Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

Irrelevant

Well-known member

Similar to my phobia of calling to bull elk, even during the rut, while continuing to glass... sometimes you have to reassess your opinions and be comfortable being wrong. I called in 3 bulls this year for various partners. Not how I thought it would go down, but you can't ignore the facts

BigHornRam

Well-known member

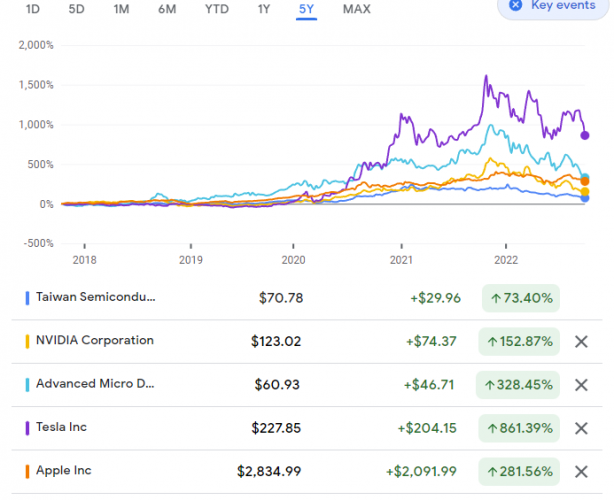

If you are buying today, I would look at today's fundamentals. Not by looking at the rear view mirror. Dividends, P/E ratio, ect.Heaven forbid we actually look at some tech stocks...

View attachment 243303

BigHornRam

Well-known member

Not interested in buying this today. Better place to put your money IMO.

www.morningstar.com

www.morningstar.com

TSLA - Tesla Inc Stock Price Quote - NASDAQ | Morningstar

See the latest Tesla Inc stock price (NASDAQ:TSLA), related news, valuation, dividends and more to help you make your investing decisions.

Irrelevant

Well-known member

I am buying tech hand over fist. Because tech never stops. It is the future. The market is driven by the future. And while you're calling it the "rear view mirror", I'll call it learning from history. Tech tanks, tech booms, and over the long run, it's destroy fundamentals.If you are buying today, I would look at today's fundamentals. Not by looking at the rear view mirror. Dividends, P/E ratio, ect.

I'd take AMD at 60$, even if it means another 30% loss this year, over any... and I mean ANY O&G stock over the next 5 years.

BigHornRam

Well-known member

5 years and we can compare how it pans out. You go your way, and I will go mine. Good luck amigo!I am buying tech hand over fist. Because tech never stops. It is the future. The market is driven by the future. And while you're calling it the "rear view mirror", I'll call it learning from history. Tech tanks, tech booms, and over the long run, it's destroy fundamentals.

I'd take AMD at 60$, even if it means another 30% loss this year, over any... and I mean ANY O&G stock over the next 5 years.

Handlebar

Well-known member

- Joined

- Jul 15, 2014

- Messages

- 314

Would you mind expanding on that, thanksNot to mention how problematic it is to believe in the reserve reporting of authoritarian dictatorships, there is a non-zero chance that the Saudi's have 10% the reserves they claim, and or Russia.

Kinda goes to your point about why the 2MM wasn't a 1MM cut.

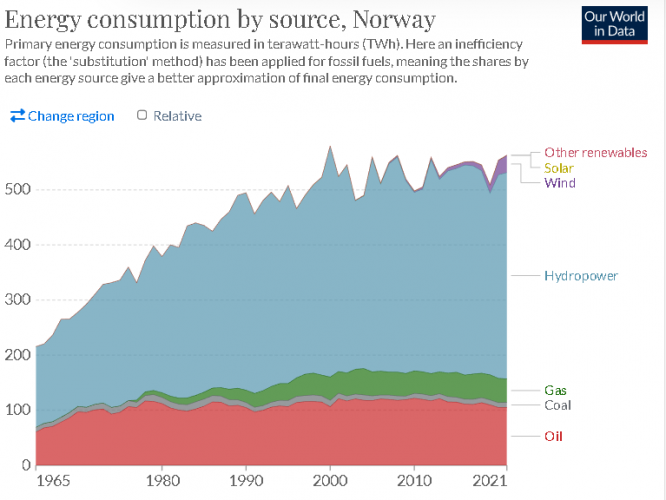

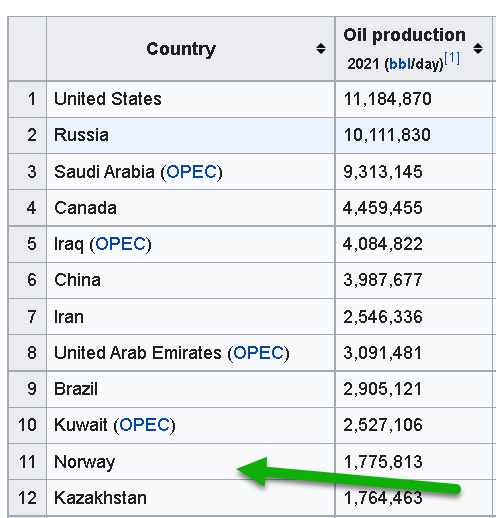

Personally I'd rather the US trend towards a Norway model of energy independence.

BigHornRam

Well-known member

Right now o&g stocks have great fundamentals and AMD does not. If in a year or two that changes and AMD business improves, I would look at buying it. If the stocks I own today decline, i will sell them. If they continue to perform, I will keep them. Crazy investment stategy!I'd take AMD at 60$, even if it means another 30% loss this year, over any... and I mean ANY O&G stock over the next 5 years.

Last edited:

SAJ-99

Well-known member

You better hope it goes above that. If it went to $10 you would make 7%. WS analysts are clowns. You should sign up for BHR's newsletter for stock tips.TPH just initiated coverage on PR with a target price of $10... good little run for them this week. Who knows what commodity price does but I could see it going above that.

You know this, so I post for @BigHornRam. O&G has the same problem as everyone else. Labor shortages. When I see a driller going down to the unemployment office and saying "I will hire and train you and you and you right NOW." I will buy that stock. Until then, I figure the easy money has been made and it is almost entirely dependent on the market price of the commodity.

D

Deleted member 28227

Guest

Honestly I'm surprised FANG or the like hasn't taken them out.You better hope it goes above that. If it went to $10 you would make 7%. WS analysts are clowns. You should sign up for BHR's newsletter for stock tips.

You know this, so I post for @BigHornRam. O&G has the same problem as everyone else. Labor shortages. When I see a driller going down to the unemployment office and saying "I will hire and train you and you and you right NOW." I will buy that stock. Until then, I figure the easy money has been made and it is almost entirely dependent on the market price of the commodity.

BigHornRam

Well-known member

Last week you were negative Nellie talking about big declines in employment. Today we have labor shortages. I think you just like to argue....You better hope it goes above that. If it went to $10 you would make 7%. WS analysts are clowns. You should sign up for BHR's newsletter for stock tips.

You know this, so I post for @BigHornRam. O&G has the same problem as everyone else. Labor shortages. When I see a driller going down to the unemployment office and saying "I will hire and train you and you and you right NOW." I will buy that stock. Until then, I figure the easy money has been made and it is almost entirely dependent on the market price of the commodity.

D

Deleted member 28227

Guest

Welcome to Hunt TalkLast week you were negative Nellie talking about big declines in employment. Today we have labor shortages. I think you just like to argue....

noharleyyet

Well-known member

BigHornRam

Well-known member

That's what I was thinking. They generate much of their electricity with hydro.Huge differences between US and Norway obviously, but most of there energy comes from non-OG sources and I think like 90%+ of all electricity generation, yet they are always in the running as a top 10 petroleum producing country.

View attachment 243318

View attachment 243319

SAJ-99

Well-known member

I said we need to see big declines in employment, not that we were. Today's report not showing it either. That is the problem. The JOLTS data is the first sign of any weakness, but openings declining and people being laid off are entirely different things. I forgive you for misreading what I was saying. It happens in retirement. I certainly hope your whaling oil and horse and buggy stocks go up.Last week you were negative Nellie talking about big declines in employment. Today we have labor shortages. I think you just like to argue...

noharleyyet

Well-known member

We really need a smile icon . . .I said we need to see big declines in employment, not that we were. Today's report not showing it either. That is the problem. The JOLTS data is the first sign of any weakness, but openings declining and people being laid off are entirely different things. I forgive you for misreading what I was saying. It happens in retirement. I certainly hope your whaling oil and horse and buggy stocks go up.

BigHornRam

Well-known member

Seems like you might give it back if jobs data starts rolling over on Friday. Unemployed people purchase much less O&G.

Maybe those unemployed GE workers can get a job in the oil patch. I hear they are hiring.

We really need a smile icon . . .

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 12

- Views

- 612

- Replies

- 22

- Views

- 2K