noharleyyet

Well-known member

Not what I asked...There’s money to be made in the market no matter what flavor of cool aid

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Not what I asked...There’s money to be made in the market no matter what flavor of cool aid

Because the market doesn't care. It may care about a specific policy decision, but let's be honest, election-year politics hasn't been about policy for decades. The market certainly doesn't care about who the Sec of State is. It barely cares about who the President is. It might care a little more about the balance of power across the various branches, but that won't matter much until the middle of Nov.We are completely conditioned to rate and rationalize policy by which party is pushing it.

How do we even begin to separate politics from the market?

Any investor that is not paying close attention to global politics right now is a fool.Please go for a hike. I enjoy this thread. It made it through one election. Let's not get political and see if it can last through another.

Because the market doesn't care

Presidents and Their Impact on the Stock Market

While administration policies and appointments can somewhat influence the economy, the president's ability to impact markets is generally indirect and marginal.www.investopedia.com

Interesting method of titling the article though good read otherwise. Maybe bad read for others... Nature of internet forums.

I generally agree, but not sure what you mean by "tilting". It didn't seem to have a bias. The market right now is watching polls on Congress and President races. What matters to Wall Street is taxes.

- Typically, Congress and the Federal Reserve can play a bigger role in directly shaping markets, compared to the president.

- Fiscal spending legislation passed by Congress can influence market sentiment.

- The independent Federal Reserve can have a significant impact by raising (bearish) or lowering (bullish) interest rates.

- Bullish stock market sentiment can improve a president's popularity, while a bearish stock market outlook can undermine a president's standing.

Click that dividen reinvest button and forget about it. Make going for hikes much more pleasantAny investor that is not paying close attention to global politics right now is a fool.

The market will drop like a rock if China invades Taiwan. I have no confidence in the Washington clown show right now.Because the market doesn't care. It may care about a specific policy decision, but let's be honest, election-year politics hasn't been about policy for decades. The market certainly doesn't care about who the Sec of State is. It barely cares about who the President is. It might care a little more about the balance of power across the various branches, but that won't matter much until the middle of Nov.

So how much gold do your really own?Any investor that is not paying close attention to global politics right now is a fool.

But what it cares about are the impact on the ability to make money. Not red or blue. Red or blue policies can affect that. Now the market does speculate on impacts that later aren't real, but again it's the impact on making money that is the issue.Of course this was with your error reading believing the word used was, "tilting" vs the actual word in the post, "titling". I had to look at my word again to make sure I didn't mistype. (Which I did not).

The market does care. Boils down to the common. O&G is Red, Green is Blue, Tarriffs (Trump) Red, Biden restrictions on domestic mining, etc Blue... Politics and Market go hand in hand, IMO. China vs US economic war... prime example.

@BigHornRam brought up the prime issues involved with market activity, as noted in the article:

I think some are thinking "the market" includes shorting and other strategies that bet on losing money. That's not a market reaction.

None. Not even in my teeth.So how much gold do your really own?

You are pointing out the obvious. China will do whatever it does regardless of the November results. The best thing we can do is have strong alliances with other countries.The market will drop like a rock if China invades Taiwan. I have no confidence in the Washington clown show right now.

Going to the point that SAJ called for BHR to take a hike is brazen considering the opinions I've read of yours and others. Especially considering Yellen, etc. They are a directly involved in Market activity.

Nevertheless, a subscription to Paul Pelosi's exclusive newsletter would be advantageous....The stock market only cares where the money is flowing too. Money leaving the market or entering the market

Saw Josh Hawley ranting about this today. I never thought I would agree with Josh Hawley on anything, so I am comforted there are still things we can agree on. Of course it will never get done.Nevertheless, a subscription to Paul Pelosi's exclusive newsletter would be advantageous....

Correct, nada will transpire, but it's a great opportunity for catchy acronym coinage.Saw Josh Hawley ranting about this today. I never thought I would agree with Josh Hawley on anything, so I am comforted there are still things we can agree on. Of course it will never get done.

The good news is that you don't need to subscribe. There is website that tracks it all. Pelosi gets all the headlines, but there are a lot of crazy stuff in the data.

Track US politician stock trades

Track US politician trades for free with Capitol Trades. Discover which Stocks/Assets/Companies/Issuers politicians are buying or selling.www.capitoltrades.com

Dude you've been negative the last 3,000 points or so on the S&P. Any investor who is scared by every single itsy bitsy teeny weeny possible little negative thing in the world is a fool.Any investor that is not paying close attention to global politics right now is a fool.

In the overall big picture, politics and the market have very little to do with each other. Tax policy would be one exception. All the day to day BS are complete nothing burgers though.How do we even begin to separate politics from the market?

How about the federal reserve? It's all about political spin . This CNN piece cracks me up!In the overall big picture, politics and the market have very little to do with each other. Tax policy would be one exception. All the day to day BS are complete nothing burgers though.

For the last two days I watched Powell testify to Congress. There is more BS grandstanding from both sides every time I watch. My conclusion was I could never do that job because I would be a little too honest. Too many of our elected officials know nothing about the subjects they ask about. If you are giving testimony, be it Powell or Yellen, the market is parsing every word for some signal as to what comes next and when. You say the wrong thing and the market implodes and you could spend the next two weeks back tracking and trying to explain what you meant.How about the federal reserve? It's all about political spin . This CNN piece cracks me up!

Come on Powell. Throw us a bone, please.

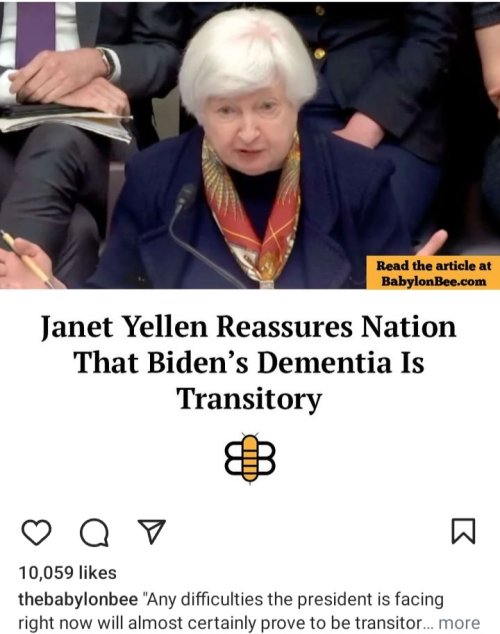

Remember inflation is transitory? View attachment 332391