Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Asset management and or Private equity invesments

- Thread starter schmalts

- Start date

SAJ-99

Well-known member

Asset management? That is not specific enough. Can you elaborate?Who is in any? Care to share your return and company you are in?

Any firm or ETF or fund that deals in Private companies instead of public traded stocksAsset management? That is not specific enough. Can you elaborate?

Private Equity - Goldman Sachs Asset Management

Discover our Private Equity program, established more than 30 years ago, that seeks to harness the scale and power of the global Goldman Sachs platform to source differentiated investments and accelerate value creation for our portfolio companies.

SAJ-99

Well-known member

My rule is once they start selling something to the retail/401K holder, it is a bad idea.

What I am hearing is the IPO market is slow and some of the large Institutional players want money to invest in new fund. The % allocations in PE are getting at or above preset limits and meeting further capital calls is getting tough. Wall street has been selling these PE and Private Debt asset classes hard for the last 24 months. The new administration has indicated a willingness to allow some funds in 401k. You are providing the big players liquidity and I highly doubt you are getting paid to do it. I would advise just saying 'No thanks'. Fees, lack of liquidity, lack of transparency are all problems. If there is something that causes a rush for liquidity, these things are a problem. I have seen names on institutional books that have been there since the dot.com days.

What I did, and think is still a better idea, is buy a basket of stocks of the firms that collect the fees on the funds and not in the funds themselves. The biggest are BX, KKR, CG, GS, BN, APO. I don't own them anymore because they all trade at pretty rich multiples, but I keep them on the watch list. I think BX reports this week.

Finding performance on the actual PE funds is hard. I found this one below. Compare it to the stock of KKR and it is pretty clear the choice.

idirectpmfund.com

idirectpmfund.com

What I am hearing is the IPO market is slow and some of the large Institutional players want money to invest in new fund. The % allocations in PE are getting at or above preset limits and meeting further capital calls is getting tough. Wall street has been selling these PE and Private Debt asset classes hard for the last 24 months. The new administration has indicated a willingness to allow some funds in 401k. You are providing the big players liquidity and I highly doubt you are getting paid to do it. I would advise just saying 'No thanks'. Fees, lack of liquidity, lack of transparency are all problems. If there is something that causes a rush for liquidity, these things are a problem. I have seen names on institutional books that have been there since the dot.com days.

What I did, and think is still a better idea, is buy a basket of stocks of the firms that collect the fees on the funds and not in the funds themselves. The biggest are BX, KKR, CG, GS, BN, APO. I don't own them anymore because they all trade at pretty rich multiples, but I keep them on the watch list. I think BX reports this week.

Finding performance on the actual PE funds is hard. I found this one below. Compare it to the stock of KKR and it is pretty clear the choice.

PERFORMANCE

Historical returns, nav and distributions for the iDirect Private Markets Fund

idirectpmfund.com

idirectpmfund.com

WyoCoalMiner

Active member

- Joined

- Nov 14, 2024

- Messages

- 109

I had a decent amount of BAM, Brookfield Asset Management. Sold all my position late last year. Did fine, but there are better options, IMO.Any firm or ETF or fund that deals in Private companies instead of public traded stocks

What I am hearing is the IPO market is slow

I can’t speak for the market as a whole, but the IPO market in the healthcare space is extremely slow.

I have seen some recent articles indicating a bit of hope for a better 2025, but I wouldn’t call the sentiment bullish by any means.

npaden

Well-known member

I have clients that have been sold the koolaid and bought into PE and Alternative Investments with Morgan Stanley and Goldman Sachs.

Big minimums and required future commitments, TERRIBLE transparency and accountability. End result was lower average returns compared to the overall market.

Big minimums and required future commitments, TERRIBLE transparency and accountability. End result was lower average returns compared to the overall market.

Both BX and BLK were nice 40%-50% gainers the last year and change for me in the general space. Got out of BX earlier this month, keeping an eye on BLK with all the current craziness.What I did, and think is still a better idea, is buy a basket of stocks of the firms that collect the fees on the funds and not in the funds themselves. The biggest are BX, KKR, CG, GS, BN, APO. I don't own them anymore because they all trade at pretty rich multiples, but I keep them on the watch list. I think BX reports this week.

Have been tempted by 2 ex-colleagues that are turnaround guys now to get into some PE the last 2 years, but as @npaden alludes to, it's something of a black hole with generally huge committments.

The more I get into the rabbit holes, the more I just consolidate into ETF's and broad-based MF's.

westbranch

Well-known member

I have some clients in PE funds that through "small" specialized wealth managers with various strategies that seem to do well. But small parts of their overall investments and not that much better than ETFs and MFs due to the higher risk and issues mentioned in prior posts.

One guy sold his business to smaller startup PE fund and did a partial rollover at their $1M minimum. Tax efficient and he was an early investor so huge returns for him. But still a large amount of risk.

One guy sold his business to smaller startup PE fund and did a partial rollover at their $1M minimum. Tax efficient and he was an early investor so huge returns for him. But still a large amount of risk.

NDGuy

Well-known member

- Joined

- Apr 26, 2018

- Messages

- 2,075

VOO/VTI/VGT and chill

BigHornRam

Well-known member

Trump wants to close the carried interest tax loophole, a longtime target of Democrats

The Trump administration's list of tax priorities includes eliminating a loophole that benefits private equity firms, hedge funds and other big investors.

Pucky Freak

Well-known member

If I was overcharged in fees, etc. on PE or boutique small-investor offerings I’d be completely clueless w/ no reference point. Index ETF’s and plain vanilla MF’s are boring, but the returns and fees are competitive, so that is where my investment money goes.

As a general rule, small individual investors are paying high transaction fees to participate in the sorts of investments you referenced. The multi-Bn pension funds, governments, and other large clients are negotiating reduced transaction costs, as the broker makes their money on volume, whereas the mom and pop investors it’s not worth the broker’s time unless the fee is high enough to make up for the tiny volume.

As a general rule, small individual investors are paying high transaction fees to participate in the sorts of investments you referenced. The multi-Bn pension funds, governments, and other large clients are negotiating reduced transaction costs, as the broker makes their money on volume, whereas the mom and pop investors it’s not worth the broker’s time unless the fee is high enough to make up for the tiny volume.

Same hereVOO/VTI/VGT and chill

SAJ-99

Well-known member

Might be a good time to update this. As I mentioned, there were trading rich. Not as much now.

YTD returns on the Private asset managers

APO -24%

BAM -14%

BLK -10% (much more public than private)

CG -21%

KKR -27%

GS -8%

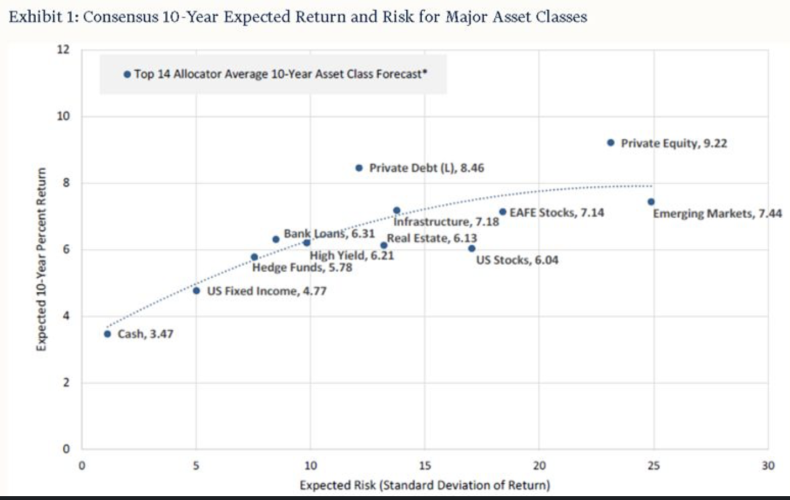

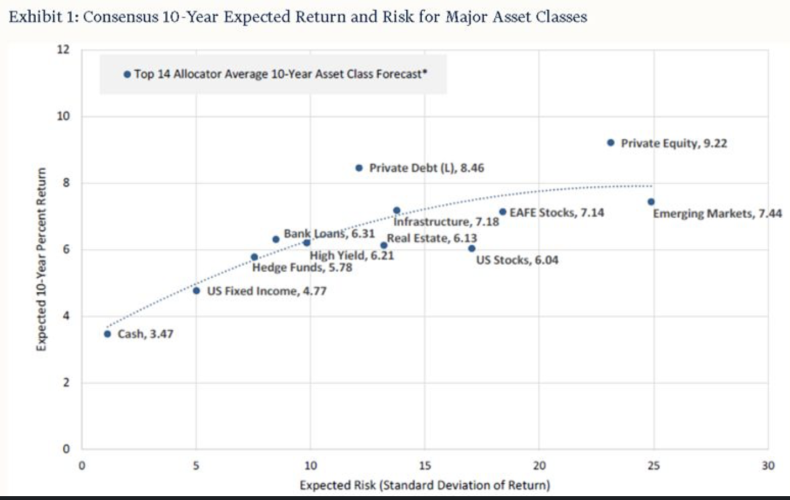

And this chart shows clearly that Wall Street is coming for retail funds. The chart is from Cliffwater, which managed large institutional alternative/private funds. But it s an average of the large allocators.

YTD returns on the Private asset managers

APO -24%

BAM -14%

BLK -10% (much more public than private)

CG -21%

KKR -27%

GS -8%

And this chart shows clearly that Wall Street is coming for retail funds. The chart is from Cliffwater, which managed large institutional alternative/private funds. But it s an average of the large allocators.

SAJ-99

Well-known member

LopeHunter

Well-known member

CPA and MBA here and have owned stocks for almost 6 decades. I like the transparency of public companies. Madoff loved not giving you transparency as have so many Ponzi schemes.

I love the big bucket EFT funds which hold 100s of stocks and, for example, charge about $300 per year to manage $1,000,000 of investment. The buy/sell spread is very small as well and is highly liquid meaning your buy orders fill in seconds. Similar love for big buckets of bonds that have similar fees and buy/sell spreads.

VTI for stocks, BND for Bonds and SWVVX for idle cash are about all I need (this is not advice for you, though) though have some maturity date certain bonds in a ladder to use for specific cash outflow needs in some years where I want to limit downside risk of the cash paid out at maturity. Is always good to match investment term with when likely need to close out that investment. Is also good to diversify your risk. I diversify risk in my investments by holding 100s of stocks and 100s of bonds lets me sleep better than if some Madoff-type was whispering a siren song in my ear.

I love the big bucket EFT funds which hold 100s of stocks and, for example, charge about $300 per year to manage $1,000,000 of investment. The buy/sell spread is very small as well and is highly liquid meaning your buy orders fill in seconds. Similar love for big buckets of bonds that have similar fees and buy/sell spreads.

VTI for stocks, BND for Bonds and SWVVX for idle cash are about all I need (this is not advice for you, though) though have some maturity date certain bonds in a ladder to use for specific cash outflow needs in some years where I want to limit downside risk of the cash paid out at maturity. Is always good to match investment term with when likely need to close out that investment. Is also good to diversify your risk. I diversify risk in my investments by holding 100s of stocks and 100s of bonds lets me sleep better than if some Madoff-type was whispering a siren song in my ear.

LopeHunter

Well-known member

I hope it closes. Settle up and pay the piper when you have the funds in hand. Come on in, the water is warm here with 99% of us that play by the rest of the tax rules.

Trump wants to close the carried interest tax loophole, a longtime target of Democrats

The Trump administration's list of tax priorities includes eliminating a loophole that benefits private equity firms, hedge funds and other big investors.www.cbsnews.com

Similar threads

- Replies

- 202

- Views

- 9K

- Replies

- 181

- Views

- 8K

- Replies

- 102

- Views

- 4K