Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The financial impacts of 2020 events?

- Thread starter Glockster

- Start date

I appreciate people keeping things on track since I posted a request for improved behavior last week. So far, so good.

I went a bit too far in my comments in the post linked above, as we do have forum segments about finances, sports, and a few other things of general interest. My bad.

Point of that post was to reel in the amount of people that were using HT as more of a Facebook ranting and raving outlet, on topics that were completely distracting to the focus of this forum. Topics were being posted in the Fireside and Sportsman's Issues that were way off target and bound to raise the rancor in a way that was detrimental to the entire forum.

As for this post, what I asked for in the thread quoted above seems to exclude some other parts of the forum, but there is a place for other discussion in this parts of the forum specifically designed for such. Sorry if in my frustration I failed to consider how my comment could be taken to not allow posts in these other parts of the forum.

Keep it on the rails and thanks for the consideration.

Continue .......

I went a bit too far in my comments in the post linked above, as we do have forum segments about finances, sports, and a few other things of general interest. My bad.

Point of that post was to reel in the amount of people that were using HT as more of a Facebook ranting and raving outlet, on topics that were completely distracting to the focus of this forum. Topics were being posted in the Fireside and Sportsman's Issues that were way off target and bound to raise the rancor in a way that was detrimental to the entire forum.

As for this post, what I asked for in the thread quoted above seems to exclude some other parts of the forum, but there is a place for other discussion in this parts of the forum specifically designed for such. Sorry if in my frustration I failed to consider how my comment could be taken to not allow posts in these other parts of the forum.

Keep it on the rails and thanks for the consideration.

Continue .......

D

Deleted member 38069

Guest

All I meant was, good intentions quickly disappear on threads nowadays. No harm just sprinkling in a little humor with a doom subject.Read literally you are correct, but as I read he was not entirely shutting down all non conservation and hunting discussion. He didn't close the many sections on this Forum that relate to other topics as he easily could have. I don't think he is going to block questions about target shooting rifles, where to get a good pizza in Salt Lake City, and he isn't going to shut down the prayer requests, etc etc. I think the broader point wass no pissing matches over politics or corona. I viewed OPs question as a fair. We will see if it stays ok, but if folks offer useful advice in an empathetic matter I would guess we are not offending BigFin or MrsBigFin. I stand to be corrected if I am off.

BigHornRam

Well-known member

If you are considering investing in Real Estate right now, the solvency of the state where it is located would be my top concern. States like Illinois, New Jersey, Kentucky, and more were already in a death spiral before all this came about. Like any investment, do your homework.I’ve considered the land angle as well, and what scares away me are the following factors (all downward forces):

-Rising interest rates, lowers resale value

-Reduced crop demand/prices, lowers resale value

-Increased inflation, lowers resale value

-Decreased building, lowers resale value

-Reduction in expendable income/lowers recreational demand, lowers resale value

Considering these things, it doesn’t feel like a safe hold-of-value right now to me.

SAJ-99

Well-known member

Inflation seems to be a big concern, and rightfully so. But it’s not guaranteed.

A quick Macro Econ 101 refresher gives a simple picture as to what is happening.

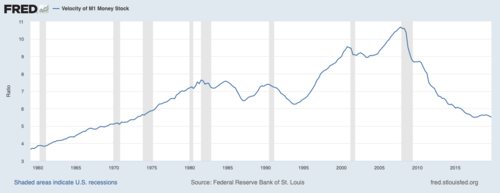

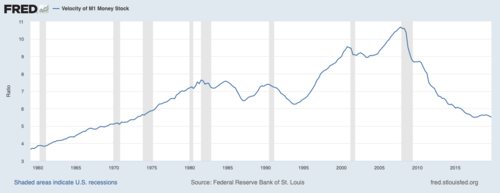

GDP = M x V

GDP is our favorite measure of general economic production/activity

M is the amount of money in the system

V is the Velocity of money, or how many times a dollar(M) changes hands.

Velocity has been declining for a while (see Chart). When you ask the entire country to shelter in place, you can expect Velocity to plummet. In the equation, the Fed can prop up GDP by just increasing M(oney supply), so it did. Once we reopen, the question will be how much does the Velocity rebound? Do people go right back to normal or do they spend more time at home, or taking walks, or reading a book, or whatever thing they did during quarantine that they enjoyed. If Velocity remains somewhat depressed, you avoid getting the full effect of the increase in M in inflation. If Velocity rebounds, inflation picks up and the Fed has to remove money for the system. We know how that turns out (see market reaction in 2013 to Taper Tantrum, and December 2018 to rate increases). This is certainly going to be interesting.

A quick Macro Econ 101 refresher gives a simple picture as to what is happening.

GDP = M x V

GDP is our favorite measure of general economic production/activity

M is the amount of money in the system

V is the Velocity of money, or how many times a dollar(M) changes hands.

Velocity has been declining for a while (see Chart). When you ask the entire country to shelter in place, you can expect Velocity to plummet. In the equation, the Fed can prop up GDP by just increasing M(oney supply), so it did. Once we reopen, the question will be how much does the Velocity rebound? Do people go right back to normal or do they spend more time at home, or taking walks, or reading a book, or whatever thing they did during quarantine that they enjoyed. If Velocity remains somewhat depressed, you avoid getting the full effect of the increase in M in inflation. If Velocity rebounds, inflation picks up and the Fed has to remove money for the system. We know how that turns out (see market reaction in 2013 to Taper Tantrum, and December 2018 to rate increases). This is certainly going to be interesting.

T Bone

Well-known member

Today, April 20, 2020 WTI oil for May is at $10.06 . Down 40%+ from Friday close. There is a whole lot of hurt coming to the economy near you.

BigHornRam

Well-known member

If you have a swimming pool, buy some oil!

www.cnbc.com

www.cnbc.com

US oil prices are on track for their worst day ever: Here's why

It comes amid concern that the volume of oil held in U.S. storage is rising sharply, with the coronavirus crisis compounding the problem.

noharleyyet

Well-known member

“The current forward crude oil curves for Brent and WTI are now in very deep contango, but the contango is also very front-loaded,” Bjarne Schieldrop, chief commodities analyst at SEB, told CNBC via email.

A contango market implies oil traders believe crude prices will rally in the future, encouraging them to store oil now and to sell at a later date.

A contango market implies oil traders believe crude prices will rally in the future, encouraging them to store oil now and to sell at a later date.

SAJ-99

Well-known member

Long squeeze on USO. USO announced it was moving a large % of the fund to the second month. May expires tomorrow and they move to June, and then July. June is $23 and July is $28. This has nothing to do with supply demand.Today, April 20, 2020 WTI oil for May is at $10.06 . Down 40%+ from Friday close. There is a whole lot of hurt coming to the economy near you.

npaden

Well-known member

Now would be a good time to own a few empty oil supertankers!

npaden

Well-known member

I'm actually pretty proud of the overall market today not reacting to an obvious short term technical issue with USO ETF. Even oil production stocks are really not being impacted much.

“The current forward crude oil curves for Brent and WTI are now in very deep contango, but the contango is also very front-loaded,” Bjarne Schieldrop, chief commodities analyst at SEB, told CNBC via email.

A contango market implies oil traders believe crude prices will rally in the future, encouraging them to store oil now and to sell at a later date.

the fact that nearly any mid size E&P company is not trading at 0 dollars a share also says that people believe oil will rebound, and it certainly will, eventually.

it's more a question of how long can many of these small to mid size american companies survive the flogging

Last edited:

the fact that nearly any mid size energy company is not trading at 0 dollars a share also says that people believe oil will rebound, and it certainly will, eventually.

it's more a question of how long can many of these small to mid size american companies survive the flogging

Given the debt on their balance sheets, the answer is likely "Not very long." A lot of the debt was short-term and will come due in the next 12 months. When it does, refi will be unlikely, they will be showing big losses, and their assets will be sold at liquidation value.

Today, April 20, 2020 WTI oil for May is at $10.06 . Down 40%+ from Friday close. There is a whole lot of hurt coming to the economy near you.

As an investor, how to advantage of these low oil prices? Oil will rebound, certainly to $30-$40/barrel in the next year. That's 3-4x.

BigHornRam

Well-known member

I have a feeling the first vultures to swoop in for the fresh roadkill may very well end up being roadkill themselves.

T Bone

Well-known member

As an investor, how to advantage of these low oil prices? Oil will rebound, certainly to $30-$40/barrel in the next year. That's 3-4x.

Like Harley mentioned, if you're a physical player in the market, and just happen to have storage capacity or have a short position, it's genius.

For those that are financial players, risk goes up like Big Fin and BighornRam mentioned. Many publicly traded and private firms will struggle to survive the near term. Choose wisely.

VikingsGuy

Well-known member

Various tools to speculate on oil prices if that is your preference. There is an added layer of complexity to pick oil companies - would really need to dig into their debt structure and also look at their cost/barrel structure. As, even if economy gets demand back to normal levels, no guarantee Russia will play nice and let the price rise that far. Their goal is to kill US fracking industry. If they liquidate the equity holders will get very little and even if we get to $40 oil in summer of 2021 it may be too late for some.As an investor, how to advantage of these low oil prices? Oil will rebound, certainly to $30-$40/barrel in the next year. That's 3-4x.

SAJ-99

Well-known member

Forget the $10 price. You can't do anything about that. As I mentioned, the contract expires tomorrow (and it is currently trading at $1.13). You want to speculate, try OIH (services companies). The May 2021 contract is trading at $35.5. Of course, OIH is down 70% YTD. Leverage will do that to you.As an investor, how to advantage of these low oil prices? Oil will rebound, certainly to $30-$40/barrel in the next year. That's 3-4x.

edited: not investment advice

npaden

Well-known member

I think with the May contracts expiring today trading well into the negative price per barrel people should be able to understand that this is a short term correction for some non consumptive speculators that were caught with their pants down.

Similar threads

- Replies

- 62

- Views

- 3K