Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

Big Tech earning conferences at bat.

seekingalpha.com

seekingalpha.com

The next big test for the markets comes this week as Big Tech reports Q2 results. OpenAI-backer Microsoft (MSFT) is on tap after today's closing bell, while Meta (META) will publish quarterly numbers tomorrow, followed by Apple (AAPL) and Amazon (AMZN) on Thursday. As in past quarters, the group of Mag7 stocks is estimated to account for the majority of earnings for the entire S&P 500 Index, but this time around, the accompanying commentary should be more of an important indicator of sentiment due to the recent rotation.

Early innings: Optimism over AI has undoubtedly been one of the biggest drivers that has propelled market indices to continuous record highs. The biggest tech players in the industry are flush with cash, so it makes sense to deploy capital to areas they see as the next engine for growth. Their core businesses are also doing extremely well, so it makes sense to keep one eye on the long term and build out the infrastructure necessary for the anticipated revolution.

However... Investors also now want to hear how all that spending will lead to profits, and understand artificial intelligence use cases and productivity models. The Big Tech giants don't necessarily have to show off revenues related to AI just yet, but painting that picture should be enough to keep shareholders in gear until that materializes. Successful conference calls and earnings commentary should separate capex spending from actual operating results, while outlining the need to go big at first and following up with more cost discipline (similar to the internet buildout in the 1990s and the cloud buildout that followed).

The AI roadmap: What to watch as Big Tech earnings kick off (NASDAQ:MSFT)

BlackJack3D/iStock via Getty Images The next big test for the markets comes this week as Big Tech reports Q2 results.

longbow51

Well-known member

- Joined

- Feb 17, 2023

- Messages

- 1,251

Lately, we have been getting many offers to buy (rather than lease) mineral interests, citing low natural gas prices and a glut in storage.Nat Gas has been taking a beating lately. Hard to explain given heat waves typically mean more use for electric. Took a chance on that today.

So, as Charlie Chan would say, two possibilities:

- They are just really nice and want to give us money, or

- They see the price going up

SAJ-99

Well-known member

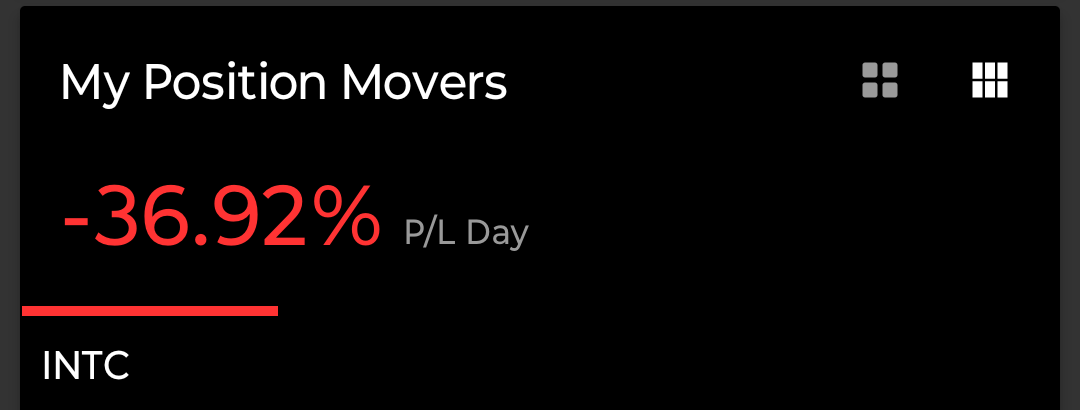

Ooof. Rough report.INTC still making a nice climb.

Now that I've said that...

ismith

Well-known member

Sure hope you shorted INTC. (Told ya, opposite my info)Ooof. Rough report.

Cringing effect took place listening to the earnings conference.

Swear, I alone, control the market. Hah!

Will be a great buy price once that labor cut completes and the AI agreement goes into effect.

SAJ-99

Well-known member

I dunno intc is a bit of a dinosaur and missed the wagon more than once.Sure hope you shorted INTC. (Told ya, opposite my info)

Cringing effect took place listening to the earnings conference.

Swear, I alone, control the market. Hah!

Will be a great buy price once that labor cut completes and the AI agreement goes into effect.

Bonasababy

Well-known member

- Joined

- May 16, 2024

- Messages

- 915

And someone is not agreeing to fully fund the IRS so they can work on that.Someone isn't paying their taxes.View attachment 334925

ismith

Well-known member

Someone isn't paying their taxes.View attachment 334925

Who pays, and doesn't pay, federal income taxes in the U.S.?

Since 2000, there has been a downward trend in average effective tax rates for all but the richest taxpayers.

www.pewresearch.org

www.pewresearch.org

BigHornRam

Well-known member

Any dumpster diving treasure to report today?

SD_Prairie_Goat

Well-known member

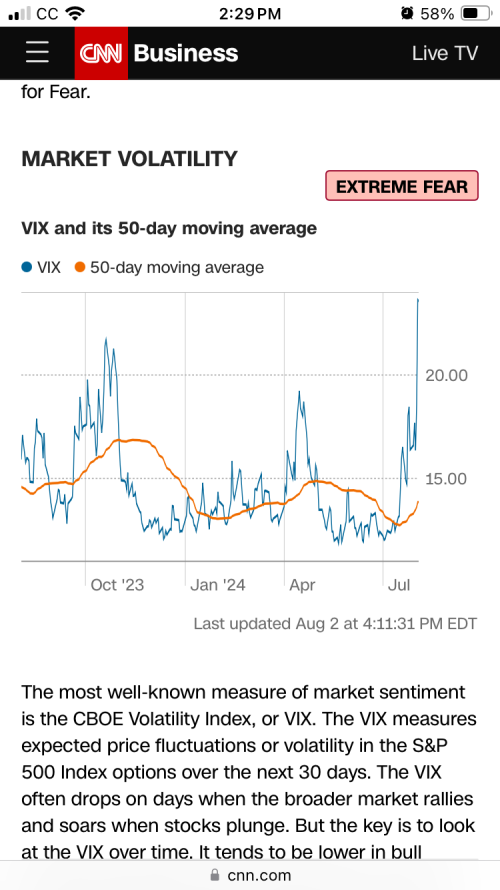

Whole place feels like it's on fire today...Any dumpster diving treasure to report today?

Apple is my only stock that's green today

noharleyyet

Well-known member

Let me know when riverboat rides are a nickel....

SAJ-99

Well-known member

This is what happens when everyone is on the same side of the boat and vol is oversupplied. All the positions have to brought back in balance. It looks like a refreshing cleansing up to this point. But I'm not sure what is on sale and what just got back to a more reasonable valuation. The vol sellers will be back at these prices.

TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,314

I'm forcing myself to sit on my hands for the day. I had several things hit limits and sell off this week. I have no idea what to do lol.

Bonasababy

Well-known member

- Joined

- May 16, 2024

- Messages

- 915

Hate these days. In it for the long haul but still bothersome for someone not into the roulette wheel that individual stocks are and with most of their money in retirement plans.

ismith

Well-known member

Came here to post this……….This is what happens when everyone is on the same side of the boat and vol is oversupplied. All the positions have to brought back in balance. It looks like a refreshing cleansing up to this point. But I'm not sure what is on sale and what just got back to a more reasonable valuation. The vol sellers will be back at these prices.

View attachment 334997

Attachments

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 12

- Views

- 606

- Replies

- 22

- Views

- 2K