I appreciate it. I am blessed to go to a job that I love. I still cannot believe I get paid to read and talk about books with a bunch of 18 year old kids that I consider my own.Thank God someone is teaching high schoolers this!

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

College costs

- Thread starter Bullshot

- Start date

- Status

- Not open for further replies.

noharleyyet

Well-known member

Good posts Willy Dee....what stateI appreciate it. I am blessed to go to a job that I love. I still cannot believe I get paid to read and talk about books with a bunch of 18 year old kids that I consider my own.

GeorgiaGood posts Willy Dee....what state

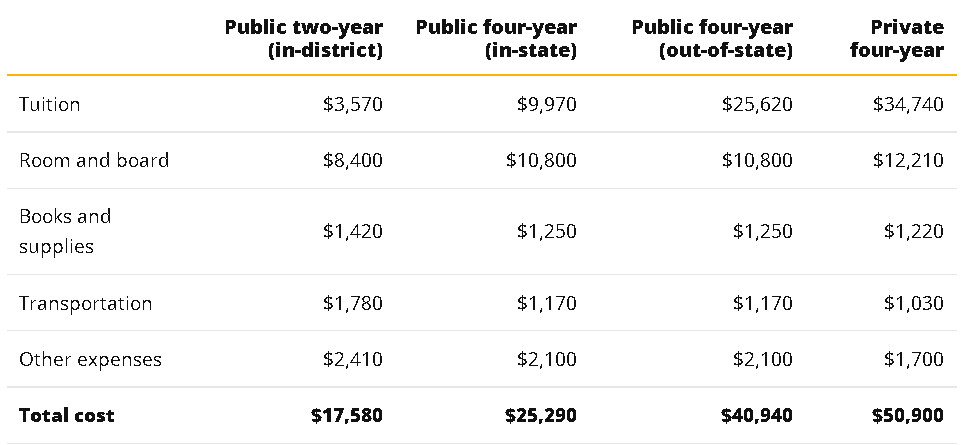

Much depends on private/public schools and location. When you talk "out of state" I assume you are talking public colleges, but for non-residents of that state, which tends to make it cost more like a private school. My son and daughter-in-law met at a state school, he in state, her out of state, his education was about 30% of hers. My other son went to an instate, private school and it costs way more.

Much also depends on the degree, or at least should. When my son decided to become a teacher, we crossed off his list a $50K school (in 2010), telling him "you're going to be a math teacher making $30K, do the math, not worth $50K/year"

Don't write off a private school solely on tuition, many start forking over scholarships and as long as the kid holds the right GPA it brings it down to reasonable. If they can't hold the GPA, well get them the hell out of college anyway.

Some degrees, it matters where you go to school, some it doesn't. Some degrees flat out aren't worth getting.

Trade schools are a good option, if the kid is interested in that as a career.

Much also depends on the degree, or at least should. When my son decided to become a teacher, we crossed off his list a $50K school (in 2010), telling him "you're going to be a math teacher making $30K, do the math, not worth $50K/year"

Don't write off a private school solely on tuition, many start forking over scholarships and as long as the kid holds the right GPA it brings it down to reasonable. If they can't hold the GPA, well get them the hell out of college anyway.

Some degrees, it matters where you go to school, some it doesn't. Some degrees flat out aren't worth getting.

Trade schools are a good option, if the kid is interested in that as a career.

belshawelk

Well-known member

Having two in out of state college I know it well, but many factors involved.

Child 1- Out of state in South Dakota on sports scholarship. Still cost 35K year for private school. Now she is in law school at University of San Diego Law School. Great scholarship because of undergrad grades but still costing 35K year plus housing ( $2500 month) and food.

Child 2 Out of state in South Carolina. 30K year out of pocket with scholarships.

This doesn't take into account extra activities they need money for, car payments and others.

its a lot. I never went to college so its difficult for me to think all through this. But then I am not going to be a lawyer at 24 or be biology major in the field of forensics. But, I do know my wallet is getting thin.

Child 1- Out of state in South Dakota on sports scholarship. Still cost 35K year for private school. Now she is in law school at University of San Diego Law School. Great scholarship because of undergrad grades but still costing 35K year plus housing ( $2500 month) and food.

Child 2 Out of state in South Carolina. 30K year out of pocket with scholarships.

This doesn't take into account extra activities they need money for, car payments and others.

its a lot. I never went to college so its difficult for me to think all through this. But then I am not going to be a lawyer at 24 or be biology major in the field of forensics. But, I do know my wallet is getting thin.

Buffs35

Well-known member

I went to a private school in Denver. When I started in 2000, tuition was 16k. Too high even back then. Now its 43k. The whole system needs to burn to the ground.

The 50 most expensive colleges in America, ranked

These colleges come with a hefty price tag

Here is a good starting point....

D

Deleted member 28227

Guest

Realizing there are MANY variables, just trying to get a sense for what is a good average target balance in 529 plans for out of state college tuition 4 to 6 years out from now. Looking for real world responses to this problem - what are people paying? I have two kids, very good students, non-athletes, who likely will go out of state to a 4-year public university. We have saved a modest amount for each child so far and feel extremely blessed to have been able to do that, but suspect we are well below what is "recommended" by the "experts". Based on our combined family income, we may not be eligible for a great deal of needs-based support (even though cost of living in our region is at the upper end of the spectrum). The general internet is not confidence inspiring (all over the map) and people I know are so damn tight lipped these days with their salary, debt, expenses , etc in order to perpetuate their facebook "best life" image.... hard to get the straight skinny on what is happening to real people in real life.

Definitely tough, anecdotal experience is pretty useless, a lot of comments, even above, are politically charged and problematic.

Broadly speaking, you haven't been able to work your way through college for decades.

Military: there are a pile of caveats. Right off the top max of $65,000 for Army/Navy. That covers a lot, in-state at some institutions and degrees, but would barely cover 1/4 the cost of attendance of a lot of schools. Definitely an option, but not a panacea.

Scholarship: lots of options, full rides are tough to come by. You can get a lot of help by stitching together a bunch of different ones, it's a lot of work but worth it.

Trades: Totally anecdotal, but I haven't met or heard of any one who is very successful (six figures) in the trades that didn't have a parent in them. I'm not saying those individuals didn't put in hard work, but they just as much road their connections as a econ major from a east coast school who gets their first job where their dad works.

To drown out the noise you have to look at aggregated data. Sure a plumber can make $150,000 but a Operational geologist in OG can make $250,000 + 20-100% bonus + stock options (often 3-20X salary) not to mention benefits insurance, vacation, 401k match etc. That plumber might be a 1099 or self-employed where you have to subtract benefits from his gross earnings while that degree holding geo adds their benefits as an employee.

But both of those are just cherry picked examples. Currently statistics show that trades make less than full college, even factoring in cost of education. I think in part that is due to the fact that the top quartile of college graduates make way more than the top quartile of trades.

At this point I have seen people become wildly successful with all kinds of degrees, folks who would credit their degree with some of there success. English, Geology, Anthropology, Psych, Geography, Spanish, etc. All making well above $300k a year. I have also have seen crashing failure, I have a hard time finding a rhyme or reason to the outcomes, both categories smart/hard working folks. Same with trades, some people I know doing very well others really struggling.

I think 30-50K a year is a realistic near term ball park. Who knows what it will be like in 20 years. Scholarship, if your kids hustle I'd say 6-10k is a possible range, 20K+ if they are exception in their cohort.

150k is probably the number, but their are a ton of variables. If that's beyond your means consider all your options.

For instance, there was no way my parents had the cash on hand for my college, but they wanted to pay for my education so my dad took out a home equity loan and used that to pay. At the time fed loads were 6.8%+ and private were 12%, I think his loan was around 3 or 4%.

If your kids need to take out loans, help them structure the loans, and understand their options.

My wife got zero parental support and went to a very expensive school, ^#1. I got full support and also went to an expensive school similar cost. I think we both made the right decision in our respective routes. I think our experiences are somewhat outliers but I would be happy to share specifics, loan amounts, salary, debt etc if that helps you at all.

We graduated in 2010, so our undergrad experience will be a bit out of date, but my wife did grad school so to some extent fairly recent student information.

Last edited by a moderator:

Irrelevant

Well-known member

Contractors, of all flavors, have been doing very well around here for quite a while, but I'd hate to think what they'd say if they found out what engineers (or in my case a geologist disguised as an engineer) are making. 401k, stock options, paid leave, bonuses...Definitely tough, anecdotal experience is pretty useless, a lot of comments, even above, are politically charged and problematic.

Broadly speaking, you haven't been able to work your way through college for decades.

Military: there are a pile of caveats. Right off the top max of $65,000 for Army/Navy. That covers a lot, in-state at some institutions and degrees, but would barely cover 1/4 the cost of attendance of a lot of schools.

Scholarship: lots of options, full rides are tough to come by. You can get a lot of help by stitching together a bunch of different ones, it's a lot of work but worth it.

Trades: Totally anecdotal, but I haven't met or heard of any one who is very successful (six figures) in the trades that didn't have a parent in them. I'm not saying those individuals didn't put in hard work, but they just as much road their connections as a econ major from a east coast school who gets their first job where their dad works.

To drown out the noise you have to look at aggregated data. Sure a plumber can make $150,000 but a Operational geologist in OG can make $250,000 + 20-100% bonus + stock options (often 3-20X salary) not to mention benefits insurance, vacation, 401k match etc. That plumber might be a 1099 or self-employed where you have to subtract benefits from his gross earnings while that degree holding geo adds their benefits as an employee.

But both of those are just cherry picked examples. Currently statistics show that trades make less than full college, even factoring in cost of education. I think in part that is due to the fact that the top quartile of college graduates make way more than the top quartile of trades.

At this point I have seen people become wildly successful with all kinds of degrees, folks who would credit their degree with some of there success. English, Geology, Anthropology, Psych, Geography, Spanish, etc. All making well above $300k a year. I have also have seen crashing failure, I have a hard time finding a rhyme or reason to the outcomes, both categories smart/hard working folks. Same with trades, some people I know doing very well others really struggling.

I think 30-50K a year is a realistic near term ball park. Who knows what it will be like in 20 years. Scholarship, if your kids hustle I'd say 6-10k is a possible range, 20K+ if they are exception in their cohort.

150k is probably the number, but their are a ton of variables. If that's beyond your means consider all your options.

For instance, there was no way my parents had the cash on hand for my college, but they wanted to pay for my education so my dad took out a home equity loan and used that to pay. At the time fed loads were 6.8%+ and private were 12%, I think his loan was around 3 or 4%.

If your kids need to take out loans, help them structure the loans, and understand their options.

My wife got zero parental support and went to a very expensive school. I got full support and also went to an expensive school. I think we both made the right decision in our respective routes. I think our experiences are somewhat outliers but I would be happy to share specifics, loan amounts, salary, debt etc if that helps you at all.

We graduated in 2010, so our undergrad experience will be a bit out of date, but my wife did grad school so to some extent fairly recent student information.

My advice is to run fast and get college paid for.

Do your kids have a plan and know what they want to be, or are they just going to school because that’s what people are “supposed to do?”

School is expensive and traps a lot of people in life long debt.

I think it’s a great idea for specific career fields, especially in math and science but people have a lot of options these days.

The journeymen electricians and lineman where I work make way more than the engineers.

School is expensive and traps a lot of people in life long debt.

I think it’s a great idea for specific career fields, especially in math and science but people have a lot of options these days.

The journeymen electricians and lineman where I work make way more than the engineers.

Irrelevant

Well-known member

Yes, those guys make bank. The only electricians I know really raking it in, work for the PUDs at the dams where they deal with real SERIOUS power. Even then the electrical engineers in the same divisions are making more.Do your kids have a plan and know what they want to be, or are they just going to school because that’s what people are “supposed to do?”

School is expensive and traps a lot of people in life long debt.

I think it’s a great idea for specific career fields, especially in math and science but people have a lot of options these days.

The journeymen electricians and lineman where I work make way more than the engineers.

you can make 92K as a master electrician/manager at my organization. you get to be in charge of things like maintaining 12,000 horsepower pumps.

paid leave, paid holidays, unlimited sick time, over time, retirement plans

but i'm a low totem-pole-undergrad-degree-only desk jockey at the same organization and almost make the same amount with all the same good benefits (and also get overtime/comp time)

like @neffa3 and in line with @wllm1313 said the electricians and other trades can do very well. but outside of the established organizations and companies that structure you with great benefits it may not always look as good as it is if you have to manage those benefits yourself - being a contractor is rarely all it's cracked up to be from what i've seen.

all that said, i highly encourage people to look at the trade routes instead if college tuition is 100% on you. i'd be very happy being that master electrician for my organization, plus you get to live in granby/fraser/grand lake/winter park

paid leave, paid holidays, unlimited sick time, over time, retirement plans

but i'm a low totem-pole-undergrad-degree-only desk jockey at the same organization and almost make the same amount with all the same good benefits (and also get overtime/comp time)

like @neffa3 and in line with @wllm1313 said the electricians and other trades can do very well. but outside of the established organizations and companies that structure you with great benefits it may not always look as good as it is if you have to manage those benefits yourself - being a contractor is rarely all it's cracked up to be from what i've seen.

all that said, i highly encourage people to look at the trade routes instead if college tuition is 100% on you. i'd be very happy being that master electrician for my organization, plus you get to live in granby/fraser/grand lake/winter park

D

Deleted member 28227

Guest

plus you get to live in granby/fraser/grand lake/winter park

Hard pass

Hard pass

bro i'd take craig over the front range. grand county would be like dying and going to heaven

Nick87

Well-known member

Yes and no. I'd say about half the guys who I'm in the trades with had family in trades. A lot of them come off the farm mainly because of the work ethic.Trades: Totally anecdotal, but I haven't met or heard of any one who is very successful (six figures) in the trades that didn't have a parent in them. I'm not saying those individuals didn't put in hard work, but they just as much road their connections as a econ major from a east coast school who gets their first job where their dad works.

TheJason

Well-known member

We’ll have to agree to disagree here. Running start (high school) programs, community colleges, in state schools, and working 20 hours a week through school all combine to make this very feasible.Broadly speaking, you haven't been able to work your way through college for decades.

DouglasR

Well-known member

How many of you got help from your parents to pay for school?

At the end of the day I think I might just rather weld wet pipe in a ditch than sit through the lifetime of math classes with my good boy face on required to be an electrical engineer.

Different strokes for different folks.

If you kid’s an irresponsible asshole prob don’t encourage them to take on 50k+ of unsecured debt for a piece of paper that might get them a job that they’re not sure they’re gonna like.

But definitely make them get a full time job.

At the end of the day I think I might just rather weld wet pipe in a ditch than sit through the lifetime of math classes with my good boy face on required to be an electrical engineer.

Different strokes for different folks.

If you kid’s an irresponsible asshole prob don’t encourage them to take on 50k+ of unsecured debt for a piece of paper that might get them a job that they’re not sure they’re gonna like.

But definitely make them get a full time job.

How many of you got help from your parents to pay for school?

i think this what it all hinges on.

yes i had help.

if i had to go back and do it over again without help knowing what i know now, i would likely not take on the debt and go a different route... maybe. a degree, contrary to some popular belief these days, is still very valuable thing. but, certainly, it's far from the only valuable thing.

but education is classified as good debt in most people's books, mine included. the problem is most 18 year olds (myself included at the time) have the mental capacity and financial know-how of a sea cucumber + parents that just want them to "do what makes you happy."; scary combo given the cost of education these days. if the kids parents aren't helping and encouraging them to navigate the debt and degree choices wisely then the path to "success" and "financial independence" will likely be a rough one indeed.

D

Deleted member 28227

Guest

"Broadly Speaking"We’ll have to agree to disagree here. Running start (high school) programs, community colleges, in state schools, and working 20 hours a week through school all combine to make this very feasible.

In some specific states with very affordable in-state options, eg. One could take a large number of Dual Enrollment (running start) + AP courses in high school to shorten a degree program by a year, live at home, and then say you were attending MSU with in-state at $7,300, work some amount and pay off that degree as you go.

It requires a decent job market in that area.

It requires a certain level and type of school

It could handicaps your ability to be successful depending on the rigor of your school and/or your career path. Hard to work any amount and be competitive with the LSAT/MCAT for instance.

So I don't disagree that it's possible, but per @MTGomer lineman comment, you can't look at one company and compare lineman wages to engineers but need to look at all lineman wages compared to all engineers.

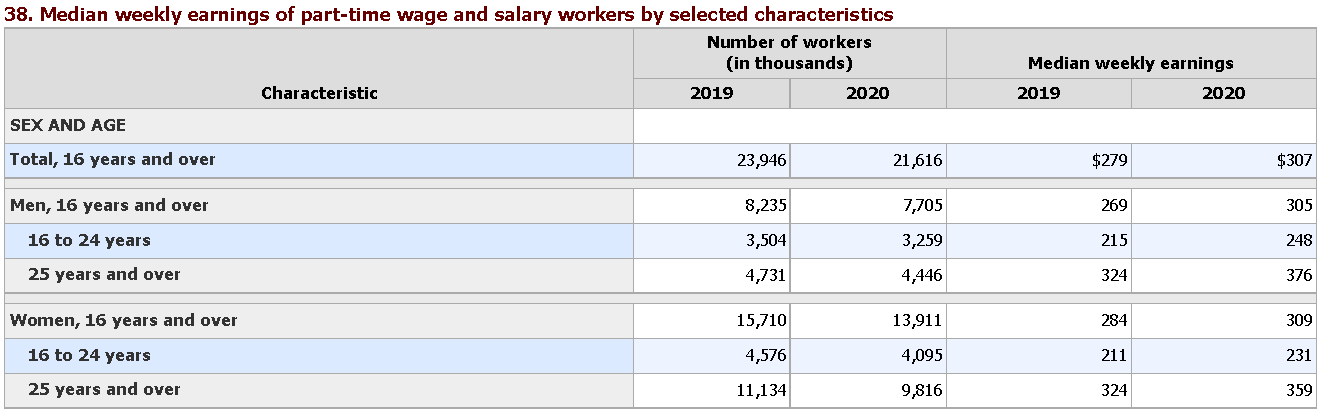

So a 20 year old male: $248 * 52 = $12,896

Therefore, broadly speaking, it's not feasible to work part time and pay off any type of college as you go, presuming you are doing it without help.

Exactly, it's the path that is best for you. There is no one size fits all.Different strokes for different folks.

Last edited by a moderator:

Irrelevant

Well-known member

Me, but scholarships paid for more.How many of you got help from your parents to pay for school?

- Status

- Not open for further replies.

Similar threads

- Replies

- 4

- Views

- 255

- Replies

- 0

- Views

- 202

- Replies

- 41

- Views

- 3K

D