D

Deleted member 28227

Guest

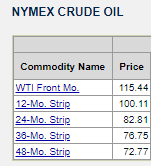

This is essentially why I’m skeptical of sustained $100+ oil.Sorry. The paywall is very annoying. The summary- they just can't stop themselves. If you want hard evidence, from news feed, -"Oil rigs in the U.S. rose by 19 to 516 this week, the biggest gain since February 2018,...".

Energy stocks seems like something you should rent more than own these days. Awesome when Russia is saber-rattling, but when it calms down might be hard to sustain these price levels.

"Oil executives tempted by the prospect of the highest crude prices in seven years are showing all the signs of abandoning pledges to hold the line on drilling budgets, Citigroup Inc. said.

U.S. shale explorers are poised to boost spending by almost 40% this year, based on comments and plans revealed during recent earnings presentations, Citi analyst Scott Gruber wrote in a note to investors on Monday. That’s up from the bank’s previous call for a 30% rise. Overseas budgets are seen jumping by 32% from the old forecast of 17%.

“E&P managements will be hard pressed to abandon their commitments,” Gruber wrote. “But we foresee an increasing number beginning to lean into the market as the challenge of managing supply in a market as disaggregated as the global oil market becomes increasingly clear.”

U.S. companies probably will lift domestic daily crude production by as much as 1 million barrels this year, according to various analysts. American oil prices have climbed 21% this year to more than $90 a barrel, extending last year’s 55% advance.

I just don’t think the industry can hold the line.