Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

PE of 60.... no DIV, Covid over, I'll passAmazon did their 20:1 split. Is this a buying opportunity now? Up almost 5% today.

SAJ-99

Well-known member

How attractive do they need to be to get you to buy Tesla or Bitcoin?Attractive women giving me advise over Cramer any day of the week!

BigHornRam

Well-known member

That woman hasn't been born yet......How attractive do they need to be to get you to buy Tesla or Bitcoin?

Nick87

Well-known member

Checked my wintrust account today for the first time in 6 months. Shouldn't of done that.

TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,315

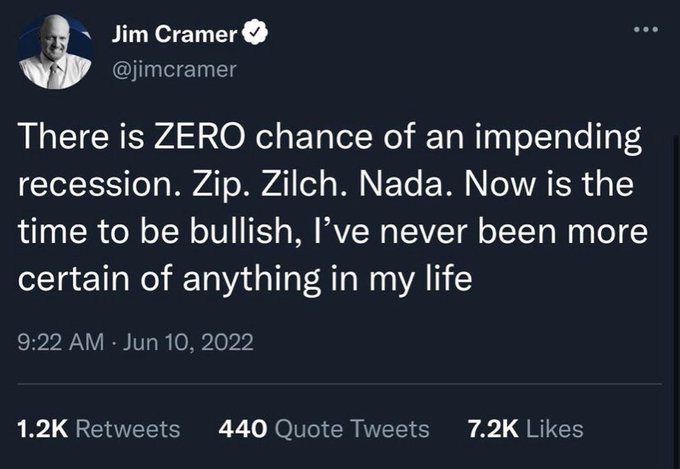

Boy he must have deleted that one fast. . .View attachment 225436

buy STONKS!

rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,124

Bonds are going down with stocks again. Until we start seeing a flight to safety this baby is going down like a sack of crap! I still like my 2800 on the S&P bottom call.

SAJ-99

Well-known member

Does a technical recession matter? Stocks are already pricing it in. Trade the market not the economy.View attachment 225436

buy STONKS!

SAJ-99

Well-known member

Hard technical line near 3400ish. It will take a lot more bad news to get to 2800. Not saying it couldn't happen, but it would need a knee-capper of an event.Bonds are going down with stocks again. Until we start seeing a flight to safety this baby is going down like a sack of crap! I still like my 2800 on the S&P bottom call.

BigHornRam

Well-known member

Two for one Friday tune/money and finanace post. Can you loan me a pair @SAJ-99Hard technical line near 3400ish. It will take a lot more bad news to get to 2800. Not saying it couldn't happen, but it would need a knee-capper of an event.

SAJ-99

Well-known member

It has never paid to be bearish long term. Consumer sentiment is lowest EVER, Investor sentiment is negative, investor cash levels are highest in decades. For full disclosure, I'm holding 25% cash, so its not like I'm All-In. But being stubbornly negative is a good way to end up broke. You can be holding cash and basking in your success while inflation erodes the value of that cash. I guess the call would be right so you can be broke and correct at the same time.

huntandfly

Well-known member

Which is worse? Inflation eroding your cash or most of your equities dropping 20+ percent?You can be holding cash and basking in your success while inflation erodes the value of that cash. I guess the call would be right so you can be broke and correct at the same time.

You are right, long term bear mentality is probably not profitable but it’s perfectly reasonable short term based on immediate market and consumer conditions

SAJ-99

Well-known member

I assume the question is rhetorical given the obvious answer. @rogerthat has a buy target, and he said he would buy. I will believe him. But what typically happens is the market rebounds when economic conditions are the worst. So will you be a buyer or are you going to say "consumer conditions and economy are horrible so I'm waiting for the next dip."? EVERYONE says they will buy, but the stubborn never do.Which is worse? Inflation eroding your cash or most of your equities dropping 20+ percent?

You are right, long term bear mentality is probably not profitable but it’s perfectly reasonable short term based on immediate market and consumer conditions

rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,124

I’m a scenario guy. I have 5 plausible scenarios as to how this goes. 2800 is my second level bear scenario and my best guess as to how this shakes. It’s a guess of course. Therefore I actually started dollar cost averaging into select etfs 3 weeks ago. Some stuff looks ok right now on a strictly valuation stand point. My bull scenario I think is unlikely but it’s possible therefore got to hedge my bets and buy. I suspect I will take some losses in the short termI assume the question is rhetorical given the obvious answer. @rogerthat has a buy target, and he said he would buy. I will believe him. But what typically happens is the market rebounds when economic conditions are the worst. So will you be a buyer or are you going to say "consumer conditions and economy are horrible so I'm waiting for the next dip."? EVERYONE says they will buy, but the stubborn never do.

stealthy_bowman

Well-known member

I have yet to meet a short-term trader that does better than a strategic long term investor that stays the course through thick and thin. Yet I’ve met plenty of traders that have done much worse than long term investors. I guess we have some exceptions on here…

rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,124

It’s nice to be buying at somewhat reasonable valuations. I love when stocks go down.

BigHornRam

Well-known member

My stocks are up 72% ytd. Down a little today. Plenty of dry powder too for when new management steps in. So I'm a short term bear for now.It has never paid to be bearish long term. Consumer sentiment is lowest EVER, Investor sentiment is negative, investor cash levels are highest in decades. For full disclosure, I'm holding 25% cash, so its not like I'm All-In. But being stubbornly negative is a good way to end up broke. You can be holding cash and basking in your success while inflation erodes the value of that cash. I guess the call would be right so you can be broke and correct at the same time.

rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,124

Your spot on but it’s fun to guess where things are headed.I have yet to meet a short-term trader that does better than a strategic long term investor that stays the course through thick and thin. Yet I’ve met plenty of traders that have done much worse than long term investors. I guess we have some exceptions on here…

huntandfly

Well-known member

Of course I have buy targets, and I too am a long term investor. I’m less than 40% cash right now though which is much higher than normal.I assume the question is rhetorical given the obvious answer. @rogerthat has a buy target, and he said he would buy. I will believe him. But what typically happens is the market rebounds when economic conditions are the worst. So will you be a buyer or are you going to say "consumer conditions and economy are horrible so I'm waiting for the next dip."? EVERYONE says they will buy, but the stubborn never do.

Your comment about basking in success for holding cash right now made me believe you were being facetious and therefore encouraging new long positions right now, which I disagree with. But I legitimately don’t know anything and am guessing, as is anyone else who is an involved trader

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 12

- Views

- 613

- Replies

- 22

- Views

- 2K