Easy decision for me. Option A every day. I don’t trust others controlling my money, if at all possible.Back to the $1m question

If you were retiring today, age 60, would you prefer

a) $1,000,000 in the bank with full control of it, or

b) $4800/mo (with COLA ($1800 SS, $3000 pension)

Keep all other things equal- house is paid for, kids are gone and self-sufficient etc. The only decision is based on retirement income, which is actually a decision on risk. You can get a steady stream of income and not think about it or have to invest it yourself and deal with market and rate ups and downs.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What age to be a millionaire?

- Thread starter grizzly_

- Start date

D

Deleted member 28227

Guest

Seems like the win/lose rate is return of 7.3%... assuming inflation of 3%, death at 95.Back to the $1m question

If you were retiring today, age 60, would you prefer

a) $1,000,000 in the bank with full control of it, or

b) $4800/mo (with COLA ($1800 SS, $3000 pension)

Keep all other things equal- house is paid for, kids are gone and self-sufficient etc. The only decision is based on retirement income, which is actually a decision on risk. You can get a steady stream of income and not think about it or have to invest it yourself and deal with market and rate ups and downs.

Die sooner or have a better ROR you win with 1MM otherwise you lose.

95? That’s optimistic, aren’t we hovering around 77?Seems like the win/lose rate is return of 7.3%... assuming inflation of 3%, death at 95.

Die sooner or have a better ROR you win with 1MM otherwise you lose.

SAJ-99

Well-known member

Sure, but it isn't a straight math question. If a person wants to tell me exactly when they are going to die I can easily calculate when they can retire. Like I said, it is about assuming the risk. It is the same thing an insurance company does when a person buys an annuity. The main risk with the $1m in a person's control is they do something stupid with it.Seems like the win/lose rate is return of 7.3%... assuming inflation of 3%, death at 95.

Die sooner or have a better ROR you win with 1MM otherwise you lose.

Most people should take the annuity and go live their lives.Sure, but it isn't a straight math question. If a person wants to tell me exactly when they are going to die I can easily calculate when they can retire. Like I said, it is about assuming the risk. It is the same thing an insurance company does when a person buys an annuity. The main risk with the $1m in a person's control is they do something stupid with it.

SAJ-99

Well-known member

You willing to get rid of SS and not bail them out if they do something stupid with the money?Most people should take the annuity and go live their lives.

Maybe framing it another way, what percentage of Americans do you think could responsibly manage that lump sum payment and safely pay their own bills through retirement?

D

Deleted member 28227

Guest

I was outlining where the break even was, as @SAJ-99 it's about risk. I was just giving the thresholds.95? That’s optimistic, aren’t we hovering around 77?

RobG

Well-known member

They say 4% withdrawal is sustainable if you know how to manage money; that would be $40,000 per year, or $3,333 per month. If you add in $1800 SS you would be at $5133 per month, so $1 million is a better deal if you know how to manage the money.Back to the $1m question

If you were retiring today, age 60, would you prefer

a) $1,000,000 in the bank with full control of it, or

b) $4800/mo (with COLA ($1800 SS, $3000 pension)

Keep all other things equal- house is paid for, kids are gone and self-sufficient etc. The only decision is based on retirement income, which is actually a decision on risk. You can get a steady stream of income and not think about it or have to invest it yourself and deal with market and rate ups and downs.

SAJ-99

Well-known member

You don't get SS with option a.They say 4% withdrawal is sustainable if you know how to manage money; that would be $40,000 per year, or $3,333 per month. If you add in $1800 SS you would be at $5133 per month, so $1 million is a better deal if you know how to manage the money.

My answer was simpler than involving the long term viability of SS or government bail outs.You willing to get rid of SS and not bail them out if they do something stupid with the money?

Maybe framing it another way, what percentage of Americans do you think could responsibly manage that lump sum payment and safely pay their own bills through retirement?

I don’t think most people could handle investing $1mm with an expected return for retirement. Some would be ok if they hired an adviser. Most Americans wouldn’t know how to invest and would eat up the principal balance until it’s gone.

Brittany Chukarman

Well-known member

For the last couple years no-risk Treasuries would have brought in $40-$50 G.

RobG

Well-known member

Well, then it tips to b, but it is close depending on what your assumption for returns are.You don't get SS with option a.

RobG

Well-known member

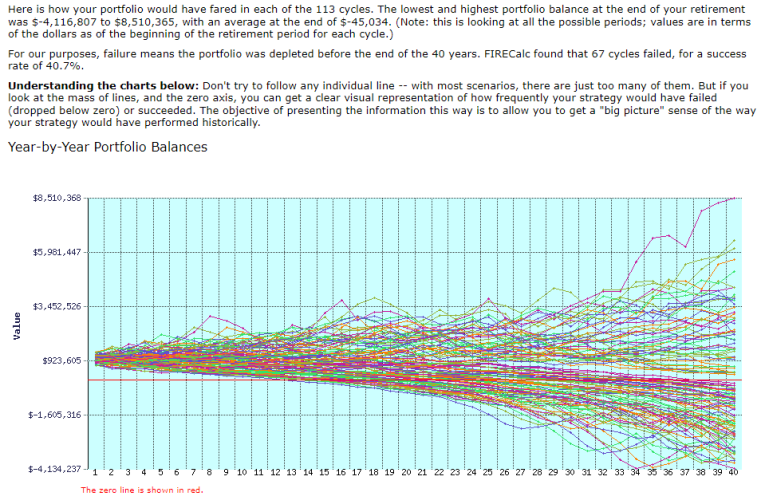

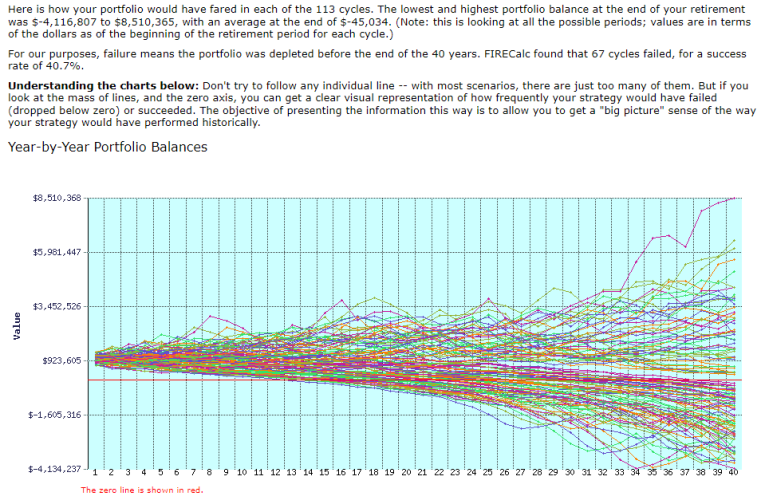

There's obviously a lot of variable, but if you use a simplistic approach of past returns the $1 million is worse about 60% of the time.

www.firecalc.com

www.firecalc.com

FIRECalc: A different kind of retirement calculator

SAJ-99

Well-known member

I bring the question up because I believe it will start to be a larger conversation in the political arena. We can't run from the problem much longer.I don’t think most people could handle investing $1mm with an expected return for retirement. Some would be ok if they hired an adviser. Most Americans wouldn’t know how to invest and would eat up the principal balance until it’s gone.

Your answer is reflective of the issue. We believe people should have control of their financial future, ie bootstraps and all, but we agree most people literally can't do it.

I made them about equal. A person could run a 50%bond/50% equity portfolio, which is largely the benchmark most FAs will use for a retired individual. They can get a 30yr treasury at 4.4% today (No COLA). Equity would need to return about 7% in year one and then keep up with inflation to get about the same return. This doesn't even touch principal. There are moving pieces. The return on the $1m would be higher over time if assumptions were reached given it has to be compensated for the risk. If you add the cost of a FA, your return is going to take a hit.Well, then it tips to b, but it is close depending on what your assumption for returns are.

Elky Welky

Well-known member

I have about 9 months to decide between options A and B right now. As a new state employee in MT, I can either choose a 9% matching state-run 401k, or join the state pension plan. If I pick the state pension plan, I'm stuck in a state job the rest of my life. So I'm gonna risk it for A.

RobG

Well-known member

Do FAs recommend treasury nominal bonds instead of TIPS?I bring the question up because I believe it will start to be a larger conversation in the political arena. We can't run from the problem much longer.

Your answer is reflective of the issue. We believe people should have control of their financial future, ie bootstraps and all, but we agree most people literally can't do it.

I made them about equal. A person could run a 50%bond/50% equity portfolio, which is largely the benchmark most FAs will use for a retired individual. They can get a 30yr treasury at 4.4% today (No COLA). Equity would need to return about 7% in year one and then keep up with inflation to get about the same return. This doesn't even touch principal. There are moving pieces. The return on the $1m would be higher over time if assumptions were reached given it has to be compensated for the risk. If you add the cost of a FA, your return is going to take a hit.

Bowmannate2000

Well-known member

That is a really nice match!I have about 9 months to decide between options A and B right now. As a new state employee in MT, I can either choose a 9% matching state-run 401k, or join the state pension plan. If I pick the state pension plan, I'm stuck in a state job the rest of my life. So I'm gonna risk it for A.

Sure, but it isn't a straight math question.

Agreed- need to know specific tax conditions of the hypothetical.

SAJ-99

Well-known member

Agreed- need to know specific tax conditions of the hypothetical.

Don't overcomplicate it. Assume it is all taxed as income.

SAJ-99

Well-known member

It varies. I just used nominal fixed treasuries for the example because 1) the government doesn't issue enough 30yr TIPS to satisfy demand in the hypothetical and 2) the TIPS would only give you the real rate as periodic income. The inflation portion would go to increase principal paid at maturity and that probably wouldn't work for people if we are just comparing retirement income streams.Do FAs recommend treasury nominal bonds instead of TIPS?

Similar threads

- Replies

- 112

- Views

- 3K

- Replies

- 140

- Views

- 8K

- Replies

- 16

- Views

- 3K