MThuntr

Well-known member

Hey crew, I need some help with planning what to do with a small 401(k)/TSP inheritance and when to time the transfers for tax purposes.

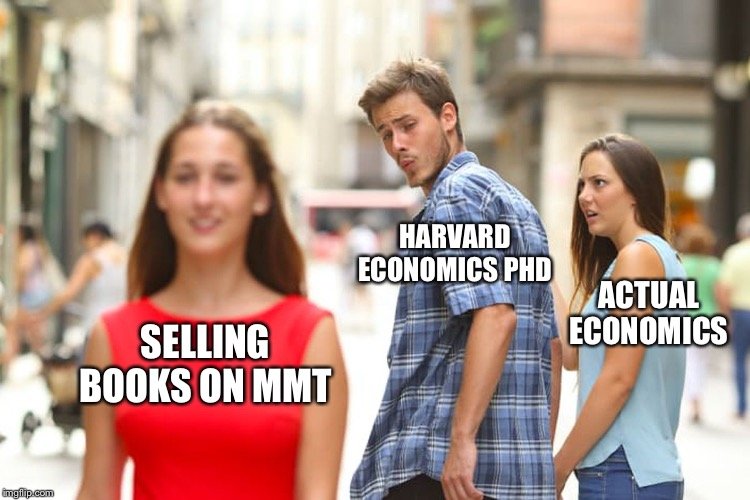

Anyone have recommendations on potential financial advisors I could talk to?

Anyone have recommendations on potential financial advisors I could talk to?

Last edited: