SAJ-99

Well-known member

I hesitate to make this post, but given I have gotten a lot of questions, even some HT members, about the markets recently I thought it may be useful. It is more an economic thread than political one, but it is hard to separate the two these day.

There is an idea going around called the Mar-A-Lago Accords (MALA) that tries to explain what "the plan" is Trump is trying to pull off. Some well-known and credible economists/firms have put out some summaries that I will share below. If the idea gains momentum, I suspect more people will see summaries from their own Financial Advisors and Firms. I suspect a lot of the idea is a post hoc justification of Trump's love of tariffs.

Some have called these summaries sane-washing, which is simply trying to put a rational explanation on something bat-shit crazy, because it attempts to reorder the entire Global economic system. It does not mean it won't work, only that it begs the question of why change the rules of a game we are winning? The summary might appeal to the some and certainly to the Trump base who worries only about the debt and deficits. The reason it gets the sane-washing label is because it is pretty ease to find some holes in the thought process, but I won't go into those. I post it not to rationalize or argue against but to inform, because it will affect your money. I advise not going too far down the economic rabbit hole on this one, but yes, a devalued dollar is the definition of inflation.

My main take-way is if you think this idea works, or maybe even if your don't, Foreign asset denominated in foreign currencies will benefit. For those with a long-term view, take a look at your portfolio or ask your FA about your exposure to the rest of the world, be it EAFE or EM or whatever. A lot of Americans' portfolios are US centric. If you talk to your FA, I would love to hear back their views. Also keep in mind as you read articles that corporations and media have been scared about publicly saying anything negative about this Admin or its ideas.

From Torsten Slok at Apollo.

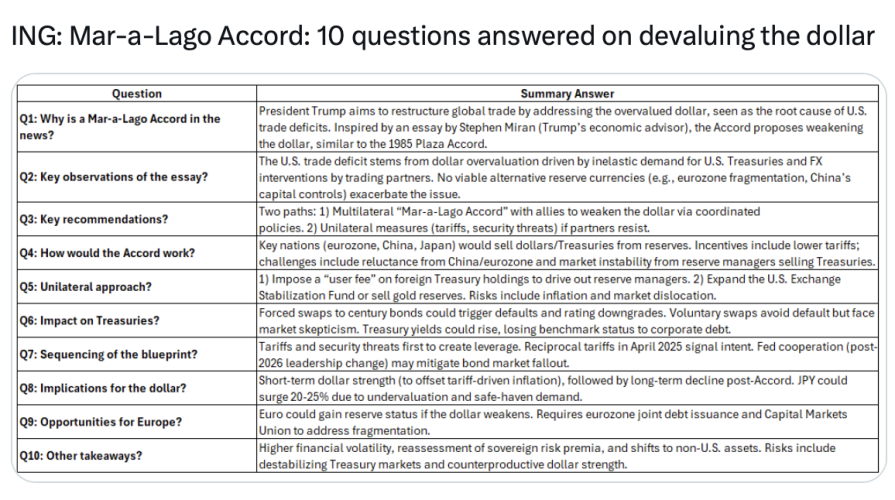

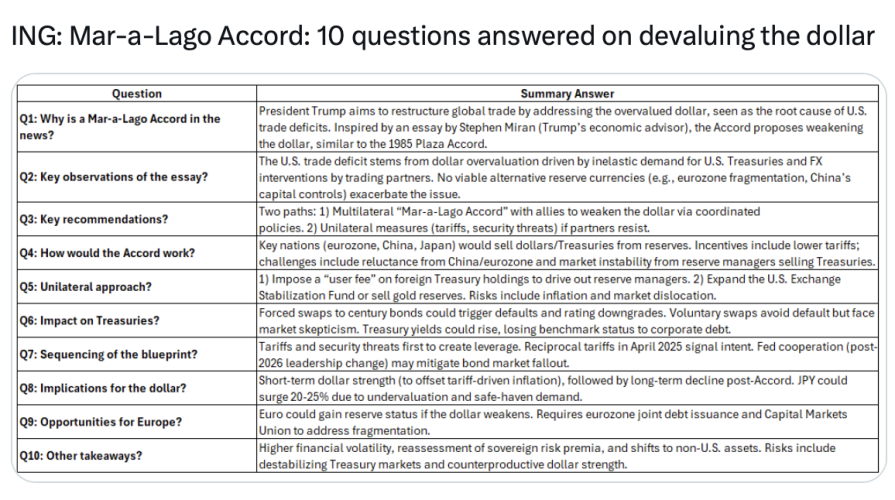

From ING

There is an idea going around called the Mar-A-Lago Accords (MALA) that tries to explain what "the plan" is Trump is trying to pull off. Some well-known and credible economists/firms have put out some summaries that I will share below. If the idea gains momentum, I suspect more people will see summaries from their own Financial Advisors and Firms. I suspect a lot of the idea is a post hoc justification of Trump's love of tariffs.

Some have called these summaries sane-washing, which is simply trying to put a rational explanation on something bat-shit crazy, because it attempts to reorder the entire Global economic system. It does not mean it won't work, only that it begs the question of why change the rules of a game we are winning? The summary might appeal to the some and certainly to the Trump base who worries only about the debt and deficits. The reason it gets the sane-washing label is because it is pretty ease to find some holes in the thought process, but I won't go into those. I post it not to rationalize or argue against but to inform, because it will affect your money. I advise not going too far down the economic rabbit hole on this one, but yes, a devalued dollar is the definition of inflation.

My main take-way is if you think this idea works, or maybe even if your don't, Foreign asset denominated in foreign currencies will benefit. For those with a long-term view, take a look at your portfolio or ask your FA about your exposure to the rest of the world, be it EAFE or EM or whatever. A lot of Americans' portfolios are US centric. If you talk to your FA, I would love to hear back their views. Also keep in mind as you read articles that corporations and media have been scared about publicly saying anything negative about this Admin or its ideas.

From Torsten Slok at Apollo.

From ING