millerkiller77

Well-known member

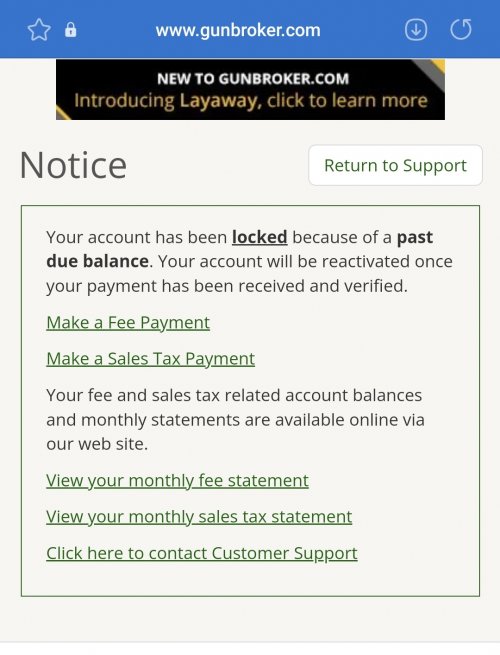

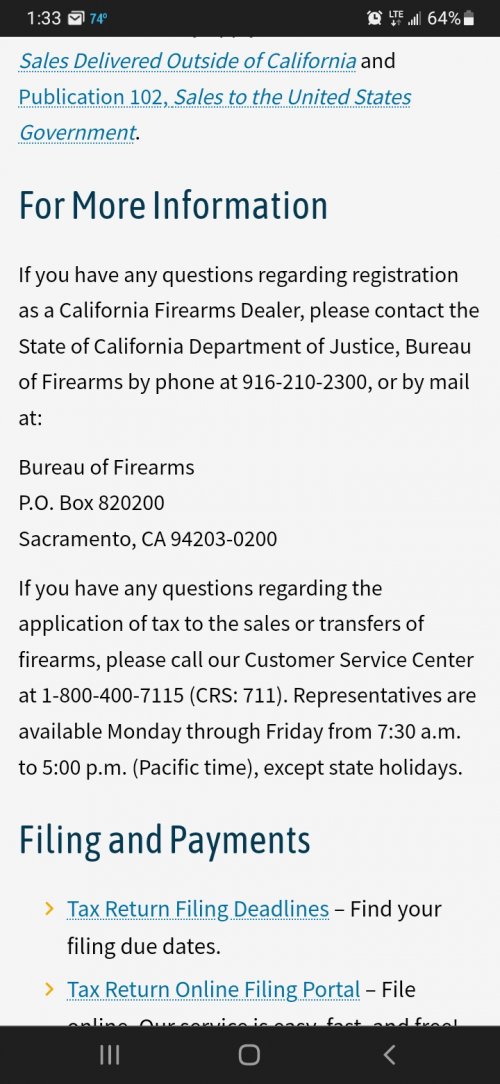

I'm going to second this. Every Gunbroker purchase I've done that requires a ffl, gunbroker collected the sales tax and I never heard another peep. On the flip side, I've done over 100 gunbroker sales and Gunbroker handled the tax on that as well. No buyer has ever contacted me because they were getting doubled charged on fees or taxes.I’ve bought from gun broker and they charged me the sales tax for PA.

i have never been charged the tax a second time at my ffl nor have they even questioned me about it. You should have gotten or be able to get a invoice from GB showing that you paid the tax