Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Monthly budget

- Thread starter Nick87

- Start date

np307

Well-known member

Maybe it's not the most effective, but I feel like my method is pretty straightforward. I take our income, subtract the "fixed" costs (car, house, minimum that goes to savings), and then everything else has to fit into the leftover. Everything goes on a credit card except for any utilities/fixed costs that charge a credit card fee, and that balance is paid off every month. If the balance is ever more than what it's budgeted to be, it's time for a closer look into what's happened to cause that. Usually it's that we got lazy and ate out too often. Groceries, utilities, etc are usually pretty consistent amounts so it's pretty easy to know what our "expendable" income is each week.

D

Deleted member 28227

Guest

Within savings how do you divide long term 401k/IRA versus short term, ie money for a trip or something?Maybe it's not the most effective, but I feel like my method is pretty straightforward. I take our income, subtract the "fixed" costs (car, house, minimum that goes to savings), and then everything else has to fit into the leftover. Everything goes on a credit card except for any utilities/fixed costs that charge a credit card fee, and that balance is paid off every month. If the balance is ever more than what it's budgeted to be, it's time for a closer look into what's happened to cause that. Usually it's that we got lazy and ate out too often. Groceries, utilities, etc are usually pretty consistent amounts so it's pretty easy to know what our "expendable" income is each week.

I put 30% of our AGI into tax advantaged accounts and I’m like… too much

Last edited by a moderator:

Nick87

Well-known member

Get off my thread with that shit.Sorry guys for making fun of your pickups…

I kid..but not really.

Nick87

Well-known member

My wife does something similar with ours but whenever it gets over x. She makes an extra mortgage payment. I'm off in the winter months so she tries to have it paid through March when the end of my work year hits.keep a buffer in the checking account so I don’t over draft but try to have a 100% utilization every month of our paycheck. If there is a bunch left in my account at the end of the month that means more needs to go to savings.

Nick87

Well-known member

What I wouldn't give to see some of that info from people I know. Leaves me scratching my head some of them I mean I have a pretty good idea what they're making and sit there scratching my head like how? Quite frustrating at times actually.got to see everyone financially naked. You would be amazed how many people give the appearance of "knocking it out of the park," yet behind the big house, the new vehicles, the toys, the timeshare, the fancy vacations, is a mountain of debt that grew faster than the income. And most of them realize it, but by the time they do, it seems almost overwhelming to get out of.

geetar

Well-known member

@Leinenkugelsfreak my wife and I have been using the Ramsey Solutions Every Dollar budget app for a little while. It’s free and seems to help. We can share an account login so either one can go in and write in items and list incomes and outgoes where both can see where it’s going. It really helps me stay on track and shows me where I’m going overboard. You can create your own categories and erase them if you no longer need them.

HuskerHunterFisher

Member

- Joined

- Sep 4, 2017

- Messages

- 31

I tell folks we all have a right to spend our money how we want, and everyone else has a right to think we're stupid for spending it that way.What I wouldn't give to see some of that info from people I know. Leaves me scratching my head some of them I mean I have a pretty good idea what they're making and sit there scratching my head like how? Quite frustrating at times actually.

I bet if you saw the accounts for those folks that always have the latest and greatest every dollar coming in has been spent already and goes out immediately.

The biggest barrier to actual wealth is a person's desire to "show off" that wealth. We all struggle with it. I came dangerously close to buying a new pickup at yearend that I didn't need, but rather felt I "deserved" for working my ass off this last year and because I could financially. I made myself think it over a couple more weeks and ultimately decided that was a really dumb idea and decided my money would be better spent servicing existing debts.

I'm also a big fan of spending money on "experiences" rather than "stuff". Or at least, stuff that leads to experiences aka camper.

Lefty315

Active member

Some good advice here. I’m not in the financial world so no need to listen to me, but I’m in a position now I only spend my kids inheritance  Someone mentioned goals and I think that‘s one of the first steps. I was given advice before I ever bought a house. Make sure you can make all your payments and live on a single income incase you or your spouse lose a job or something worse happens. The day I bought my first house I said I wanted to have my house paid for when I retired. I’m 53 and can retire any day I want to and I exceeded my goal by paying the house off 6 years ago. I started with bi-monthly mortgage payments and rounding up on my mortgage. Once I paid a vehicle off I was already used to not having that money so I just rolled it into my mortgage payment. Then I bought a truck camper, paid it off quickly and did the same with that money. Same with the Lund boat. Before I knew it I was making a double mortgage payment.

Someone mentioned goals and I think that‘s one of the first steps. I was given advice before I ever bought a house. Make sure you can make all your payments and live on a single income incase you or your spouse lose a job or something worse happens. The day I bought my first house I said I wanted to have my house paid for when I retired. I’m 53 and can retire any day I want to and I exceeded my goal by paying the house off 6 years ago. I started with bi-monthly mortgage payments and rounding up on my mortgage. Once I paid a vehicle off I was already used to not having that money so I just rolled it into my mortgage payment. Then I bought a truck camper, paid it off quickly and did the same with that money. Same with the Lund boat. Before I knew it I was making a double mortgage payment.

if you have the ability for any overtime, use that to help pay down toys. That’s what I did with the camper and boat. I didn’t go looking for the overtime, it would happen here and there. But I was disciplined and put it straight to the toy payments.

I also put money into a 457(very much like 401) and never looked back. Increasing it as as I got pay raises over the years and have been contributing the maximum allowed by law for many years.

Once my daughters were born my next goal was to put them through college without any loans and no debt for them. Paying off the house and toys has allowed me to do this, with both starting at a community college and moving over to Universities.

Throw in a couple of Canadian guided hunts, an African hunt, and hunts out of state every year while still having no credit card debt. Some years I didn’t have the money to apply for a Buck tag so I would buy a doe tag but still get to hunt with Grandad in Montana. In the last 3 1/2 years I bought a new car and Truck for myself, paying cash for both.

All of this may sound daunting but it just takes some planning and discipline. Here’s a few things that helped.

I drove my truck for 17 years instead of getting a new one every few years. I didn’t buy the most expensive one available, only getting options I really needed. I would wait for an appliance to syptop working before it was replaced. I finally had to say goodbye to a 28 year old washer and dryer set after the dryer went out.(I figured if I’m buying one I might as well go with the pair after 28 years). I need business casual and professional clothes for work but only buy when I can find a sale. But I also try to buy quality that will last on all my clothing. I only allow myself to eat out for lunch once a week, and this is a massive financial savings!! I rarely eat out at restaurants, another massive savings. I take care of my own lawn instead of paying anyone to do it for me. I am not shy about buying food for the house but started to look at what items eventually got wasted and cut back On those specific things. Most importantly I never cut back on my mortgage to put extra money in my pocket.

All the extra I paid on the mortgage was always my buffer if something tragic happened and I needed to liquidate in order to provide a place for my kids. Same goes for the toys, they would have been the first to go.

I was only married for 8 years so I haven’t had a dual income family for over 17 years. But the bottom line, goals, discipline and realistic expectations based on your income.

if you have the ability for any overtime, use that to help pay down toys. That’s what I did with the camper and boat. I didn’t go looking for the overtime, it would happen here and there. But I was disciplined and put it straight to the toy payments.

I also put money into a 457(very much like 401) and never looked back. Increasing it as as I got pay raises over the years and have been contributing the maximum allowed by law for many years.

Once my daughters were born my next goal was to put them through college without any loans and no debt for them. Paying off the house and toys has allowed me to do this, with both starting at a community college and moving over to Universities.

Throw in a couple of Canadian guided hunts, an African hunt, and hunts out of state every year while still having no credit card debt. Some years I didn’t have the money to apply for a Buck tag so I would buy a doe tag but still get to hunt with Grandad in Montana. In the last 3 1/2 years I bought a new car and Truck for myself, paying cash for both.

All of this may sound daunting but it just takes some planning and discipline. Here’s a few things that helped.

I drove my truck for 17 years instead of getting a new one every few years. I didn’t buy the most expensive one available, only getting options I really needed. I would wait for an appliance to syptop working before it was replaced. I finally had to say goodbye to a 28 year old washer and dryer set after the dryer went out.(I figured if I’m buying one I might as well go with the pair after 28 years). I need business casual and professional clothes for work but only buy when I can find a sale. But I also try to buy quality that will last on all my clothing. I only allow myself to eat out for lunch once a week, and this is a massive financial savings!! I rarely eat out at restaurants, another massive savings. I take care of my own lawn instead of paying anyone to do it for me. I am not shy about buying food for the house but started to look at what items eventually got wasted and cut back On those specific things. Most importantly I never cut back on my mortgage to put extra money in my pocket.

All the extra I paid on the mortgage was always my buffer if something tragic happened and I needed to liquidate in order to provide a place for my kids. Same goes for the toys, they would have been the first to go.

I was only married for 8 years so I haven’t had a dual income family for over 17 years. But the bottom line, goals, discipline and realistic expectations based on your income.

Last edited:

elkantlers

Well-known member

I have never had a budget and can't imagine trying to live with one. However, I live well below my means. I max out my retirement every year at work and put some in e-trade and Vangard as well. a healthy portion goes in a savings account each month. I pay for just about everything with a credit card but it gets paid off every month. I can proudly say I have never paid a penny in credit card interest. I saved money every check from the time my kids were born for their college. Two have gotten their bachelor's degrees with zero debt. the third should as well.

I think what has worked for me is that neither my wife or I need to have the best or biggest or newest. We have nice dependable vehicles. Our house is modest but nice (and paid off). we both buy stuff we want but don't go overboard.

I think what has worked for me is that neither my wife or I need to have the best or biggest or newest. We have nice dependable vehicles. Our house is modest but nice (and paid off). we both buy stuff we want but don't go overboard.

Potsie

Well-known member

We do 15% of net into retirement - sticking with Roth advantaged accounts, and keep ~$20k as liquid emergency fund. The rest gets dumped into the house (on a 15 yr note, but will have it done in <10 yrs), the boys 529’s and their savings accounts.Within savings how do you divide long term 401k/IRA versus short term, ie money for a trip or something?

I 30% of our AGI into tax advantaged accounts and I’m like… too much

I don’t see the house as an investment, emotionally, but it still is one. If we weren’t permanent and paying rent I’d be maxing out all the retirement accounts and 529s until we did buy.

np307

Well-known member

Rotating goals. So we are currently saving up for a house, so that gets the weight of savings money. For the first few years of our marriage neither one of us had an employer that would match contributions so that's one area that has lagged behind admittedly. Other savings funds, like emergency expenses, have a fixed amount that if they are full they don't get anything extra. Once we finally have a house, most of the savings weight will go more long term. I don't currently have any crazy hunting aspirations, so that piece of the savings pie is pretty small. Same with our family vacations.Within savings how do you divide long term 401k/IRA versus short term, ie money for a trip or something?

I 30% of our AGI into tax advantaged accounts and I’m like… too much

npaden

Well-known member

Not to go too far off topic but this is something that has to be somewhat flexible on your personal life journey.Within savings how do you divide long term 401k/IRA versus short term, ie money for a trip or something?

I 30% of our AGI into tax advantaged accounts and I’m like… too much

Things like kids, unexpected health issues and things like that can all change that.

I do think 15% minimum going to retirement is a good rule of thumb. Beyond that we’ve saved anywhere from 0% more when we were young and pretty much living right at our means to as much as 50% going to savings (investing) as our standard of living pretty much remained unchanged and our income levels increased significantly.

Living below your means and saving up a big chunk of mad money is a great thing if you can do it. Having a chunk of money available has allowed us to make some timely investments as well as pick up some really good deals on some expensive toys when some buying opportunities arose. My gut feel is that there are going to be a few of those in the next year or so similar to 2009.

My 2 cents on that.

BucksnDucks

Well-known member

So how do you categorize hunting expenses? Do you only hunt local, in state game?The fun money category gets the shaft, and I think more than anything it’s me not being able to lighten up on the reins after a decade of super tight budgets.

The tightwad thing also makes me kinda a judgmental jerk when it comes to how other people choose to spend their money.

NR license fees, tag draws, travel costs can add up to a chunk of "fun money". It would be easy for a non hunter to scratch their judgmental heads at some of our spending.

Pucky Freak

Well-known member

I’d highly recommend Dave Ramsey’s Financial Peace University class. Monthly budget is a big component, and there are other elements too that taken together establish a sound and simple financial plan for households. This system is used successfully by millions of Americans because it works, and there is no close rival. There is no good reason to try and reinvent the wheel. In my observation about 90-95% of households who try and “do better than Dave” come up short.

If there is one other element to the budget that is key, it’s putting giving at the top. This is year 21 of me doing that, and it helps put the other budget items into a healthy perspective.

If there is one other element to the budget that is key, it’s putting giving at the top. This is year 21 of me doing that, and it helps put the other budget items into a healthy perspective.

D

Deleted member 28227

Guest

Fun money, it’s entirely a luxury for me.So how do you categorize hunting expenses? Do you only hunt local, in state game?

NR license fees, tag draws, travel costs can add up to a chunk of "fun money". It would be easy for a non hunter to scratch their judgmental heads at some of our spending.

D

Deleted member 28227

Guest

Speaking of, those new 529 rules on the latest budget bill.We do 15% of net into retirement - sticking with Roth advantaged accounts, and keep ~$20k as liquid emergency fund. The rest gets dumped into the house (on a 15 yr note, but will have it done in <10 yrs), the boys 529’s and their savings accounts.

I don’t see the house as an investment, emotionally, but it still is one. If we weren’t permanent and paying rent I’d be maxing out all the retirement accounts and 529s until we did buy.

Backdoor Roth part deux + state tax benefits if I’m reading it correctly.

It’s like the Uber Roth.

Last edited by a moderator:

No apps for us, just basic no nonsense rules of thumb:

* pay yourself first, we shoot for a goal of putting 25% of our income away (before taxes)

* no more than 25% to be spent on dwelling costs, no exceptions

* no monthly debt except mortgage, no exceptions

* credit card debt paid off every time it hits $1K, no exceptions

* drive used vehicles till the wheels fall off or we get so bored with them we try something else, buy 2-3 years old with <40K miles

* shop hard for everything, buy everything possible on sale

* don't scrimp on food, it keeps you healthy and means less medical bills so cheaper in the long run

than buying crap food

* don't try to reinvent the wheel, it's all been done by someone else before

* be brutally honest with one another about finances, trust me on this one. Notice I didn't say be

rude.

These are the important ones to us. It's quite amazing what happens over time when you practice these concepts.

* pay yourself first, we shoot for a goal of putting 25% of our income away (before taxes)

* no more than 25% to be spent on dwelling costs, no exceptions

* no monthly debt except mortgage, no exceptions

* credit card debt paid off every time it hits $1K, no exceptions

* drive used vehicles till the wheels fall off or we get so bored with them we try something else, buy 2-3 years old with <40K miles

* shop hard for everything, buy everything possible on sale

* don't scrimp on food, it keeps you healthy and means less medical bills so cheaper in the long run

than buying crap food

* don't try to reinvent the wheel, it's all been done by someone else before

* be brutally honest with one another about finances, trust me on this one. Notice I didn't say be

rude.

These are the important ones to us. It's quite amazing what happens over time when you practice these concepts.

L

longbow51

Guest

Yep. Our CFO was late with the payroll by one day once, and the folks with salaries mid 6 figures who were complaining were amazing. I was like, what's the big deal? It's a day. They had payments to make and no reserves.Very glad to see this thread. Lots of good information to be shared with a thread like this.

In my 30+ years as a CPA, my anecdotal observation is that 90%+ of my successful clients had a budget that was a monthly road map that helped them achieve their goals, whether they were business clients or individual clients. Their lives were much more sane, they did not have consumer debts or credit card debts, they had savings, they were thinking about retirement income, and they took comfort in the monthly/annual progress they saw toward their goals.

Of those clients who spent more than they made, whether they made $75K or $500K, about 90% of them did not have a budget. Their financial maturity was through the narrow lens of next month's cash inflow. They were stressed, in debt beyond their means, and too often ended up in a divorce.

I got to see everyone financially naked. You would be amazed how many people give the appearance of "knocking it out of the park," yet behind the big house, the new vehicles, the toys, the timeshare, the fancy vacations, is a mountain of debt that grew faster than the income. And most of them realize it, but by the time they do, it seems almost overwhelming to get out of.

I am convinced the exercise of budgeting makes a better financial adult for anyone with a third grade math ability. If I could change one thing about our public education system that I think would make a huge difference in our society, it would be to require every high school graduate to pass a personal budgeting class in order to get their diploma.

As it relates to hunting, I suspect the majority of folks who budget well and avoid debt also have budgets, using that as the path to do the trips they want, purchase what they need, and they do so on all levels of income.

Some might be reading this and be at the beginning of their earning years. If your household is not on a budget, make that your New Year's resolution. Better yet, make it your "Rest of your life" resolution. Doing so will add a lot more hunting days to your future.

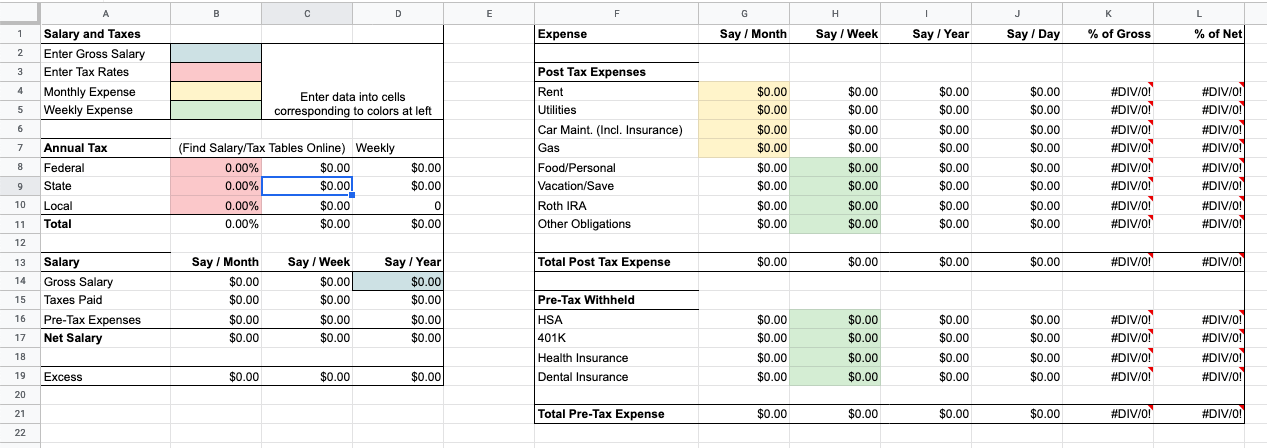

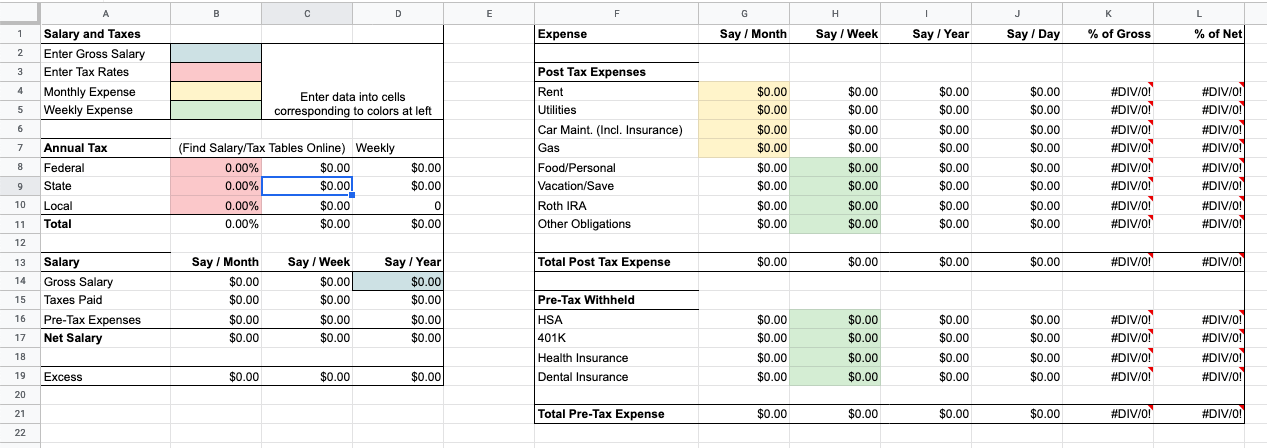

A few years ago I decided to get things in order and built a big old spreadsheet that calculates my anticipated expenses for the year and lets me know how much to set aside for each of them every week. I went to my local credit union and asked them to set me up with a few savings accounts so I could do a digital cash envelope kind of thing.

Though I started a little later in life than what was ideal, I've been finally hitting or exceeding Liz Warren's 50/30/20 budget rule. Like some others on here, I also drive old cars and such and avoid debt. I was young and ok with being broke in '08 and wasn't terribly affected by the financial collapse, but seeing what happened to folks I know scarred me for life on having debt for crap I don't need. I don't want to be in the hole for anything if things go south.

Here's a screenshot of the spreadsheet with everything zero'd out.

Though I started a little later in life than what was ideal, I've been finally hitting or exceeding Liz Warren's 50/30/20 budget rule. Like some others on here, I also drive old cars and such and avoid debt. I was young and ok with being broke in '08 and wasn't terribly affected by the financial collapse, but seeing what happened to folks I know scarred me for life on having debt for crap I don't need. I don't want to be in the hole for anything if things go south.

Here's a screenshot of the spreadsheet with everything zero'd out.

Last edited:

Similar threads

- Replies

- 101

- Views

- 6K

- Replies

- 11

- Views

- 989

- Replies

- 24

- Views

- 3K