jryoung

Well-known member

Saw Josh Hawley ranting about this today. I never thought I would agree with Josh Hawley on anything, so I am comforted there are still things we can agree on. Of course it will never get done.

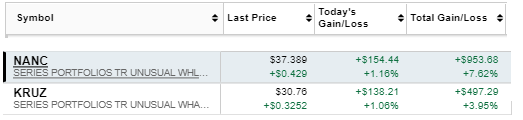

The good news is that you don't need to subscribe. There is website that tracks it all. Pelosi gets all the headlines, but there are a lot of crazy stuff in the data.

Track US politician stock trades

Track US politician trades for free with Capitol Trades. Discover which Stocks/Assets/Companies/Issuers politicians are buying or selling.www.capitoltrades.com

They just need to mirror the independence requirements of any partner in a Big 4 firm.