Nick87

Well-known member

You could sell those and by a pickup...

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You could sell those and by a pickup...

You moved across the country multiple times and didn't off load those? I think I gave mine away sometime around losing my virginity.

Generational trading card wealth... some day my 13 year old is going to be stoked to drop some over powered Ursa's cards on some fool.You moved across the country multiple times and didn't off load those? I think I gave mine away sometime around losing my virginity.

Causality is not a thing to be taken lightly.You moved across the country multiple times and didn't off load those? I think I gave mine away sometime around losing my virginity.

I have a pile of magic cards from 20 plus years ago. How do I find out what they are worth and where do I sell them?

Doing this is how my wife and I are able to move back west. Budgeting is so eye opening that you never understand why you didn’t start sooner.Very glad to see this thread. Lots of good information to be shared with a thread like this.

In my 30+ years as a CPA, my anecdotal observation is that 90%+ of my successful clients had a budget that was a monthly road map that helped them achieve their goals, whether they were business clients or individual clients. Their lives were much more sane, they did not have consumer debts or credit card debts, they had savings, they were thinking about retirement income, and they took comfort in the monthly/annual progress they saw toward their goals.

Of those clients who spent more than they made, whether they made $75K or $500K, about 90% of them did not have a budget. Their financial maturity was through the narrow lens of next month's cash inflow. They were stressed, in debt beyond their means, and too often ended up in a divorce.

I got to see everyone financially naked. You would be amazed how many people give the appearance of "knocking it out of the park," yet behind the big house, the new vehicles, the toys, the timeshare, the fancy vacations, is a mountain of debt that grew faster than the income. And most of them realize it, but by the time they do, it seems almost overwhelming to get out of.

I am convinced the exercise of budgeting makes a better financial adult for anyone with a third grade math ability. If I could change one thing about our public education system that I think would make a huge difference in our society, it would be to require every high school graduate to pass a personal budgeting class in order to get their diploma.

As it relates to hunting, I suspect the majority of folks who budget well and avoid debt also have budgets, using that as the path to do the trips they want, purchase what they need, and they do so on all levels of income.

Some might be reading this and be at the beginning of their earning years. If your household is not on a budget, make that your New Year's resolution. Better yet, make it your "Rest of your life" resolution. Doing so will add a lot more hunting days to your future.

Bruh, Im working through some Pokémon cards right now. Found me some attic gold over the holidays. I want to spend the proceeds on a guided private land elk hunt but my wife wants me to put it in the baby's 529... I haven't held on to all those mint 1st edition shadowless holographics for multiple decades to spend it on someone else!.. she can get some loans like the rest of usSearch

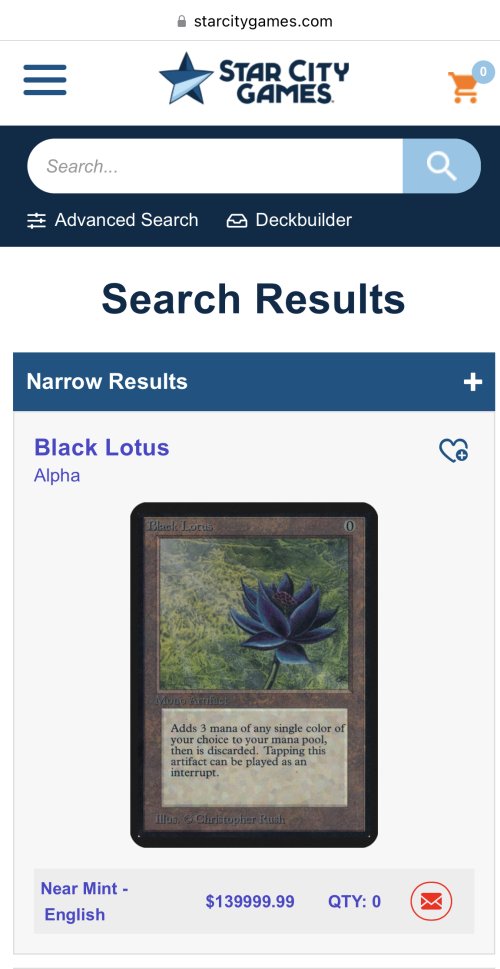

starcitygames.com

There are a couple other sites that will give you an idea of prices.

Take out a loan or save up?Bruh, Im working through some Pokémon cards right now. Found me some attic gold over the holidays. I want to spend the proceeds on a guided private land elk hunt but my wife wants me to put it in the baby's 529... I haven't held on to all those mint 1st edition shadowless holographics for multiple decades to spend it on someone else!.. she can get some loans like the rest of us

Don’t forget, divorces are more expensive than elk huntsBruh, Im working through some Pokémon cards right now. Found me some attic gold over the holidays. I want to spend the proceeds on a guided private land elk hunt but my wife wants me to put it in the baby's 529... I haven't held on to all those mint 1st edition shadowless holographics for multiple decades to spend it on someone else!.. she can get some loans like the rest of us

Personally, my wife and I live far beneath our means. Our core expenses are about half our income. This is primarily accomplished by driving dependable but inexpensive cars, and buying a house that was about half of what we could qualify for.We're pricing new windows for the house ( they are completely shot) around $25 to 26k for all of them. I think the plan is to do about a third and our tax return should handle most of that and do that for the next three years. My question is what do those folks do when there already maxed and something like this comes up. Puts my anxiety through the roof just thinking about it.

Thought about the heloc, didn't want to take out another loan. Well just wait and pay cash. Little at a time. I don't like bumping the nest egg too much. My line of work income can fluctuate quite a bit from one year to the next so I sleep real good with a little extra for a buffer. That and 08 scarred me for life with a lot of people inmy line of work. I'd never be without a years salary or something close to it in the bank in my life if I can absolutely help it.Personally, my wife and I live far beneath our means. Our core expenses are about half our income. This is primarily accomplished by driving dependable but inexpensive cars, and buying a house that was about half of what we could qualify for.

On a regular month we take the remaining half of our income and allocate it to savings, investments, vacation fund, Christmas, paying extra at the mortgage, capital improvements, etc. When there is a large unexpected expense, we can put a ton of things on hold and save up cash very quickly. We can come up with $2000 extra a month in a snap, $4000 if we really scrape the bucket. Once the windows (or whatever) are paid for, we play catch up on all the categories where we went without while focusing on the single large expense. The real life example for us was adopting our daughter, which was unplanned and on a very short timetable. I read an article recently that 98% of private adoptions are financed. We paid cash.

We could look a lot flashier living at the edge of our means, but we choose to give that up in exchange for having a ton of financial flexibility. From my observation among most everyone I know, it's far more common to put it on a HELOC and not think twice about it. There's no right or wrong way to do it - just sets of pros and cons.

On a similar note we used to work with an engineer who made 175k plus a truck before bonuses. His wife owned her own accounting firm so whatever she made I'm sure she did well. Guy was so cheap he ate a bologna sandwich everyday looked like someone ran it over in the street. Halloween he didn't buy his kids pumpkins because they were up to $6 dollars a piece that year and he thought that was too much. I wouldn't want to live like that guy.Personally, my wife and I live far beneath our means. Our core expenses are about half our income. This is primarily accomplished by driving dependable but inexpensive cars, and buying a house that was about half of what we could qualify for.

On a regular month we take the remaining half of our income and allocate it to savings, investments, vacation fund, Christmas, paying extra at the mortgage, capital improvements, etc. When there is a large unexpected expense, we can put a ton of things on hold and save up cash very quickly. We can come up with $2000 extra a month in a snap, $4000 if we really scrape the bucket. Once the windows (or whatever) are paid for, we play catch up on all the categories where we went without while focusing on the single large expense. The real life example for us was adopting our daughter, which was unplanned and on a very short timetable. I read an article recently that 98% of private adoptions are financed. We paid cash.

We could look a lot flashier living at the edge of our means, but we choose to give that up in exchange for having a ton of financial flexibility. From my observation among most everyone I know, it's far more common to put it on a HELOC and not think twice about it. There's no right or wrong way to do it - just sets of pros and cons.

I agree with this method, I like setting up financial systems. Auto investing in retirement, bi-annual reviews, and track progress against the plan. I don’t like reviewing things monthly or weekly. My wife and I have always put as much as possible automatically each paycheck into retirement then live within the means of what’s left over. We do have two kids and have adjusted accordingly with extra daycare costs, etc. we’ve also gotten raises and just put even more into retirement vs upgrade cars and our house. I’m sure we could always do better but there’s also the part where you can’t take it with you and try to be content with what you have (bigger lawns and more house projects aren’t appealing to us, we live in Montana to recreate, not do lawn care). Low cost index funds have performed very well the last 10 years but we plan based on the long term average. I have converted to cash on some highs and re-invested on a downturn to try and beat the market but there’s added stress and uncertainty with that. Will probably wait till March and see what the fed does with interest rates and decide to wait for a recession or get back in and let it ride.I tried a budget for a few months after I got out of school but that fell by the wayside relatively quickly. I’ve always been a saver and lived well below my means. My wife saves too, but not as much as I do. She balances me out some, as I could probably be classified as a miser if left up to my own devices - I’ve been using the same rifle and shotgun for over 25 years. The planner in me still runs numbers to make sure we are good on big purchases like cars and houses.

One of things I do to help with the saving is prepare an annual PFS/balance sheet in lieu of a budget. This allows me to track our progress towards THE GOAL - retirement by the time I’m 60. It also helps my wife, who’d like to spend more, see the progress we are making. When I can show her our net worth went up over $100K YOY she sees the payoff of the financial/wants sacrifices we are making. That $1,000 she wanted to spend on a new couch a couple of years ago is still there, only now it’s $1,400 (yes, I know that couch will now cost me $1,250).

There’s another tab on the spreadsheet that projects retirement balances by age given different rates of return and income streams. The spreadsheets help me track progress towards that retirement goal, having the house paid off by 55, and 80 acres of hunting land by 45.

And credit cards are great tools. If you can exercise the restraint, use them!