noharleyyet

Well-known member

My son in law is in land sales. Booming here with Boomer & heirs selling and money’d buying.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

That's exactly what the hay field picture is. Boomer heirs that don't want to farm. The whole farm is 300 acres with some run down buildings. I wouldn't mind buying the 40 across the road.My son in law is in land sales. Booming here with Boomer & heirs selling and money’d buying.

Just curious, why do you own all those individual stocks when you could buy a ETF and cover most of those bases? Not criticism at all most of those companies are very main stream solid businessesPretty good day for my portfolio so far!

View attachment 242786

Still have a few dogs in there though!

View attachment 242787

Kind of agree, although DCB is a bit depressing when referring to the entire market. The volume the last couple of days was light, even compared to last Friday. That makes it hard to trust the bounce. I took off calls yesterday and bought puts (took those off this morning). Although we hear it all the time, this jobs report will be the most important in a while. ADP number was stronger than expected and ISM services is solid too. If we added more than 250k jobs, this market will easily see new lows. CPI will start to weaken just due to denominator effect, but Fed won't stop until economy looks to be weakening.I think right now we are experiencing my favorite economics /trading phrase…a dead cat bounce. Most likely shorts booking profits prior to CPI announcement

That dead cat is starting to twitch............I think right now we are experiencing my favorite economics /trading phrase…a dead cat bounce. Most likely shorts booking profits prior to CPI announcement

That dead cat is starting to twitch............

OPEC cut 2MM BOEd and the SPR oil rolls off in Nov.Seems like you might give it back if jobs data starts rolling over on Friday. Unemployed people purchase much less O&G.

OPEC cut 2MM BOEd and the SPR oil rolls off in Nov.

Europe hasn’t figured out gas for the winter and I believe Freeport LNG is slated to come back in Nov.

I think those all provide some decent reasons to be bullish over the winter.

Though your point is well met. I’m not sure where oil will go in the near term, but I’d guess it stays above $65 and below $100.

www.forbes.com

www.forbes.com

OPEC has been underproducing, which is why the number is 2m instead of the 1m they floated last week. But I agree, mostly only reasons to be bullish oil prices. The first cold wave will send nat gas through the roof. But in the end, nothing cures high prices like high prices and if economic data keeps coming in that doesn't show cracks, Fed is going to send rates higher.OPEC cut 2MM BOEd and the SPR oil rolls off in Nov.

Europe hasn’t figured out gas for the winter and I believe Freeport LNG is slated to come back in Nov.

I think those all provide some decent reasons to be bullish over the winter.

Though your point is well met. I’m not sure where oil will go in the near term, but I’d guess it stays above $65 and below $100.

That guy had fun while it lasted....local guy git busted here a few years back for something similar.I mean I suck at investing, but I don't suck this bad.

Rancher Sentenced for Running $244 Million “Ghost Cattle” Scam

A cattle rancher in Washington was sentenced yesterday to 11 years in prison for defrauding Tyson Foods Inc. (Tyson) and another company (Company 1) out of more than $244 million by charging the victim companies for the purported costs of purchasing and feeding hundreds of thousands of cattle...www.justice.gov

I mean he took 244 mil and then lost 200 mil playing the futures market. I've only lost like 50% in my robinhood account, I should pat myself on the back...That guy had fun while it lasted....local guy git busted here a few years back for something similar.

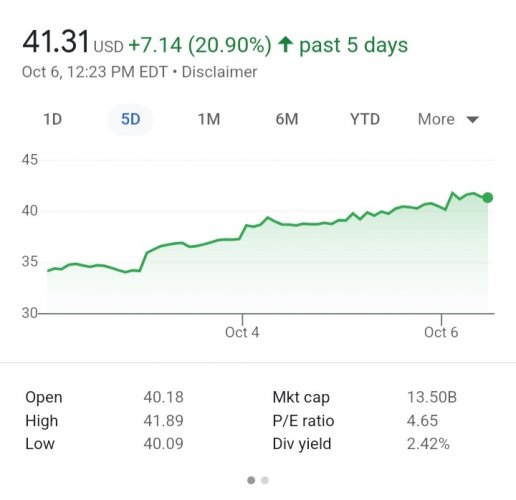

This one has been on a nice 5 day run.I got less faith in the dollar than I do in the market right now, and that's saying something. #*^@#* it, I bought this morning.

View attachment 241558