SAJ-99

Well-known member

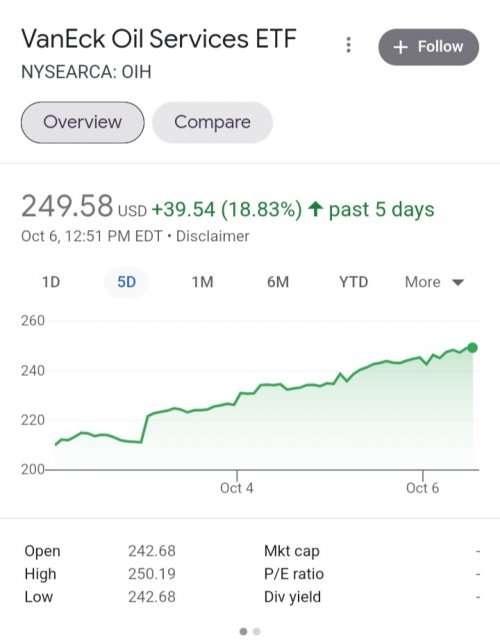

Still 20% below its June high. Timing is everything. Why so secret about the name? Might as well just buy the OIH. It's just a levered play on O&G.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Still 20% below its June high. Timing is everything. Why so secret about the name? Might as well just buy the OIH. It's just a levered play on O&G.

Good play, but my play is better. That buy on the 26th will fill my tank for over a year right now.Still 20% below its June high. Timing is everything. Why so secret about the name? Might as well just buy the OIH. It's just a levered play on O&G.

Can you explain a bit? Benchmarks that led up to 10 year Treasury Bonds present and some form of projected Sept 2032 T Bonds? Does it show the inflation type of market, "correction" or?Check on benchmarks through Sept 30, 2022 showed some surprises, and not the good kind. The Long (10yr+) Treasury Inflation Protection (TIPS) benchmark is down almost -35% YTD.

It shows that the bonds were super sensitive to any change in real yields (nominal minus inflation). The loss from the change in rates more than swamped any gain in price from inflation. In summary, they are a terrible inflation hedge when real rates are zero, or negative as they have been. When unexpected inflation hits, the Fed's text-book response is to raise rates which negatively impacts the value of all bonds, including TIPS. This little fact was ignored by investors.Can you explain a bit? Benchmarks that led up to 10 year Treasury Bonds present and some form of projected Sept 2032 T Bonds? Does it show the inflation type of market, "correction" or?

Cheers SAJ. - Thanks.

I'll just leave this here...This article on the similarities and differences of the 70's economy to today's economy might give you some insight on investment strategies into the future. It made my head hurt and more confused than ever. @wllm will probably like it though.

Today’s global economy is eerily similar to the 1970s, but governments can still escape a stagflation episode

Jongrim Ha, M. Ayhan Kose, and Franziska Ohnsorge examine how emerging markets can rethink economic policies to cope with rapidly tightening global financing conditions.www.brookings.edu

It's deja vu all over again!I'll just leave this here...

Find me a politician today that will say “Many of these proposals will be unpopular. Some will cause you to put up with inconveniences and to make sacrifices.”It's deja vu all over again!

Be as hard to find as someone who will vote for themFind me a politician today that will say “Many of these proposals will be unpopular. Some will cause you to put up with inconveniences and to make sacrifices.”

Here's one that is saying I am going to go forward with this, even though it doesn't make a lick of sense.Find me a politician today that will say “Many of these proposals will be unpopular. Some will cause you to put up with inconveniences and to make sacrifices.”

Find me a politician today that will say “Many of these proposals will be unpopular. Some will cause you to put up with inconveniences and to make sacrifices.”

Not exactly the same thing. And it doesn’t make sense to you because you don’t agree with the politics. The transition needs to take place and putting it off keeps us tied to the whims of fascists around the globe.Here's one that is saying I am going to go forward with this, even though it doesn't make a lick of sense.

Biden promises to take action on climate change despite setbacks

Biden did not specify what actions he will take on climate, but said they will create jobs, improve energy security, bolster domestic manufacturing and protect consumers from oil and gas price increases. “I will not back down,'' he promised.www.pbs.org

Not exactly the same thing. And it doesn’t make sense to you because you don’t agree with the politics. The transition needs to take place and putting it off keeps us tied to the whims of fascists around the globe.

And it makes sense to you because it does align with your politics. We are subject to whims, incompetence, and ideological preference, globally or nationally, regardless. There is no evil policy vs perfect by default policy.Not exactly the same thing. And it doesn’t make sense to you because you don’t agree with the politics. The transition needs to take place and putting it off keeps us tied to the whims of fascists around the globe.

No, because I see the situation we are in and I know how we got here. Despite BHR's claims, the transition to renewables will continue regardless of China-made solar panels, or India-made solar panel, or Alabama-made solar panels. It does contribute to general economic growth (as every transition to new technology does) and it makes the US less dependent on other countries. We can scream "energy independence" all we want, but being tied to a globally produced commodity and not being the low-cost producer is a bad situation.And it makes sense to you because it does align with your politics. We are subject to whims, incompetence, and ideological preference, globally or nationally, regardless. There is no evil policy vs perfect by default policy.

Here's a guy that had the guts to point out the pending problems with the Social Security program, and it cost him an already unlikely chance at the Whitehouse. Still Senator though.Find me a politician today that will say “Many of these proposals will be unpopular. Some will cause you to put up with inconveniences and to make sacrifices.”