4ohSick

Well-known member

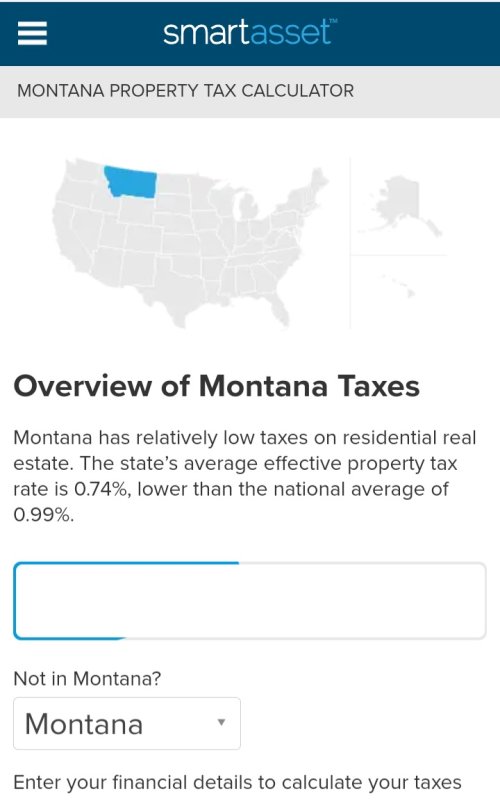

Just received this year's property classification and appraisal notice - even though it's the second year of the two-year cycle (and our value increased $174k or 66% last year) the appraisal is getting bumped another $40k for market appreciation - so 82% in two years. Can't wait til the shop we finished right after the re-appraisal gets added next year. Anyways, vote for Busse.