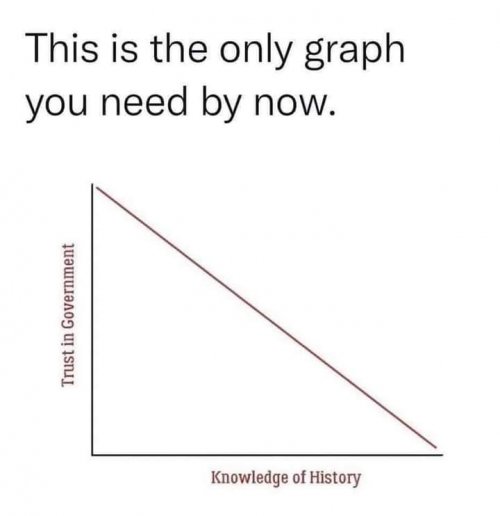

They only want to help…If the politicians are behind it, I'm already skeptical.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement goal changed due to inflation?

- Thread starter Cammy

- Start date

brocksw

Well-known member

D

Deleted member 28227

Guest

Probably going to get called a comie...

Mass healthcare > the rest of the country

States that spend money on regulatory agencies are far easier places to operate than those who don't, Janky should not be a badge of honor

brocksw

Well-known member

I'm just not knowledgeable enough to speak intelligently about it and I'm kind of split on the issue. But my grandfather has been a hardcore republican all his adult life, I refer to him as a "thoroughbred republican". Even he has flipped on the healthcare issue. He says, "Poor people need healthcare, no matter what. We're paying for it anyway." That's a major flip, because he's as German as sauerkraut and you know what they say about old Germans. You can always tell a german, but you can't tell em much.Probably going to get called a comie...

Mass healthcare > the rest of the country

States that spend money on regulatory agencies are far easier places to operate than those who don't, Janky should not be a badge of honor

Last edited:

VikingsGuy

Well-known member

We could have a whole forum dedicated to debating the role and effectiveness of govt. But in short - pure libertarianism is a pipe dream, pure progressivism/socialism/communism leads inevitably to tyranny, over-involvement of religion in govt. rarely ends well, and what we call common sense social democracy (I include the US, western Europe and democracies in Asia in this bucket) seems to trend a lot closer to crony capitalism than we would like to believe.Probably going to get called a comie...

Mass healthcare > the rest of the country

States that spend money on regulatory agencies are far easier places to operate than those who don't, Janky should not be a badge of honor

AlaskaHunter

Well-known member

One advantage of retirement is more time to spend with family and friends. For example, instead of having to get back to work, after retirement travel can be less expensive, booking flights on certain days to save $, and instead of a single 3-day visit to the parents, a 3-day visit on the front end, several visits to family and friends in nearby states, and a 3-day visit to the parents on the backend. Plus time to drive instead of fly if you hate to fly.I have had jobs I liked and jobs I hated. That rarely was the decider on whether I stayed or moved. For me, it is about my family. What is the aggregate best outcome for my wife, kids, and closet family? Sometimes that aligned with my like/hate and sometimes it didn't, but as I approach retirement I wouldn't change a thing. The aggregate well-being of my family is in the end my highest value - of course, my happiness/misery is part of that, but it can't be the only one.

At times I have stayed in a job I hated because it allowed my wife to stay in one she loved. I have passed on huge financial opportunities to be present as my father was nearing his death. I stayed in a job I hated for the immediate need of one of my teens and then found out I actually really like the job (after a leadership change). I am no martyr - these are just where my values are - and for me, values come before FIRE.

I have seen colleagues move their kid across the country on the eve of their senior year for a 15% raise - maybe an ok choice for some kids, but a disaster for others. I have seen folks take their "dream job" far away from their aging parents and regret it after they pass.

Maybe it is a generational thing, maybe it is a hunting forum thing, but I am surprised at how often the dialog is "me and I" focused. Life is short and it is best lived with others in mind, whether working or retired. YMMV.

This, and/or the freedom to change plans in midstream or extend the tripOne advantage of retirement is more time to spend with family and friends. For example, instead of having to get back to work, after retirement travel can be less expensive, booking flights on certain days to save $, and instead of a single 3-day visit to the parents, a 3-day visit on the front end, several visits to family and friends in nearby states, and a 3-day visit to the parents on the backend. Plus time to drive instead of fly if you hate to fly.

My grandparents will go on a trip and then they might decide to expand or change their original plans. One trip they took specifically to Australia. While there they decided to visit New Zealand and just when the family was adjusting to their spur of the moment trip to New Zealand , they were in Tahiti .

Good for you ! I bet Rio loves it as wellView attachment 222505

What retirement looks like to me. Not many obstructions now.

This, and/or the freedom to change plans in midstream or extend the trip

My grandparents will go on a trip and then they might decide to expand or change their original plans. One trip they took specifically to Australia. While there they decided to visit New Zealand and just when the family was adjusting to their spur of the moment trip to New Zealand , they were in Tahiti .

Good for you ! I bet Rio loves it as well

Sure beats the slammer he says....and bunnies!

Seriously, it was dicey. Retiring @ 54 and moving and all. But somehow I am living on 1/3 of my old income and can breath. Yeah the inflation and crap that is going on is bad.

I made it through the 70's and 12% inflation & $1.25 hr minimum wages.

TheJason

Well-known member

I’ve been doing a lot of penciling lately…But somehow I am living on 1/3 of my old income and can breath.

MarvB

Well-known member

When I retired two years ago we plotted out what we “thought” our expenses would be at the time and then made sure our NET retirement income would handle it plus a buffer. Then we looked at what the milestone of additional income might look like going forward compared to costs/possible inflation. The additional monies came/will come sporadically and often in chunks while the inflation we factored as was gonna happen across most items on the board and every year but buffeted back by guaranteed small (2%) increases in our primary retirement wages. Baring catastrophic health issues everything penciled put into our 80s (I’m now 63) without touching our savings 457 accts. After that just find me a peaceful view for my ashes as we pulled the trigger and decided to live our lives now.

Shangobango

Well-known member

Wow, I just checked in on my 401k for the first time in a few months…

The knee jerk reaction was to lower my contributions. I aborted that mission. The next thought was to readjust contributions toward leas risky investments. Right now I am about 2 to 1 small/mid cap growth to large cap/ blue chip type funds. I decided I am just going to keep doing what I have been doing on the 401k front. Buy low sell high they say…

My brokerage account is very heavily weighted toward commodities either through commodity related companies or commodity ETF’s. It is fairing much better than my 401k for now. My commodity futures trading has been nil this year and most of last. I just don’t have time to put in the research and watch the charts like needed in order to be comfortable with commodities futures contracts right now.

Any one else looking at commodity ETF’s as a hedge against inflation?

The knee jerk reaction was to lower my contributions. I aborted that mission. The next thought was to readjust contributions toward leas risky investments. Right now I am about 2 to 1 small/mid cap growth to large cap/ blue chip type funds. I decided I am just going to keep doing what I have been doing on the 401k front. Buy low sell high they say…

My brokerage account is very heavily weighted toward commodities either through commodity related companies or commodity ETF’s. It is fairing much better than my 401k for now. My commodity futures trading has been nil this year and most of last. I just don’t have time to put in the research and watch the charts like needed in order to be comfortable with commodities futures contracts right now.

Any one else looking at commodity ETF’s as a hedge against inflation?

Pucky Freak

Well-known member

I likewise just looked at my investments, which are way down. I think the time to have commodity ETF’s was before we all got shellacked by high inflation and nose-dived stocks. Right now looks like bargain prices on small and mid-cap company ETF’s. My wife and I have just 20% of our home’s value in our mortgage left to pay off. The plan is to knock that out in the next 30 months. However, very tempting right now to just make minimum payments and double down on moderately aggressive stocks instead.Wow, I just checked in on my 401k for the first time in a few months…

The knee jerk reaction was to lower my contributions. I aborted that mission. The next thought was to readjust contributions toward leas risky investments. Right now I am about 2 to 1 small/mid cap growth to large cap/ blue chip type funds. I decided I am just going to keep doing what I have been doing on the 401k front. Buy low sell high they say…

My brokerage account is very heavily weighted toward commodities either through commodity related companies or commodity ETF’s. It is fairing much better than my 401k for now. My commodity futures trading has been nil this year and most of last. I just don’t have time to put in the research and watch the charts like needed in order to be comfortable with commodities futures contracts right now.

Any one else looking at commodity ETF’s as a hedge against inflation?

TheJason

Well-known member

Depressing for sure.Wow, I just checked in on my 401k for the first time in a few months…

AlaskaHunter

Well-known member

Think long term and diversified investments.Depressing for sure.

In 2008 crash, S&P 500 dropped nearly 50% and took seven years to recover,

yet my 401k recovered in about a year after the 2008 crash due to diversified investments.

TheJason

Well-known member

Yeah, I’m not losing sleep over it.Think long term and diversified investments.

In 2008 crash, S&P 500 dropped nearly 50% and took seven years to recover,

yet my 401k recovered in about a year after the 2008 crash due to diversified investments.

RobG

Well-known member

A standard estimate of inflation is the spread between treasuries and TIPs. Based on that, this is a short term "bump" and inflation will average ~3%/year for the next 10+ years. That is about normal.Oh it’s nothing to worry about. Inflation is only 8.5%

Similar threads

- Replies

- 45

- Views

- 5K

- Replies

- 214

- Views

- 19K