D

Deleted member 28227

Guest

@Wind Gypsy

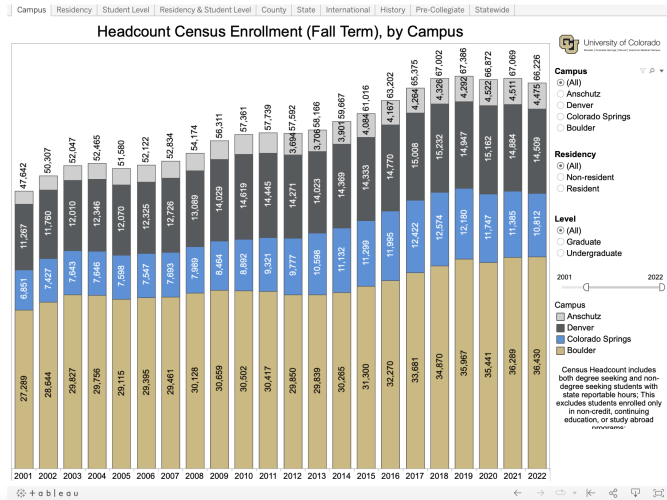

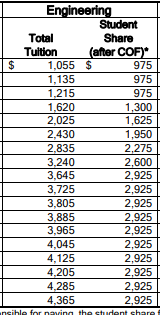

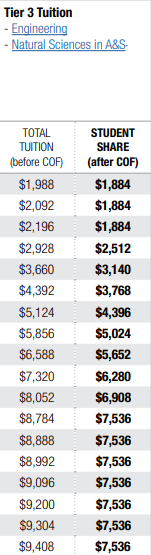

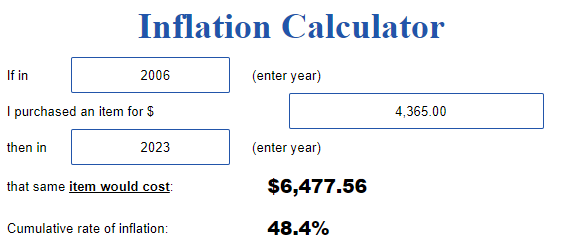

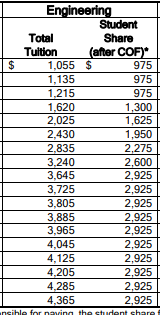

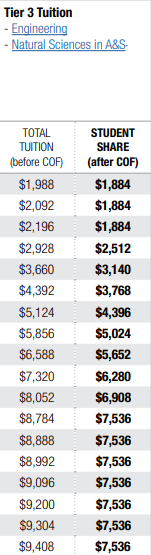

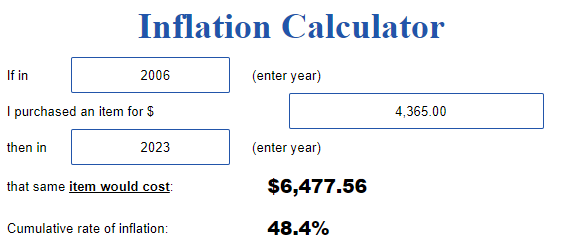

I graduated HS in 06' cost for me if I had attended CU v. genZ

2006

2023

Tuition at CU since I was in HS (millennial) has dramatically outstripped inflation, with the price more than doubling.

I graduated HS in 06' cost for me if I had attended CU v. genZ

2006

2023

Tuition at CU since I was in HS (millennial) has dramatically outstripped inflation, with the price more than doubling.

Last edited by a moderator: