BigHornRam

Well-known member

2008

2020

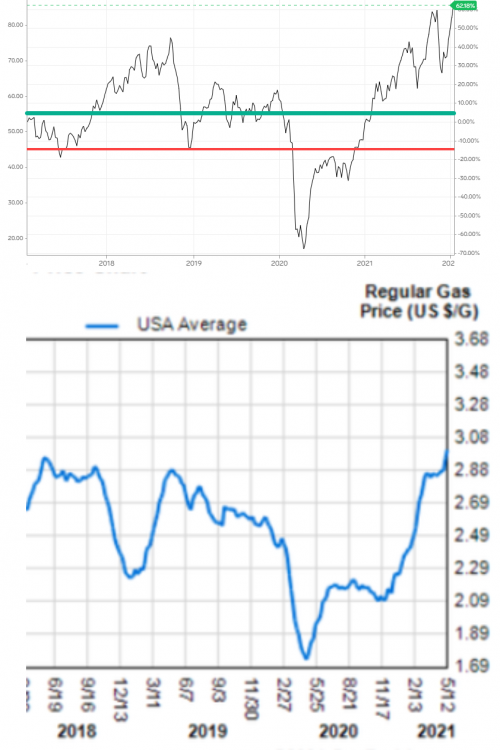

"Super-spike" could lift oil to $200: Goldman

Oil could shoot up to $200 within the next two years as part of a "super-spike" driven by poor growth in oil supplies, investment bank Goldman Sachs <GS.N> said in a research note.www.reuters.com

2018

$190 oil sounds crazy. But JPMorgan thinks it's possible, even after the pandemic

In a little-noticed report, JPMorgan Chase warned in early March that the oil market could be on the cusp of a "supercycle" that sends Brent crude skyrocketing as high as $190 a barrel in 2025.www.cnn.com

$100 oil is back on the table as OPEC stays strong on tightening production limits

Only a week ago, news surfaced that Saudi officials were quietly hoping to push oil prices up to $80 per barrel, which would help boost the valuation of Saudi Aramco IPO. But why not $100 per barrel? Reuters reports that Riyadh would be fine with prices rising that far.www.usatoday.com

Oil rises on concerns global political risks could tighten supplies

Oil prices rose over 2% on Tuesday on concerns supplies could become tight due to Ukraine-Russia tensions, threats to infrastructure in the United Arab Emirates and struggles by OPEC+ to hit its targeted monthly output increase.