SAJ-99

Well-known member

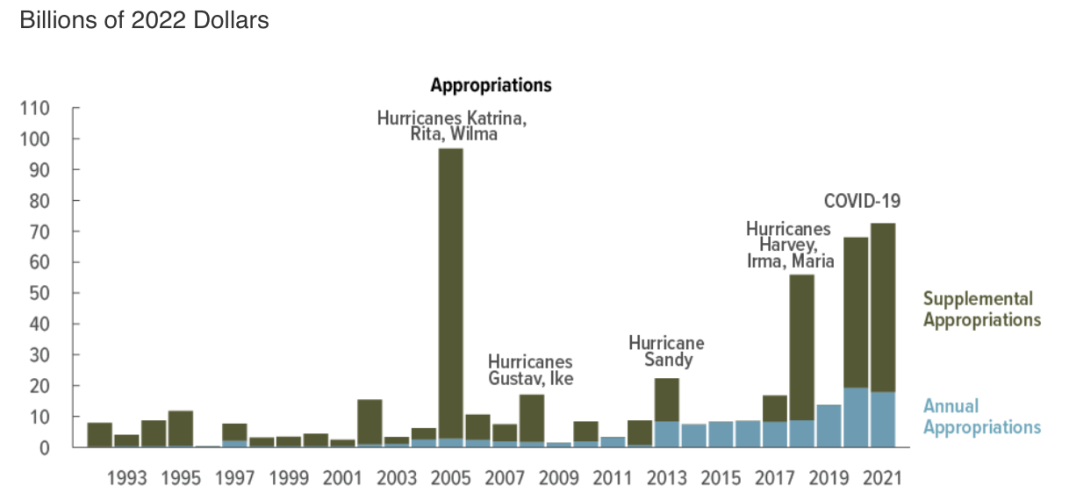

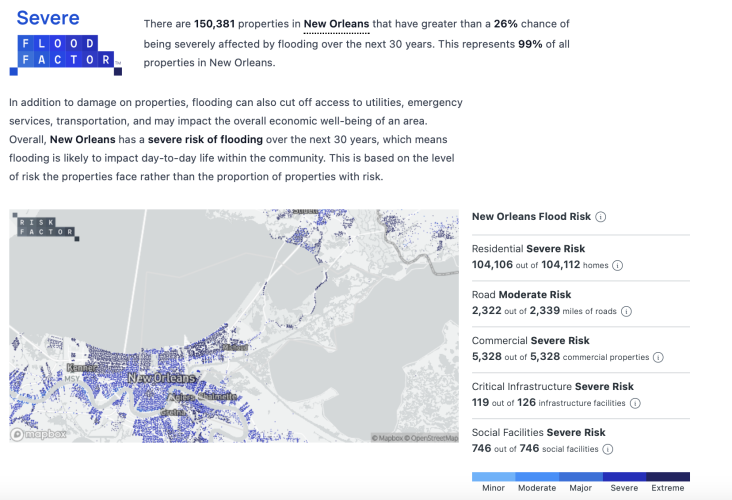

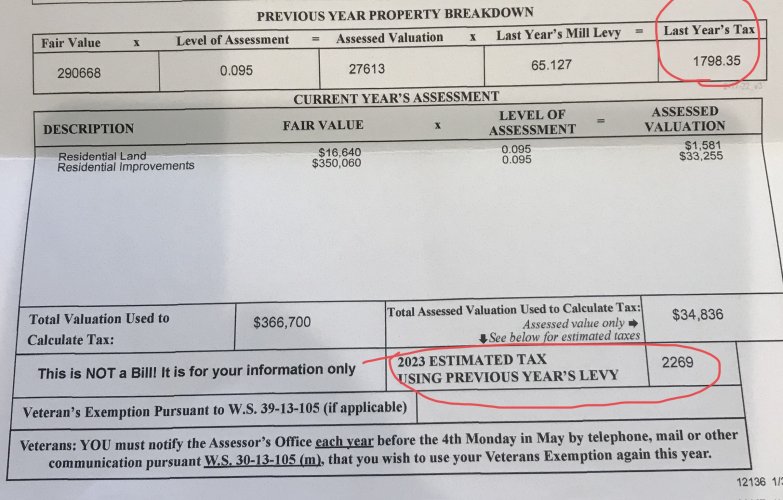

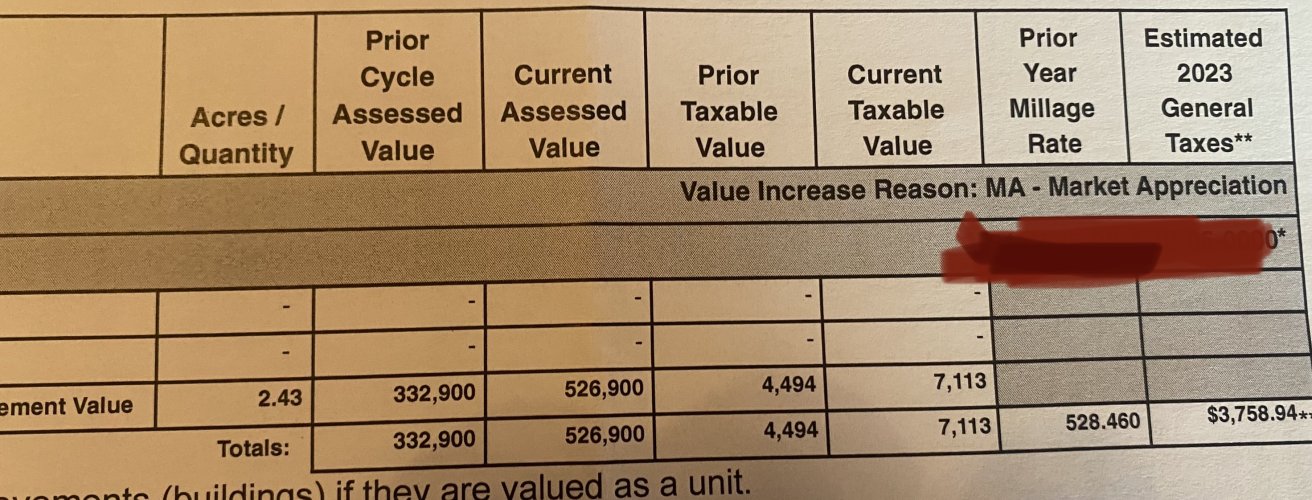

Sure it is FEMA, but there are reasons the premiums have increased. The same reasons premiums have increased in the fire-prone areas of the West. Everyone wants the financial safety of insurance, but paying for it is painful (more so today, obviously), whether it is FEMA insurance or private insurance.FEMA