When is the last time you heard hunting advise on here? Just really good one sided political piety.I typically find the financial advice on huntalk more solid than the hunting advice.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement goal changed due to inflation?

- Thread starter Cammy

- Start date

Bearmagnet

New member

- Joined

- Mar 7, 2022

- Messages

- 2

Certain investments do better during times of inflation, just as some investments do better during increases in interest rates. Reposition investments as times dictate, just like, NOW look to protect high risk investments by moving to those that can minimize your risk during hectic time here in US and overseas. You may not make lots of return on your money with that approach, but you don't need to worry about seeing five digit dollar losses on your 401-K, just when you are nearing retirement. Unfortunately, many 401-K investments have very limited choices to pick from, and don't have a great number of choices to handle inflation and/or interest rate increases, which is happening now! Look to do a hardship rollover out of your 401-K to a large mutual fund company which will expand the choices to locate such an investment to deal with inflation and the Feds increasing interest rates. You won't make 20%, but you will stop the bleeding that's going on right now in most pension accounts. Nonetheless, you should review investments at least every six months, and position accordingly. Certain investments fall in and out of favor all the time, so don't just sit on your investment, but move it as the times dictate. You will see major improvements to your savings, and sleep better at night.I remember reading somewhere that the Dems would take away your 401K if they were to win the presidency. Given the current cries of inflation and the devaluing of the dollar due to "printing money", how does that impact retirement goals? The cash that sits in the 401K now keeps losing value as the dollar value declines so basically the Dems aren't taking it away, they are basically making it worthless.

Really getting sick of the shiznizzle that is going on here at work (family owned business and I am not family) and would like to walk away from the drama. Would walk away today making pretty good money a year just going to the mailbox (other sources of income). Don't live high on the hog and am debt free.

Suck it up and take a wait and see approach to see if the inflation is just a blip on the radar or walk? What would HT do?

Way things are going now I think exchange your paper money for gold and silver. Then late at night put them in Mason jars and burie them...don't forget get to draw a map....oh and don't forget traps!! Ohh and sign the map with your HT name. One day our grand children might watch a History Channel show about searching for the "Cushman Treasure"...or whomever.

BigHornRam

Well-known member

Yes, but that's part of the fun. It's boring when everyone agrees with you. When you are in the minority, it makes you consider your philosophies more thoroughly.When is the last time you heard hunting advise on here? Just really good one sided political piety.

I'd like to respond (not critically, but appreciatively and constructively) to both comments above. Also to an earlier one that was comically deprecative regarding financial advice on a hunting forum.Yes, but that's part of the fun. It's boring when everyone agrees with you. When you are in the minority, it makes you consider your philosophies more thoroughly.

This place on the web is a nice sweet spot with a high percentage of hunters who've excelled well enough on their day jobs that they can spend above average amounts to hunt western game. Because of that, I recall gleaning refreshing insights from their respective trades (biologists, MDs, business owners, mechanics, etc.) that are both eclectic and helpful. On behalf of the audience members like me, we appreciate your input!

brocksw

Well-known member

Inflation rate on the bottom graphic is bit low. I think the 50 year average is 3.8%. Then throw in a nearly 1000% percent increase in prices over that same period. Then minus taxes depending on the type of account.One of the biggest mistakes I see is people not taking full advantage of their 401K's and other retirement vehicles early on in life. We cant rewind the hands of time but if you have some extra cash there is always some catch-up contributions.

Everyone is so hell bent on paying off their house. lol Why? Doesn't make any sense to me unless you were locked in at a high interest rate. Ya, so you own your house. I'm sure that has a feel good to it but at what cost to your retirement thats right in front of you??

If a person waited until they were in their 40's to contribute max to a 401K they should be ok but they are going to have to put MAX in to acheive a decent retirement. This is of course what your opinion of "decent" is.

This is a fun little tool that may help you realize your goals:

Retirement Withdrawal Calculator |- MyCalculators.com

Retirement Withdrawal Calculator - If you're already retired, or close to retirement, calculate how much you can withdraw from your savings to last through retirement. Free, fast and easy to use online!www.mycalculators.com

Max/year Vs $5000/ year Example Just rough figures.

Basically if you didn't start until you were 40 years old you should consider putting in the maximum amount if you can afford it.

View attachment 214024

If you were 60 you would be surprised to learn what you could withdraw for 20 years....You dont need 5 million to retire...once again it all depends on your needs and priorities.

View attachment 214026

D

Deleted member 28227

Guest

@Mallardsx2 and I guess everyone on the thread are you all single income households? If not how does that play into your planning?

Pucky Freak

Well-known member

For us, my salary is our primary income, accounting for about 70% of the total. The sources of the remaining 30% shifts around over time, and is a combination of PRN work, moonlighting, rental income, and other sources. Our current budget, savings, and retirement projections are based just on my salary, and all additional income is just gravy for extra saving, giving, and lifestyle spending. We don’t rely on any of it. Conceivably, the same could hold true in retirement; we should have everything we need and more from what we are investing now. If either or both of us want to work after age 60 the idea is it will not be a necessity, just an option if it fits our wants when the time comes.@Mallardsx2 and I guess everyone on the thread are you all single income households? If not how does that play into your planning?

Mallardsx2

Well-known member

- Joined

- Apr 4, 2015

- Messages

- 2,848

@Mallardsx2 and I guess everyone on the thread are you all single income households? If not how does that play into your planning?

I’m not sure what your asking but I can tell you that we are a dual income household and everything my wife pays into her 401k just simply solidifies our plan and will be massive by the time, and if, we need it in our 70’s. My 401k ( I hope) will be large enough at 60 years old to replace both of our incomes for a minimum of 15 years.

Add 10 years onto those calculations and make the age 70 before you touch it and the numbers become pretty massive….but your odds of living much longer go down significantly…so what was it all for?

If you follow the math, you’ll live well in retirement, and you can in fact retire early.

All depends on what your bills are I guess.

Either way, if a person does not contribute at least enough to get the full match of their companies 401k then they are foolish and they will always likely be broke. I see it all the time. I just shake my head at people throwing free money away.

It’s all just for good conversation.

Last edited:

AlaskaHunter

Well-known member

Or just maintain a well-diversified 401-k and think long term.Certain investments do better during times of inflation, just as some investments do better during increases in interest rates. Reposition investments as times dictate, just like, NOW look to protect high risk investments by moving to those that can minimize your risk during hectic time here in US and overseas. You may not make lots of return on your money with that approach, but you don't need to worry about seeing five digit dollar losses on your 401-K, just when you are nearing retirement. Unfortunately, many 401-K investments have very limited choices to pick from, and don't have a great number of choices to handle inflation and/or interest rate increases, which is happening now! Look to do a hardship rollover out of your 401-K to a large mutual fund company which will expand the choices to locate such an investment to deal with inflation and the Feds increasing interest rates. You won't make 20%, but you will stop the bleeding that's going on right now in most pension accounts. Nonetheless, you should review investments at least every six months, and position accordingly. Certain investments fall in and out of favor all the time, so don't just sit on your investment, but move it as the times dictate. You will see major improvements to your savings, and sleep better at night.

For example, with my 401-k investment options include equities, real estate, inflation-linked bonds, multi-asset, and guaranteed classes.

D

Deleted member 28227

Guest

I guess I read various posts and articles about retirement planning and they never really specify.I’m not sure what your asking but I can tell you that we are a dual income household and everything my wife pays into her 401k just simply solidifies our plan and will be massive by the time, and if, we need it in our 70’s. My 401k ( I hope) will be large enough at 60 years old to replace both of our incomes for a minimum of 15 years.

Add 10 years onto those calculations and make the age 70 before you touch it and the numbers become pretty massive….but your odds of living much longer go down significantly…so what was it all for?

If you follow the math, you’ll live well in retirement, and you can in fact retire early.

All depends on what your bills are I guess.

Either way, if a person does not contribute at least enough to get the full match of their companies 401k then they are foolish and they will always likely be broke. I see it all the time. I just shake my head at people throwing free money away.

It’s all just for good conversation.

I completely understand, it's variable, everyone has different goals etc. etc.

But when folks (like everyone) talks about oh if you max out your 401k at X age you will be set do they mean $20,500 or $41,000? Seems like most retirement calculators even for "married" individuals only use one income/ contribution limit. ie Nerd Wallet. It maxes at 20,500.

To that end and maybe this is a because I'm a numbers guy but why are people so opaque, just say the damn number lol.

Point of my question, is that as a millennial, I'm super pessimistic at this point and it seems like with inflation and probably the implosion of SS, I will need way more to retire with a reasonable lifestyle at 65 then some who is retiring now.

npaden

Well-known member

I’ve always said 15% of your income should get you close. That doesn’t matter whether you are one or two incomes. You need to start putting 15% of your income starting before you are 25. If you get a late start it will need to be more.

Maxing out the limit sounds like a lot but often is less than 15%.

If you start at 20% including employers contributions right from the start I would think you are set.

Past performance is not always and indicative of future returns and all that Jazz.

My 1/2 cent.

Maxing out the limit sounds like a lot but often is less than 15%.

If you start at 20% including employers contributions right from the start I would think you are set.

Past performance is not always and indicative of future returns and all that Jazz.

My 1/2 cent.

SAJ-99

Well-known member

Because there is no number. Retirement nest egg is based on a few simple things- the amount and timing of your savings, the return you get, and how long you work. Whether it’s enough depends on how much you spend, your returns on what you don’t spend, and how long you live. You really don’t have much control over a lot of these things and the number is different for everyone. Save more, spend less, die sooner. Those are your choices.To that end and maybe this is a because I'm a numbers guy but why are people so opaque, just say the damn number lol.

D

Deleted member 28227

Guest

$20500 at 15% of gross is $136,666 so if your talking a duel income household both maxing and being at $273,332 which in 2021 puts you in the 95% percentile for household income in the United States.I’ve always said 15% of your income should get you close. That doesn’t matter whether you are one or two incomes. You need to start putting 15% of your income starting before you are 25. If you get a late start it will need to be more.

Maxing out the limit sounds like a lot but often is less than 15%.

If you start at 20% including employers contributions right from the start I would think you are set.

Past performance is not always and indicative of future returns and all that Jazz.

My 1/2 cent.

So it's essentially a pipe dream for virtually every American.

If it's $136,666 for the total household income you're still at the 78th percentile.

Also retirement benefits aren't available to everyone.

Last edited by a moderator:

westbranch

Well-known member

Because there is no number. Retirement nest egg is based on a few simple things- the amount and timing of your savings, the return you get, and how long you work. Whether it’s enough depends on how much you spend, your returns on what you don’t spend, and how long you live. You really don’t have much control over a lot of these things and the number is different for everyone. Save more, spend less, die sooner. Those are your choices.

I would say the biggest thing to add is what retirement spending will be. If a married couple makes $150k gross a year combined and thinks they need to match that in retirement based on 3-4% withdrawal rate they will way over save. If they put 15% in retirement accounts and pay 35% in taxes between fed, state and FICA they are already living on only 50-55% of their gross income. So a goal of replacing 70% of gross in retirement could be pretty damn luxurious.

Through my line work I tend to see people that are way over saved. Of course not an accurate representation of America. Definitely better than under saved but working until 68-70 for above average earners to max out everything + more is just going to create a larger inheritance for kids.

I would tend to agree but you have to take into account that we’re nerds and put way more analysis into that plan than the average person. A huge percentage of Americans put nothing or just what their company matches into retirement. If you consistently invest that 15% it may not get you to your pre retirement salary but you should be in a substantially better position that most people. You can also weigh in avoiding and not carrying debt into retirement and having a Roth funded that you could use for large purchases (car) and not screw with your taxes$20500 at 15% of gross is $136,666 so if your talking a duel income household both maxing and being at $273,332 which in 2021 puts you in the 95% percentile for household income in the United States.

So it's essentially a pipe dream for virtually every American.

If it's $136,666 for the total household income you're still at the 78th percentile.

SAJ-99

Well-known member

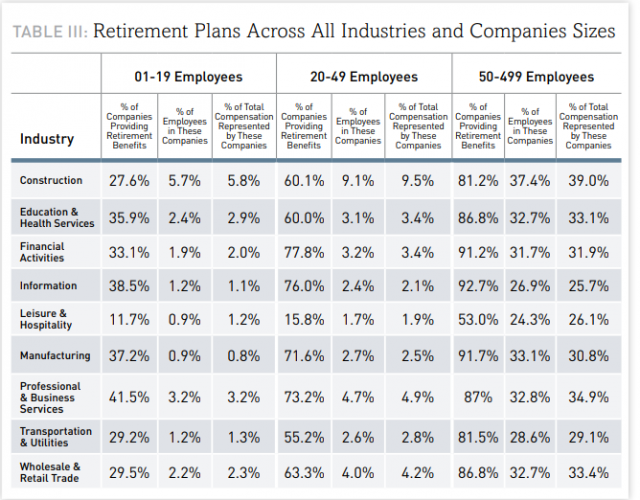

So much for small business being the backbone of America.$20500 at 15% of gross is $136,666 so if your talking a duel income household both maxing and being at $273,332 which in 2021 puts you in the 95% percentile for household income in the United States.

So it's essentially a pipe dream for virtually every American.

If it's $136,666 for the total household income you're still at the 78th percentile.

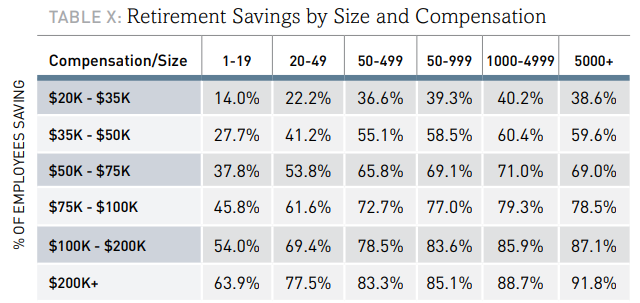

View attachment 222191

Also retirement benefits aren't available to everyone.

View attachment 222190

D

Deleted member 28227

Guest

Yeah... working for a small business is basically screwing yourself for retirement unless you have an ownership stake.So much for small business being the backbone of America.

npaden

Well-known member

So don't max it out and just do the 15%. My 15% and 20% includes the employer portion. I was trying to be helpful, not start an argument.$20500 at 15% of gross is $136,666 so if your talking a duel income household both maxing and being at $273,332 which in 2021 puts you in the 95% percentile for household income in the United States.

So it's essentially a pipe dream for virtually every American.

If it's $136,666 for the total household income you're still at the 78th percentile.

View attachment 222191

Also retirement benefits aren't available to everyone.

View attachment 222190

Similar threads

- Replies

- 45

- Views

- 5K

- Replies

- 214

- Views

- 19K