Potsie

Well-known member

We’ve tripled in assessed value since 2019.Welcome to Idaho? Mine has looked similar for two straight years. I have friends that have been way worse

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

We’ve tripled in assessed value since 2019.Welcome to Idaho? Mine has looked similar for two straight years. I have friends that have been way worse

Yet, nobody will or does.The good news is it’s easier to hold local officials accountable.

I don’t think there’s anything you can really do in most cases.What’s the justification for the appeals? Property values have in fact skyrocketed in some of these areas per the mls listings. I would file an appeal. Our house an hour from Bozeman went up 50% but what would be my justification for an appeal?

I thought Abbott was trying to get rid of property taxes?I think I am the winner. Over 300% increase.

It is 14 acres of scrub that at one point was a gravel pit. No topsoil left on it.

View attachment 282466

Lol, less than 3/4 total. It's three different residential properties within city limits. Comes down to way more luck and timing than actual wealth.How many acres?

Ball park... I'm not trying to know your business

I occasionally miss living in Montana, but wayyyy more often I'm so glad I moved to Wyoming. Montana politics are an absolute joke, glad all the move-ins left the high taxes and liberal agenda behind.

Montana chose it's politicians, sounds like a lot of buyers remorse.

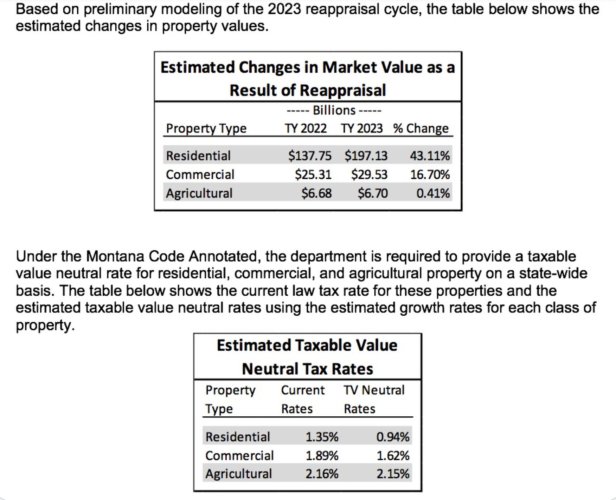

Here's an article that explains this and property tax in general.The best hope for us is that because most every property in the county will see large assessed value increases, the millage formulas used to determine the actual tax owed will result in taxes being lower than what they estimate on the notices they sent.

Have you seen the alternative? It’s why people left the hell holes they lived in, which created insatiable demand for housing, which in turn caused the price of housing to skyrocket. I can’t think of a state that’s being run by the other party that I’d want to grow roots in.Your super-majority party of the Legislature just chose to dramatically lower business equipment taxes, which further shifts tax burden onto residental property owners. And they continually vote down options for local communities to raise revenue via tourism, etc. And of course, most of them being ag-centric, they are always going ensure ag gets all the tax benefits they can muster. Voting matters.......and most of you voted them in.

We can’t pass the tax increase on to our renter. She is on a fixed income and her income increase got ate up by food cost increases. Wierd Al Yankovich “Just Eat It” will be our theme songHere's an article that explains this and property tax in general.

Mine went up 50% on the notice. Hopefully it won't be that much due to the millage. Assessed value was in line with what the houses are selling for in my neighborhood. Renters, including mine, are going to get hammered.

Idaho has it as well but our legislators decided to get rid of indexing it yearly and made it a fixed amount; then passed the savings in to businesses and commercial properties basically crushing homeowners especially given the recent explosion in home prices. As others have mentioned with a super majority in power and no threat of that changing they’re basically at no real threat to help out people. We did have some time of property tax reduction passed this year but the formula and calculation is so convoluted that I don’t think anyone has a clue what it will actually amount toIn Maryland we have a Homestead Tax Credit which limits the increase if the property is your primary residence. Sounds like an idea for you all..

Yup. FOMOMy mortgage increased almost $200 a month this year due to tax increases here in WY!

Hey: "While everybody else is financially raping our citizens, let's join in and make them even poorer!"

That is the tough part for raw land and residential. The market determines the value.What’s the justification for the appeals? Property values have in fact skyrocketed in some of these areas per the mls listings. I would file an appeal. Our house an hour from Bozeman went up 50% but what would be my justification for an appeal?

But the good news is we all got that $500 check from Brad - right before the primary. Glad he could demonstrate to his constituents that he’s all about responsible, small government. Meanwhile the state education budget is continually cut. Awesome! Thanks Uncle Brad!Idaho has it as well but our legislators decided to get rid of indexing it yearly and made it a fixed amount; then passed the savings in to businesses and commercial properties basically crushing homeowners especially given the recent explosion in home prices. As others have mentioned with a super majority in power and no threat of that changing they’re basically at no real threat to help out people. We did have some time of property tax reduction passed this year but the formula and calculation is so convoluted that I don’t think anyone has a clue what it will actually amount to

Don’t spend it all in one place.But the good news is we all got that $500 check from Brad - right before the primary. Glad he could demonstrate to his constituents that he’s all about responsible, small government. Meanwhile the state education budget is continually cut. Awesome! Thanks Uncle Brad!