rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,124

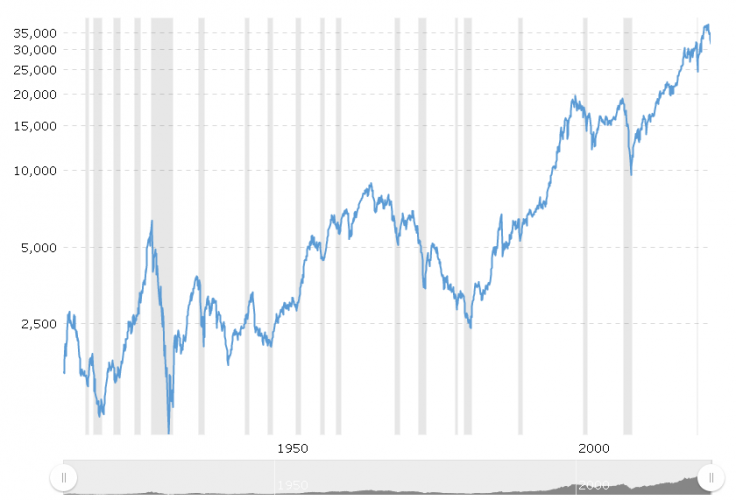

Yeah. It could be really ugly. So much excess built up in the system, will inflation start to plateau? That’s the question. An earnings recession is almost guaranteed at this point. Seems like people are just buying goods right into the inflation so I’m not sure rate hikes are going to do much. I’m just going to start buying quality stuff based off historical valuations in small chunks. I have said 2800 on the S&P a few times but that could end up being way off either way (3600 or 1600 would be my other bottom guesses based off most plausible scenarios). Be greedy when others are fearful. I don’t think we are to the fearful part yetWhat worries me is if the economy tanks on top of the rate hikes. Recession will kill the market with a double whammy