Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

Don’t believe anything this administration says. They didn’t desire to call it inflation or Recession and now they just sured up the banks with billions of dollars and refuse to call it a bailout. Can’t wait for a Trump/Lake 2024.

One thing for sure I have made very well with XLE and VDE while the Green president has been in office. But I am looking forward to a new administration and MAGA and securing America.

One thing for sure I have made very well with XLE and VDE while the Green president has been in office. But I am looking forward to a new administration and MAGA and securing America.

Last edited:

rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,133

I don’t think Trump/Lake is a winning ticket even against Joe the schmo. You might want to grab a snickersDon’t believe anything this administration says. They didn’t desire to call it inflation or Recession and now they just sured up the banks with billions of dollars and refuse to call it a bailout. Can’t wait for a Trump/Lake 2024.

One thing for sure I have made very well with XLE and VDE while the Green president has been in office. But I am looking forward to a new administration and MAGA and securing America.

rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,133

Letting your politics skew your financial decisions is a sure way to lose your money but to each their own

D

Deleted member 28227

Guest

Looks like everyone is dropping rigs FYI, and gas prices are really going to put the hurt of folks who didn’t hedge.Don’t believe anything this administration says. They didn’t desire to call it inflation or Recession and now they just sured up the banks with billions of dollars and refuse to call it a bailout. Can’t wait for a Trump/Lake 2024.

One thing for sure I have made very well with XLE and VDE while the Green president has been in office. But I am looking forward to a new administration and MAGA and securing America.

It will be interesting to see what the summer brings but sitting here today I’m not bullish.

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

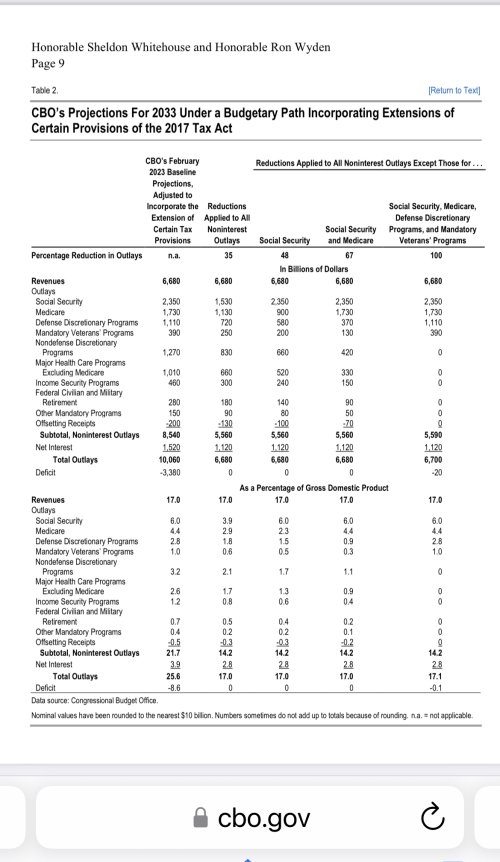

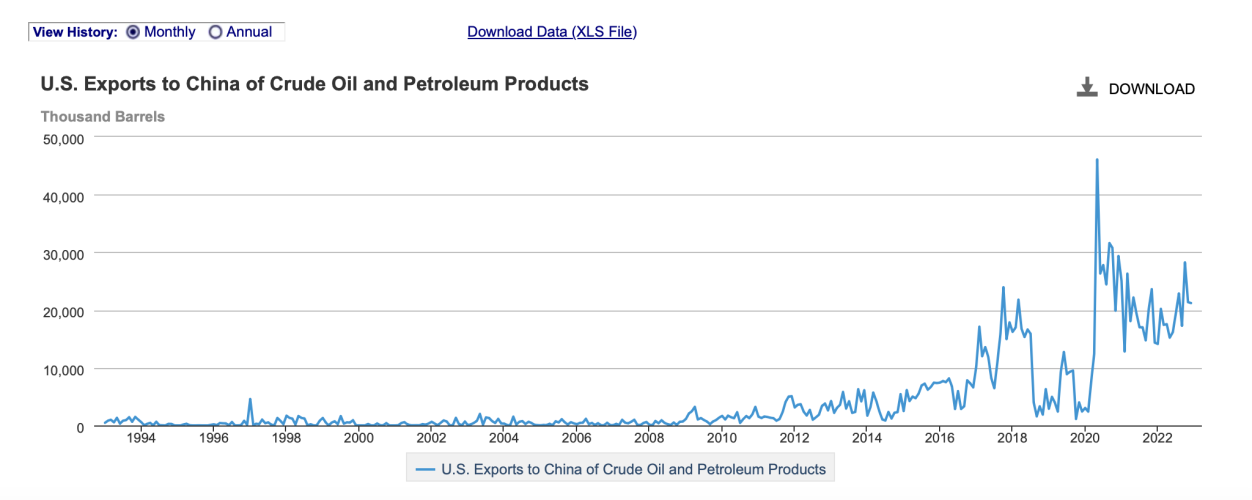

Expect a rough 1st six months of 2023. The China Reopening has just started. They sent 10 supertankers that hold 2 million barrels each to US in March and are trying to lease more supertankers. Expect a rocky ride but a great 2nd half of 2023 for energy.

SAJ-99

Well-known member

Regarding oil, data for WTI looks bearish for prices, while data for the rest of the world looks bullish. These things tend to even out, but the global political climate is such that the main beneficiaries might be Russia and Saudis. Nat gas is a mess. About the only thing that will save it is a hot summer.Looks like everyone is dropping rigs FYI, and gas prices are really going to put the hurt of folks who didn’t hedge.

It will be interesting to see what the summer brings but sitting here today I’m not bullish.

I got stopped out of XLE last week. Price action is tough to read given and market seems to be moving from value (Banks and Energy) back to growth (tech).

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

Expect a great last 6 months of 2023 in Energy XLE on China reopening. Currently 10 supertankers from China at US ports for Oil and China looking to lease more Supertankers to send. Very Bullish on XLE and VDE for 2nd Half of year.

Attachments

D

Deleted member 28227

Guest

So what one small company produces lolExpect a rough 1st six months of 2023. The China Reopening has just started. They sent 10 supertankers that hold 2 million barrels each to US in March and are trying to lease more supertankers. Expect a rocky ride but a great 2nd half of 2023 for energy.

The SPR draw down was almost 10x that size and we saw that effect on price.

What is going on with the dollar?

news.bitcoin.com

news.bitcoin.com

Putin, Xi Vow to Use Yuan as Russia and China Move to Settlements in National Currencies – Economics Bitcoin News

President Putin and President Xi Jinping have vowed for Russia to use the Chinese yuan as a settlement currency with emerging economies.

SAJ-99

Well-known member

Xi is talking out of both sides of his mouth. The Yuan is soft pegged to the Dollar and highly manipulated by his government. It will be hard to get other countries to start settling in anything but the Dollar with the current political backdrop. SDRs have been around a long time, and are used but haven't come close to displacing the Dollar. It has been a risk for decades and could happen faster than we expect, but it is hard to plan out the scenario right now.What is going on with the dollar?

Putin, Xi Vow to Use Yuan as Russia and China Move to Settlements in National Currencies – Economics Bitcoin News

President Putin and President Xi Jinping have vowed for Russia to use the Chinese yuan as a settlement currency with emerging economies.news.bitcoin.com

In the Macroeconomics is hard category, this is pretty good summary.

SAJ-99

Well-known member

Expect a great last 6 months of 2023 in Energy XLE on China reopening. Currently 10 supertankers from China at US ports for Oil and China looking to lease more Supertankers to send. Very Bullish on XLE and VDE for 2nd Half of year.

There is nothing there the market doesn't already know. And your numbers aren't all that high.

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

Saudi are shifting from US Dollar to Russian and China……….simple. We are losing the Middle East !

SAJ-99

Well-known member

What about "Energy Independence!!!"?Saudi are shifting from US Dollar to Russian and China……….simple. We are losing the Middle East !

I guess that is one way to look at it......if it was by choice instead of incompetence.What about "Energy Independence!!!"?

noharleyyet

Well-known member

Got any data to back that up...I guess that is one way to look at it......if it was by choice instead of incompetence.

The Fed's actions drove a $6.4 trillion increase in the M2 money supply between March 2020 and the end of 2021. This was a massive and unprecedented 42% increase in only 22 monthGot any data to back that up...

Partly this.....

SAJ-99

Well-known member

Went in a different direction with that argument. I assure you that oil producers in the Middle East will take US Dollars for their oil.The Fed's actions drove a $6.4 trillion increase in the M2 money supply between March 2020 and the end of 2021. This was a massive and unprecedented 42% increase in only 22 month

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

Since Day 1 of this administration after closing down the pipeline and all the actions against the oil industry using EPA as a weapon. The Green connection between Bidens and Chinese are all suspicious. The bank account transactions with the CCP. It’s clear we have less than 2 more years of this administration war on Fossil fuel.

D

Deleted member 28227

Guest

Since Day 1 of this administration after closing down the pipeline and all the actions against the oil industry using EPA as a weapon. The Green connection between Bidens and Chinese are all suspicious. The bank account transactions with the CCP. It’s clear we have less than 2 more years of this administration war on Fossil fuel.

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 13

- Views

- 710

- Replies

- 22

- Views

- 2K