rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,133

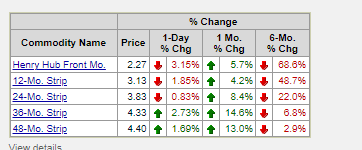

Yeah I’m fully sold out of o&g except for a couple tanker stocks. Sold PR at 10.67. I had bought that when it was cdev during the pandemic low at $0.33. Fairly solid 3 year return on that oneHow many are investing in VDE and XLE in Energy ?

Strong Buy just before the China Reopening!