.

Interesting listening to you guys. I've only ever adjusted my buying. I've never sold anything.

I have a half dozen or so different stocks that I bought probably 5 years ago and have stuck with them. two have increased about 250%, four are over 300% and one is at -56%. So I have the ones I have stuck with. I sold a mutual fund in February that I had been riding and have been using it to play options with. I doubled my money in about 3 weeks and then the crash came and I ended up with about 10% of the original amount left. After the FB sells yesterday I am back up to about 85% of the original amount. Options remind me of slot machines.

noharleyyet

Well-known member

Man I hate this "made me look" thread some days.

Stocks Are Recovering While the Economy Collapses. That Makes More Sense Than You'd Think.

While the economy is contracting, the market is soaring. If you look closely at what's up and down, it actually makes sense--for now.

Thought this was a good article

“The most visible effect of the money in motion now is the stock market, but that will be not the sole beneficiary as more Fed money flows to states and Main Street.

So while it appears crazy that markets are doing relatively well as the world economy burns down, there is a method to the madness that reflects some potentially positive realities of an otherwise dire time. That may be small comfort just now, but it is a clear reminder that as bad as things are just now, they actually could be considerably worse.“

Well, @brymoore - you held the market crystal ball...He can say that all he wants but he bought banks at the bottom in 2008. He sold out of airlines now to better position himself for his next big purchase. He sold $1.8B in bonds now at a low rate to have cash to purchase. He’s positioning himself for a payday.

Warren Buffett says Berkshire sold all its airline stocks because of the coronavirus

Buffett said Berkshire sold its entire stake in United, American, Southwest and Delta Airlines, worth more than $4 billion on December 31.

Any predictions you'd care to share? I'm listening.

I believe we're going to see a retraction this coming week. Maybe not massive spike though, I believe we'll have a bit more red days than green.

My foggy crystal ball proclaims red... yet I sold my AMD puts Friday... Green is green. It was a good piece of lunch $.

Well, @brymoore - you held the market crystal ball...

Warren Buffett says Berkshire sold all its airline stocks because of the coronavirus

Buffett said Berkshire sold its entire stake in United, American, Southwest and Delta Airlines, worth more than $4 billion on December 31.www.cnbc.com

Any predictions you'd care to share? I'm listening.Has to be better than my coin flip...

I believe we're going to see a retraction this coming week. Maybe not massive spike though, I believe we'll have a bit more red days than green.

My foggy crystal ball proclaims red... yet I sold my AMD puts Friday... Green is green. It was a good piece of lunch $.

I don’t know if I have a crystal ball. Buffet’s number two said the other day that no one was calling Buffet for money, yet.

I’m still seeing a business blood bath. We’ll have a reduced economy even if everything is opened up today.

I think another reduction in the market is coming.

UPS triggered a buy alert I set a few weeks ago... now I'm hesitant to hop on for a ride.

I'm testing the waters w/ a few July calls this morning... Not jumping in as I agree, I think we're going to take another dip.

However, I believe B2B (business -> Business) and B2C (Commerce) are at a low and building steam as we open up a bit, worldwide. Amazon suspended it's in house delivery so they've become full dependant on ups/FEDX/USPS. Online sales have soared and cargo is not a covid-19 passenger issue so... Well, here's to my coin flip. Short trend suggests my lunch $ will be a quick swing trade though we'll see.

I'm testing the waters w/ a few July calls this morning... Not jumping in as I agree, I think we're going to take another dip.

However, I believe B2B (business -> Business) and B2C (Commerce) are at a low and building steam as we open up a bit, worldwide. Amazon suspended it's in house delivery so they've become full dependant on ups/FEDX/USPS. Online sales have soared and cargo is not a covid-19 passenger issue so... Well, here's to my coin flip. Short trend suggests my lunch $ will be a quick swing trade though we'll see.

SAJ-99

Well-known member

I think most people are. I hear a lot of "too expensive here, but buy the dip". A 50% retracement of the recent bounce gets the S&P to about 2600 (at 2800 right now). The current "dip" is about 5% from the 2940 level we hit a week ago. There are signs the reopening is going to be pretty slow. I don't know what changes over of the next 6 months unless it comes from the biotech/pharma field in the way of treatment options the greatly reduce deaths or a vaccine, which I don't think is coming in 2020 unless the FDA and CDC start cutting corners on trials.I am still optimistic.......

Well, swing trade is what it is. Lunch $

Between that and AYX... I *should have rode that horse and sold pre earnings the 6th. Green's green so not complaining.

Micron has paid some good $ in the past. Either it's rocketing to new levels and I'll be benched in red or this run is going to hit this upcoming wall and drop back in its place... Coin flip? Crystal ball has been a bit fuzzy of late.

Between that and AYX... I *should have rode that horse and sold pre earnings the 6th. Green's green so not complaining.

Micron has paid some good $ in the past. Either it's rocketing to new levels and I'll be benched in red or this run is going to hit this upcoming wall and drop back in its place... Coin flip? Crystal ball has been a bit fuzzy of late.

Last edited:

I believe my crystal ball may, in fact, be a garage sale funky bowling ball... Maybe that's why it's been a bit foggy of recent.

I'm still up a fair amount this week however, today, futures appear to suggest a heavy green run. Considering the stay at home orders phasing out, the market mood has held a positive run. I'm mainly in a short / Put pattern and I feel I may pay the Piper a bit.

Even more interesting, the incredible volume combined w/ volatility has tempered itself. Even still, 2% Dow/S&P moves are large for calm markets, we've not had our 9%+ / - days...

I'm a bit surprised, as a hobby market player, considering the inventory stall, etc that the market is tempering itself.

If we do not have a resurgence of COVID-19, this may be the, *bottom"... Of course ripple effect of businesses will be felt for a good while however the significant market blow may have made it's mark.

I really thought 18000 support mark would be tested again however, the market has significantly simmered since the radical volatile days. Of course, red comes w/ green, a given though...

Thoughts?

I'm still up a fair amount this week however, today, futures appear to suggest a heavy green run. Considering the stay at home orders phasing out, the market mood has held a positive run. I'm mainly in a short / Put pattern and I feel I may pay the Piper a bit.

Even more interesting, the incredible volume combined w/ volatility has tempered itself. Even still, 2% Dow/S&P moves are large for calm markets, we've not had our 9%+ / - days...

I'm a bit surprised, as a hobby market player, considering the inventory stall, etc that the market is tempering itself.

If we do not have a resurgence of COVID-19, this may be the, *bottom"... Of course ripple effect of businesses will be felt for a good while however the significant market blow may have made it's mark.

I really thought 18000 support mark would be tested again however, the market has significantly simmered since the radical volatile days. Of course, red comes w/ green, a given though...

Thoughts?

I'm still up a fair amount this week however, today, futures appear to suggest a heavy green run. Considering the stay at home orders phasing out, the market mood has held a positive run. I'm mainly in a short / Put pattern and I feel I may pay the Piper a bit.

Thoughts?

I am there with you. After the big move last week, I thought Put. They are putting it to me right now. Did make a little on RGR this morning, but not near enough to cover the red I am seeing on others.

thusby

Well-known member

The bottom is in. I'm expecting states to start reopening after memorial day.

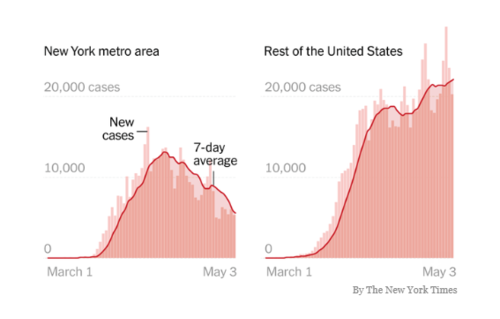

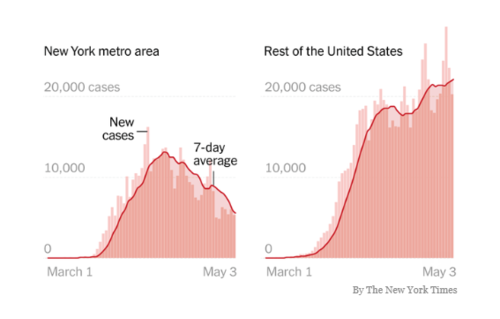

This graph is what really alarms me, the 'rest of the US' is what is opening up, and they haven't gotten control of virus spread anyway. I read this morning that 40 states will have at least partially reopened by this weekend. Seems like the spread will really start to surge here in the next couple weeks in these states, and if states have to go back into lock downs it seems like that is when we could see another large pull back in the markets. I'm with you guys that the bottom is probably in, but starting to get nervous about a 10%-20% drop

Hope I made you look today... Anyway, CenterPoint Energy, Inc. (CNP) is Up 12% on beating earnings. I bought last week. Anyone thinking this would still be a good long hold? They DIV was cut in half but it is still 3.75%Man I hate this "made me look" thread some days.

Simmered?? I don't know if i would say that. Last week was ugly, just as stupid as the gains the week before that. Q2 earnings and bankruptcies is what I am worried about causing an effect that will trigger others. I am still half in with Hertz, and that one is my biggest and only loser so far and best chance of going BK at this point. Right now I am in QQQ, SUN, BP, CLX, AMZN. OKE, RDS-A, MPC, BAC, MSFT Yes it is a lot of energy in there but like I always say, BIG oil is never going out of business, never has, never will. I would not say that about the small shale drillers though, I would not touch them. My biggest regret is not buying Sunoco when I first wanted. Could not buy in my 401k but played around and found I could in my IRA's but a couple weeks after I wanted to really buy in. That was would have been so sweet to buy near the bottom., the market has significantly simmered since the radical volatile days. Of course, red comes w/ green, a given though...

Thoughts?

TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,328

This graph is what really alarms me, the 'rest of the US' is what is opening up, and they haven't gotten control of virus spread anyway. I read this morning that 40 states will have at least partially reopened by this weekend. Seems like the spread will really start to surge here in the next couple weeks in these states, and if states have to go back into lock downs it seems like that is when we could see another large pull back in the markets. I'm with you guys that the bottom is probably in, but starting to get nervous about a 10%-20% drop

View attachment 139355

I'm worried about a second wave as well and I think the market will take a hit if/when there is one. The recovery has been so much faster than I expected but it could fall again pretty hard. I worry that we're convincing ourselves that we have a better handle on the disease than we do.

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 13

- Views

- 705

- Replies

- 22

- Views

- 2K