rogerthat

Well-known member

- Joined

- Aug 29, 2015

- Messages

- 3,124

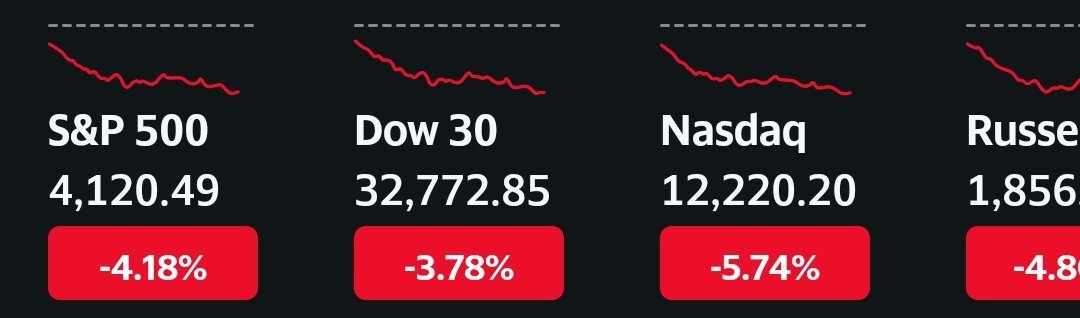

I can assure you your wrong. What makes you think I am not buying now? Without specifics of my situation, time horizon, etc. your making some wrong assumptions. Lots of stocks not in the S&P 500. If your investing for retirement and you have a 30 year time horizon that is a scenario - dollar cost averaging, index funds, and time in the market are hard to beat, but what if I have a 10 year time horizon? 5 year time horizon? Decisions are tougher. You see the performance of the S&P during the inflation years of the mid 70's to 80's? 2000 to 2010? The S&P was dead money. Definitely not saying that will be the case with current politics, wussification of society, and an ingrained dovish fed(I bet we don't end up anywhere near current rate predictions) but it is nice to see valuations come down a little and a little euphoria come out of this bubblicious market at least maybe I don't have to get stock tips from my taxi drivers. With any luck we will see 2800 on the S&P and some reasonable valuations. But as they say "if you were buying the market before, you ought to really like it now".Best I can find is this below. I can find a half dozen problems with this concept, but whatever. If you are waiting for the S&P to drop below 2800 you might be disappointed. It could happen, sure, but I guarantee that when it does, you will be completely convinced not to buy it then either.

View attachment 220522