I don’t think the broad brush works in this instance. Sales tax is for the state, everyone pays it and it’s proportional to what you buy so people who spend more pay more. Property tax is local and helps fund those governments. The federal is where we need the participation because that’s where most of these “necessary“ programs are funded. When you see that hitting your check every week and don’t expect a refund greater than what you have paid in it changes your view.At some point the govt has to have the funds to run the “common good” activities our democratic process supports. I figure 50-50 is a fair balance of a dead person’s interest in charity.

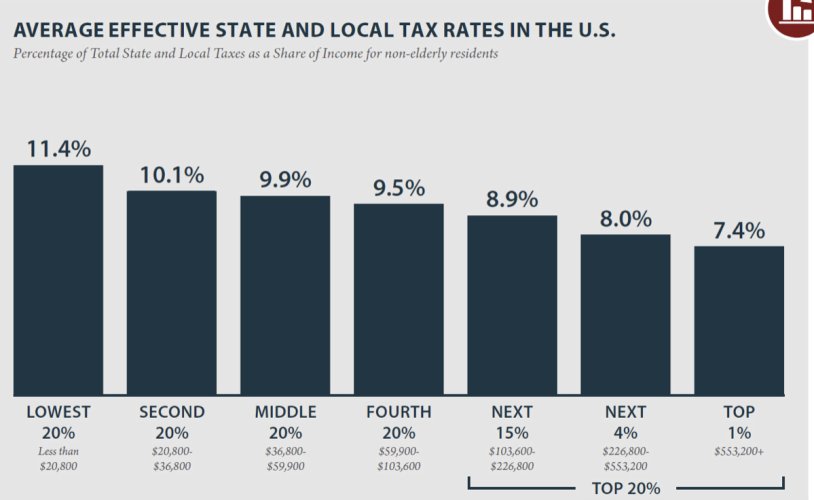

My view of taxes is broad and includes sales taxes, property taxes (incl, that paid indirectly by renters), payroll withholding for Soc/Med and if you do that, the poorest 25% does pay a reasonable share compared to the other quartiles. With a broad brush, about the only folks that avoid skin in the game are the uber rich (>$50m) who ”hide” wealth as unrealized gains and live lavish lifestyles using “borrowed money” instead of generating income. I would guess 95% if Americans have skin in the game relatively connected to their income/wealth. There is probably a bottom 5% who pays almost none and a top 0.01% that does the same. Our focus on fed income tax skews perceptions of tax base.

Also, if most that money was being directed to functional charities maybe we can get the government out of some of those businesses

100% on the borrowing, something needs to be done to correct it