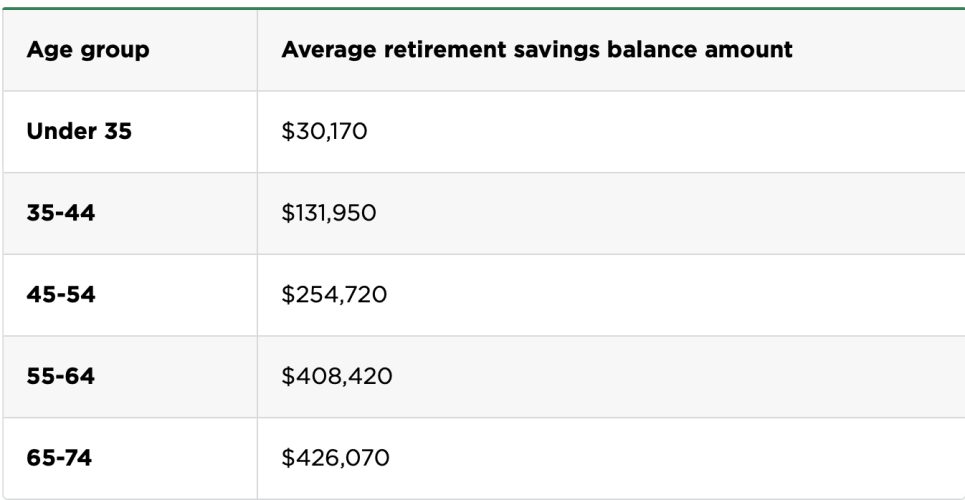

I'm sitting on the dock.I'm a force out come late '28. If politics don't pinch me, I'll bridge over until 62.

When I retire, wife has 10 years to slave the American dream .

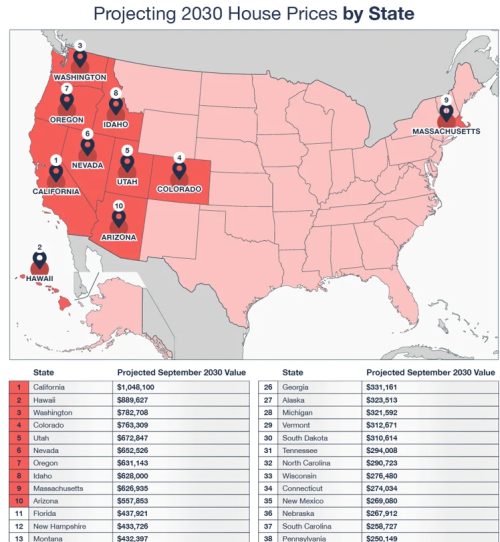

We hope to have our intended house paid off by '28. No debt currently, aside from mortgage. Plan to buy some tropical five cabana setting to escape the majority of this white shit. My body's beyond the thrills of boarding, skiing, shoeing. Live with toes in the water, ass in the sand... then VRBO out the remainder while "home".

I'm limited to 20%(?) of my high three years pay for work w/o effecting retirement sooo, a few prospects to keep semi occupied. Wife will own the business and make the big $ while I make the fool's wage.

Looking forward to lots of fishing. Hopefully, I'll maintain well enough for lots of scuba and... with fishing pole and Coors Banquet Beer cooler at the end of our dock...

Who knows. Maybe my ship will come in...LOL