BigHornRam

Well-known member

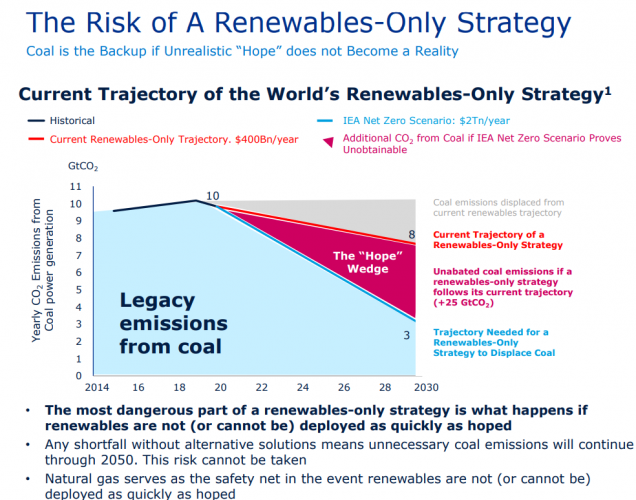

The transition will go forward, when and if it makes economic sense. The markets will ultimately decide what wins and what does not.No, because I see the situation we are in and I know how we got here. Despite BHR's claims, the transition to renewables will continue regardless of China-made solar panels, or India-made solar panel, or Alabama-made solar panels. It does contribute to general economic growth (as every transition to new technology does) and it makes the US less dependent on other countries. We can scream "energy independence" all we want, but being tied to a globally produced commodity and not being the low-cost producer is a bad situation.

Wrong thread for this discussion. BHR has been presented a lot of data on other threads and just chooses to ignore it. Now, back to the markets...