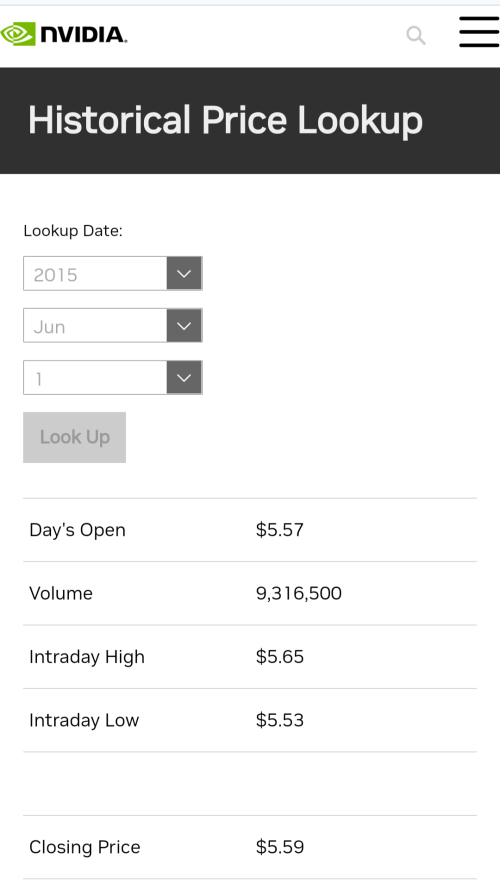

There was a heavy media attempt to sway people to take $ for short sellers. NVDA marked their place at an affordable price point to collect more investors.

10/1 split is fantastic! Their valuation is far from diluted shares. AI is the new world, the new .com of the market and as of right now NVDA is the public face of the future.

10/1 split is fantastic! Their valuation is far from diluted shares. AI is the new world, the new .com of the market and as of right now NVDA is the public face of the future.