SAJ-99

Well-known member

Tried to do the same this morning, pick up OTM puts, and had the same problem. They weren't there. I ended up buying an 80 strike put (at like a 500% Imp Vol, makes me sick just thinking about it) when stock was 95. Stock went to 150 and the option didn't move much, so I figured it was going to be a fun day. Stock fell to 65 and I tried to sell it but the stock kept getting halted (9 times in first 4 hrs). I decided to hold until close and see what happens and ended up with a 3 point gain. GME isn't worth $77, but the decay on the option is brutal and the market seemed to find some footing.That’s a helpful explanation. I tried to buy some way out of the money puts and calls at open this morning. Both were priced out of utility. Out of the money calls don’t even exist anymore. I’d still pick up some long term puts if the stock stabilizes at this price for a couple weeks but I think there’s little chance of that.

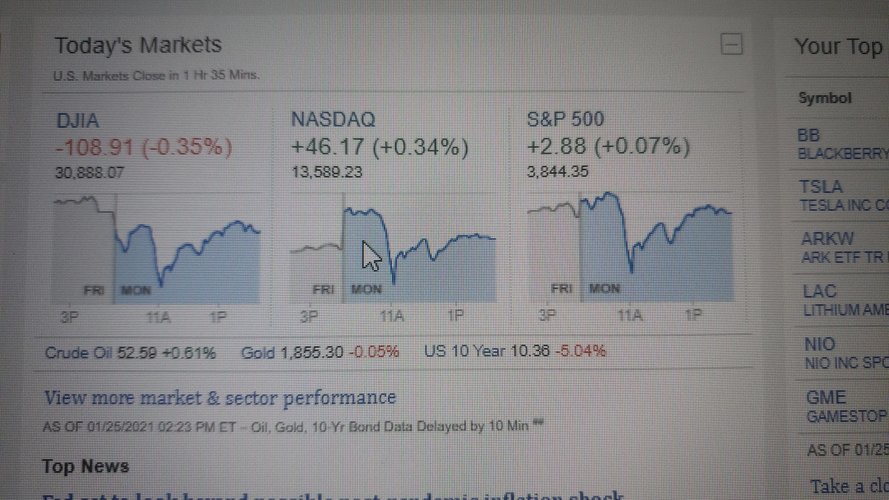

I checked out the WSB Reddit board and those guys are batshit crazy, or stupid, or both. They work each other into a frenzy and try to attack the perceived opposition (there is always a "them"), which i guess is short sellers. Like I said, I don't think any wall street pro who is short GME is unhedged and WSB guys are basically battling among themselves and market maker is trying to keep up (hence the halts today). It's basically a mob. They seemed to have moved on to Blackberry (BB) and Nokia (NOK).

I guess they can do this, post a stock and gang up to move the price. 1st amendment and whatever applies i'm sure, but what happens when they figure out they can drive a stock lower by buying puts. Mobs are fickle.