BigHornRam

Well-known member

You should spend your time focused on your states overall tax burden, not Montana's.Source? And date? Did you factor in average home cost?

What I see from several sources is that the two states are pretty similar.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You should spend your time focused on your states overall tax burden, not Montana's.Source? And date? Did you factor in average home cost?

What I see from several sources is that the two states are pretty similar.

Touristy areas like Red Lodge and Whitefish have resort taxes to hit up the tourists.a sales tax would put burden on anyone shopping in Montana, not just those that own property there. Might as well get a little something more from all the tourists

Damn! You must live in Hooterville!Man, some of the tax bills you guys are reporting are crazy!

My MORTGAGE is $997 a month.

Property taxes are just under $800 a year for 5 city lots, 1200 square foot house. 2.4 acres total. I am sure I will see an increase this year, it's never been much at all.

Haha. Nope. But it is BFE. Nothing real pretty, no tourist attractions, no big names, just in the middle of gold country. Town of 600 people. 60 miles to a Walmart and a stop light.Damn! You must live in Hooterville!

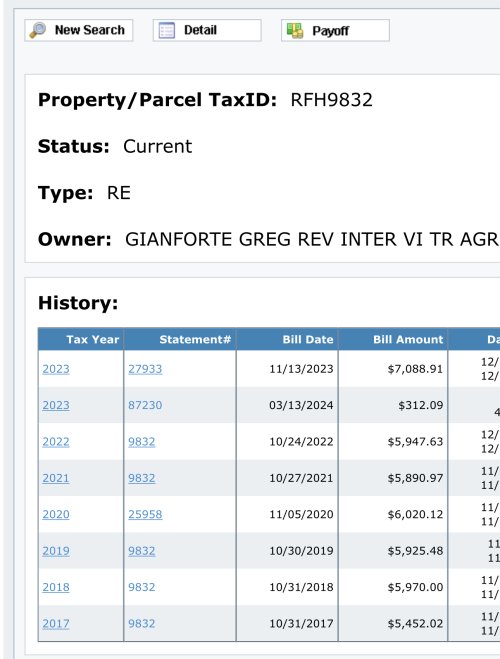

The last legislative session with Rs having a super majority gave big corporations like Verizon and railroads big tax breaks. Ag exemptions meant gianforte property tax went down. So your property taxes went up? Voting has consequences.

Unfortunately, one of the first points of guidance from the Montana Governor to his recently appointed taxation study commission was that a sales tax is off the table ... "Don't even bring it up!" Sad and irresponsible directive from the Gov office, IMO.

Well can't say I wasn't warned (that this board is not overly friendly to those not from the west).You should spend your time focused on your states overall tax burden, not Montana's.

Well can't say I wasn't warned (that this board is not overly friendly to those not from the west).

The appraisal process is oiuja board science at best.@BigHornRam will love this.

For background, in WA everything is taxed at full mkt value, tax rate is 9.7% or there abouts. We have no state income tax, but do have sales tax of 6.5%.

In my latest assessed value report

2023 total valuations rose 9.1% from 2022 (+37% on lot, +3.4% on Building).

2024 total valuation rose 5.9% from 2023 (+67% on lot, -10.9% on building)

Figure that out. I asked about it and the assessor cited one of the few remaining empty lots in the neighborhood being bought for a crazy value and another purchase where the house was torn down to rebuild, so that value was placed on the land. Apparently a couple of wealthy people with enough money to make bad real estate decisions revalued my lot 67% higher. I didn't even care to ask how the hell he got the building lower by 10%. I could challenge, but I have a strong suspicion that the numbers will change to come back pretty close to the 5.9%.

I need to say he may have a small point, I didn't notice this was the state specific board until just now.BHR is a grumpy SOB. He's mostly harmless.

I need to say he may have a small point, I didn't notice this was the state specific board until just now.

Some would argue that this is the goal...At this rate we will be taxed out of our house and Montana in 4 years.

Same here where we live in WY.my property taxes have more than doubled in 4 years. I used to get a tax break due to being a 100% disabled Vet. Then I got an 8% cost of living increase and lost my disabled Vet tax reduction due to my income being "too" high. My monthly mortgage went up over $350 a month, I sure have not received a $350 a month raise to off set the tax and insurance increase. I live in a little nothing town. At this rate we will be taxed out of our house and Montana in 4 years.

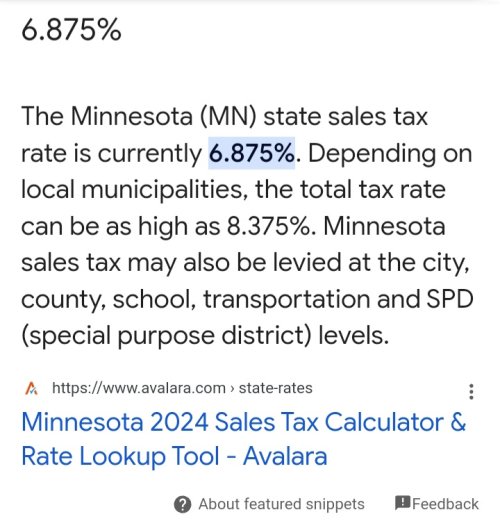

Thought I would throw a log on your fire for ya! MN sales tax is 7.375%. I have no idea what avalara is, but they are wrong. Maybe that is for buying a car, cuz that is a little less. But for everyday purchases, not including clothing or most foods, it is 7 3/8%. The good news is, that 3/8% goes to conservation. It has been a great deal for conservation for sure. Missouri has a similar model.Touristy areas like Red Lodge and Whitefish have resort taxes to hit up the tourists.

Resort Tax

www.cityofredlodge.net

The Minnesota tourist think they are getting a heck of a deal when shopping for trinkets in Red Lodge!

View attachment 332519

You got to have a screw loose to want to be in public office to begin with. Like herding cats.He's been accused of being pro-sales tax for a long time, and now he's getting attacked for not being for it.

Politics is $*)Q!#@$ hilarious.