TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,315

Now THAT is a good point. I haven't researched it in TN yet, but I know in FL it was limited to a small percentage year over year if the property isn't sold (or refinanced, maybe). But current homeowners should be ok.Until the tax assessor starts hiking taxes.

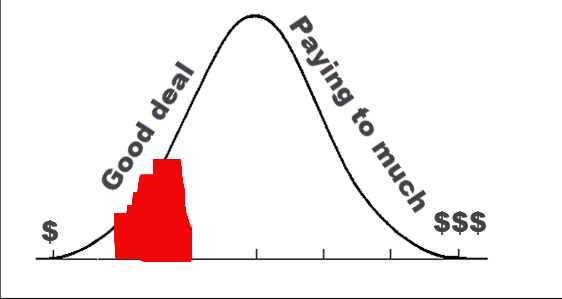

But I'm genuinely worried about people buying houses with current tax assessments which are low due to long term ownership. I think a bunch of them might not realize the taxes ( and their mortgage payments) are going to skyrocket based upon the new assessment.