No bailout for rentals yet. If the get it that stock should pop like airlines did. And I agree, a billionair has many connections. Although call Trump is pointless, he has to call the lawmakers instead correct? Trump only signs the bill, he can't craft it.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

SAJ-99

Well-known member

Slush fund.

Slush fun maybe. HTZ won't be the only one asking for money (hence the gif I posted). I bought HTZ when Ichan bought it years ago, price was in the upper teens. Cut my losses early and it has been dead money. The fund has a lot of debt and the car rental market is commoditized. They have premier locations, but if no one is flying it doesn't matter. They can only pay the debt for so long. My thoughts on Ichan as an investor are best left to private conversations. Oh the stories.No bailout for rentals yet. If the get it that stock should pop like airlines did. And I agree, a billionair has many connections. Although call Trump is pointless, he has to call the lawmakers instead correct? Trump only signs the bill, he can't craft it.

NEWHunter

Well-known member

I can’t see how we don’t retest the lows. Nobody has ever seen what a 6 week shutdown of America and over half the rest of the world looks like.

Walkathon

Well-known member

You mean there's a bottom ? Joking, I hope

redwoood

Well-known member

I thought I hit Spg perfect yesterday but it kept going down.

Going to sit on the sidelines for a bit and see what happens...I was very happy to break even today!

Going to sit on the sidelines for a bit and see what happens...I was very happy to break even today!

Buffet pulled out a snot ton of his holding from DAL (Delta) and LUV (Southwest) aftermarket... DAL dropped 11.5% after the announcement.

Tomorrow the reverberation from such will send other large holdings in travel, etc into the red.

Tomorrow the reverberation from such will send other large holdings in travel, etc into the red.

redwoood

Well-known member

Which airline looks good at "bottom" prices?

Leaning toward Delta but they all scare me somewhat.

Leaning toward Delta but they all scare me somewhat.

I'd personally steer clear of airlines. Originally, I thought a long term hold would be a good play though further research shares the following.Which airline looks good at "bottom" prices?

Leaning toward Delta but they all scare me somewhat.

Delta and United both filed bankruptcy in 2002 and 2005 from Sept '01 event. C-19 holds much broader implications.

IF bankruptcy occurs;

Common share holders are last in line to gain crumbs on the dollars held... Usually after x duration of time consumed by legal action.

Options are gone. Big fat zero for calls. Great for puts.

If you feel bankruptcy will not occur, I'd shoot for UAL over DAL. Bare bones #'s over a steady yearly review. Not looking at business models, earning reports, etc...

Pre C-19:

DAL steady @ $45.

UAL steady @ $85.

Both linger around the same 20$ price point.

Remember, it took five years for stocks to rise from that 18000 DOW area and it's been a great run! It's not, as many TSP/401 holders believe, an immediate return to recover losses in a year or two... We are in a Presidential election year as well... who knows how our market reacts.

Many good stocks ripe for a gain once they reach that bottom.

Not that a disclaimer is necessary on some internet hunt forum though for chits n grins, I'm a hobby day/swing trader that picks up mid/long term holding along the way.

hogcarpy

Well-known member

I bought a small amount of DAL just about the 52 week low. Even at that, I'm a little concerned, but they are a well ran company and I don't have a lot invested.Which airline looks good at "bottom" prices?

Leaning toward Delta but they all scare me somewhat.

VikingsGuy

Well-known member

RobG

Well-known member

I'm not sure what you are trying to say here.

stealthy_bowman

Well-known member

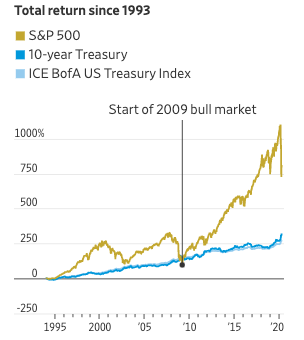

I think he's just trying to say that for the long haul, you can't beat the returns from equities.I'm not sure what you are trying to say here.

BigHornRam

Well-known member

Buy low sell high, and the S&P has a ways to go before it hits bottom.I'm not sure what you are trying to say here.

VikingsGuy

Well-known member

Sorry, some seem to be preferring uncommented data these days.I'm not sure what you are trying to say here.

A number of possible thoughts to consider out of this data set. A few of mine:

- If a person looked at their investments in 2017 and didn't feel poor, no need to feel poor today - human emotions/perceptions are a funny thing

- If a person thinks we must be at rock bottom because the fall has been so dramatic, lots of room still at least in theory

- If you think "safe" investments are always best, not always true over long timeframes

- If you think "equities" are always best - probably true over long windows, but in intermediate windows not at all a guarantee

Hopefully support levels of 2014/5-2017 avg 18000 (DOW) maintain. Fear is w/o a visible horizon for C-19, yet... I believe that support will be tested. If it breaks, well then we are looking at some serious short opportunities.

SAJ-99

Well-known member

The chart basically says you get paid for taking risk. You just have to endure the downside of taking that risk. Remember that rates have been very low since 2009, so the gap between equities and the US treasury bonds looks extreme. Low rates are a driver of that gap. I would not say it means equities need to return to that line, like it did in the previous downturns. Starting and ending points drive a lot of visuals in the investing business.I'm not sure what you are trying to say here.

redwoood

Well-known member

Which airline looks good at "bottom" prices?

Leaning toward Delta but they all scare me somewhat.

JETS ?

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 13

- Views

- 701

- Replies

- 22

- Views

- 2K